Simple Summary

Gauntlet recommends the following adjustments to COMP incentives across comets. These adjustments are intended to encourage optimal utilization, lead to interest rate discovery, and optimize COMP spend across the protocol.

| Comet | Daily Borrow Incentive(in COMP) | Daily Supply Incentive(in COMP) |

|---|---|---|

| Ethereum wstETH | 3→2 | 0 |

| Base USDS | 9 | 15→0 |

| Base AERO | 4→0 | 1→0 |

| Mantle USDe | 4 | 4→0 |

Current spend is 40 COMP per day. We recommend reducing that by 25 COMP for a daily spend of 15 COMP. With the current COMP price at $15.74, this equates to ~$143.63K in emissions saved annually.

Rationale

Our aim in making these adjustments is to reduce Compounds’ incentive spend across markets while providing market-specific recommendations intended to optimize market utilization and competitiveness.

Ethereum wstETH

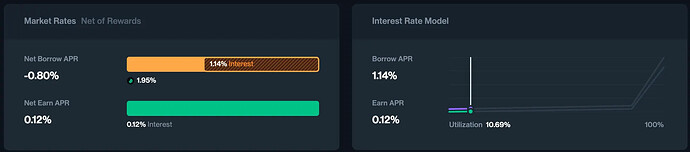

Incentives for borrowers currently induce negative APYs on this comet. By decreasing incentives, borrowers’ APYs should stabilize at a positive value and encourage more accurate interest rate discovery for this market.

Base USDS

Reduction of supply incentives should lead to reduced supply and higher utilization as a result. The goal of this update is to adjust this market towards optimal utilization around the kink.

Base AERO

Incentives for borrowers currently induce negative APYs on this comet. By fully cutting incentives, this proposals restores a positive borrow APY and encourage more accurate interest rate discovery for this market.

Mantle USDe

Reduction of supply incentives should lead to reduced supply and higher utilization as a result. The goal of this update is to adjust this market towards optimal utilization around the kink.

Next Steps

- We welcome community feedback.