Okay, I think it’s time for a poll!

Summary of recent developments for folks just joining or returning to this discussion:

- There appears to be consensus in this forum toward some kind of airdrop to early users with vesting.

- Many good ideas about the distribution model have been shared, but the conversation stalled due to the absence of a curated early user list with sufficient data to inform a capital-weighted distribution.

- I was inspired by @grasponcrypto’s efforts with Dune Analytics data to try my hand at curating a list of early-user interactions by directly querying on-chain data.

- The community has helped refine this list, e.g. @grasponcrypto and @rleshner provided the guidance I needed to isolate and remove addresses that participated in an early Sybil attack on governance.

- The code to reproduce this list is available on Github

- Finally, a written summary is now available that explains how the proposed distribution is computed.

I am hearing two main objections to this proposal as posted:

- Objection 1: the calculation of capital input should be an integral over C(t)m(t), rather than a sum over supply/borrow events of C(t_i)m(t_i), where C is the capital borrowed supplied and m is a multiplier that favors interactions that occurred earlier in the eligibility window (when Compound had a smaller TVL).

- Objection 2: the 95% weight to the social distribution is too high.

The first objection is addressable but would require considerable additional effort to implement. Given the level of effort required, I would seek support from the Compound grants program to do this.

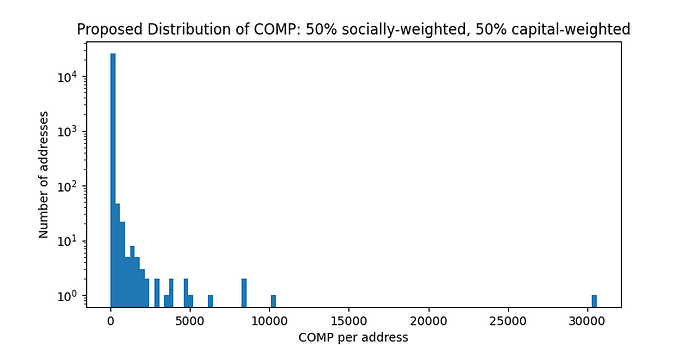

The second objection is easily addressable; I just happen to disagree with it. As evidence, here are plots of the distributions for the 95%-5% case and the 50%-50% case.

These distributions look almost identical, except the 100 or so addresses that could afford to plow multimillions (or more) USD equivalent into the protocol receive ~10x the rewards in the 50%-50% case. All that extra COMP comes from smaller users, who each end up with only half of the 20 COMP available in the 95%-5% case. I don’t see how that helps achieve the goal of promoting participation in governance by early users.

However, we should hear from more voices than @Andre1 and myself to understand where a consensus lies, if any.

What do you think?

- Yes, I support the currently posted list as-is, not interested in seeing how the more accurate block-by-block capital weights would change things

- Yes, but I support @allthecolors applying for a Compound grant to implement the more accurate block-by-block capital weights and produce a report for the community

- No, but I support @allthecolors applying for a Compound grant to implement the more accurate block-by-block capital weights and produce a report for the community

- No, I don’t support the currently posted list, and the block-by-block capital weights wouldn’t change my mind