deUSD and sdeUSD Risk Recommendations on Mainnet Stablecoin Comets

Simple Summary

Should the community decide to onboard deUSD and sdeUSD as collateral across Mainnet stablecoin Comets, Gauntlet proposes the following risk parameters:

USDC Comet

| Collateral | Supply Cap | Collateral Factor | Liquidation Factor | Liquidation Penalty |

|---|---|---|---|---|

| deUSD | 8M | 88% | 90% | 4% |

| sdeUSD | 5M | 88% | 90% | 4% |

USDT Comet

| Collateral | Supply Cap | Collateral Factor | Liquidation Factor | Liquidation Penalty |

|---|---|---|---|---|

| deUSD | 8M | 88% | 90% | 4% |

| sdeUSD | 5M | 88% | 90% | 4% |

USDS Comet

| Collateral | Supply Cap | Collateral Factor | Liquidation Factor | Liquidation Penalty |

|---|---|---|---|---|

| deUSD | 8M | 88% | 90% | 6% |

| sdeUSD | 5M | 88% | 90% | 6% |

While parameter recommendations were provided for all stablecoin Comets, to isolate risk and prevent high-leverage assets from impacting other borrowers, it is recommended that deUSD and sdeUSD be listed exclusively on the USDS Comet.

Analysis

Supply Cap and Liquidation Penalty

deUSD Liquidity sources

| Pool Type | Pool Name | Pool URL | TVL ($M) | 24H Volume ($) |

|---|---|---|---|---|

| Curve | deUSD / USDC | Link | 18.6 | 515.3K |

| Balancer Ethereum | sdeUSD / deUSD 0.01% | Link | 9.9 | 109.9K |

| Curve | DOLA / deUSD | Link | 5.0 | 157.0K |

| Curve | deUSD / USDT | Link | 2.8 | 241.9K |

Total TVL: $36.9M

Although deUSD has ~$37M in liquidity across various pools, we are only considering USDC and USDT pools which have a total TVL of $21.4M.

USDT available to redeem

Furthermore, the mint-redeem contract for deUSD has close to $24M USDT for atomic redemptions.

Given the above, we recommend setting the caps to a third of the total USDT available for atomic redemptions.

sdeUSD Liquidity sources

| Pool Type | Pool Name | Pool URL | TVL ($M) | 24H Volume ($) |

|---|---|---|---|---|

| Balancer Ethereum | sdeUSD / deUSD 0.01% | Link | 9.9 | 109.9K |

| Curve | DOLA / sdeUSD | Link | 1.6 | 5.2K |

Total TVL: $11.5M

Similarly for sdeUSD, we only account the pool liquidity with deUSD pairs. This also signifies that immediate liquidity for sdeUSD is only via deUSD pool on Balancer. Staked deUSD has a 7 day cooling period on withdrawal. We therefore setting the supply caps at half of the sdeUSD/deUSD pool TVL i.e 5M sdeUSD

We recommend aligning the Liquidation Penalty (LP) to that of sUSDS on USDS comet for deUSD and sdeUSD on USDC and USDT comets. However, given the higher degree of volatility and limited pathways for deUSD and sdeUSD to USDS we recommend an LP of 6%.

Liquidation Factor (LF) and Collateral Factor (CF)

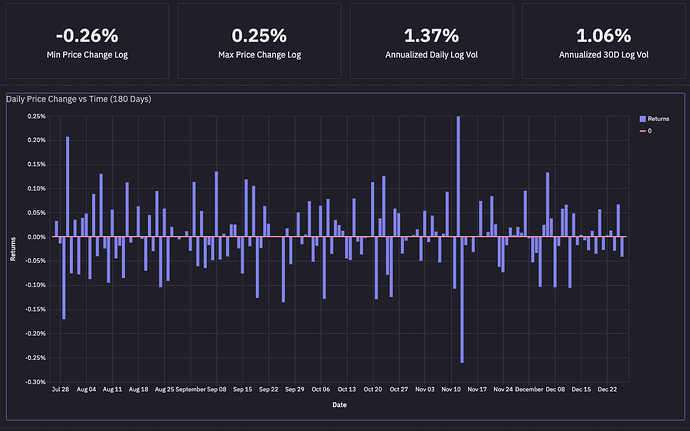

deUSD/USDC Volatility and Returns

deUSD/USDT Volatility and Returns

deUSD/USDS Volatility and Returns

Based on the provided metrics and the proposed Liquidation Penalty, Gauntlet recommends setting a Liquidation Factor (LF) of 90% and a Collateral Factor (CF) of 88% for the USDC,USDT and USDS Comets. Gauntlet will monitor and adjust these risk parameters accordingly based on market data and closeness-to-peg.

Next Steps

- We welcome community feedback