[Chainrisk] deUSD and sdeUSD Market Analysis

Chainrisk herein provides a transparent insight into the current market performance of deUSD and sdeUSD to be listed as collateral assets on Compound.

deUSD Analysis

Market Data:

All data given below are as per 23th December, 2024

About:

deUSD is a fully collateralized, yield-bearing synthetic dollar powered by the Elixir Network.

Market Cap: $235.8 Million

At $235.8 Million, the market cap indicates a moderate level of investor interest and market presence for deUSD.

24h Volume: $12.3 Million

The 24-hour trading volume of $12.3 Million suggests healthy trading activity, indicating that deUSD is actively traded among investors.

Circulating Supply: 235.8 Million deUSD

The circulating supply of 235.8 Million deUSD tokens reflects the total number of tokens currently available for trading, calculated as the total coins created minus any coins that have been burned.

Fully Diluted Value: $235.8 M

The FDV of $235.8 M provides insight into the potential future valuation of deUSD if all tokens were to be issued.

Current Rankings

- CoinMarketCap: 346

- Coingecko: 326

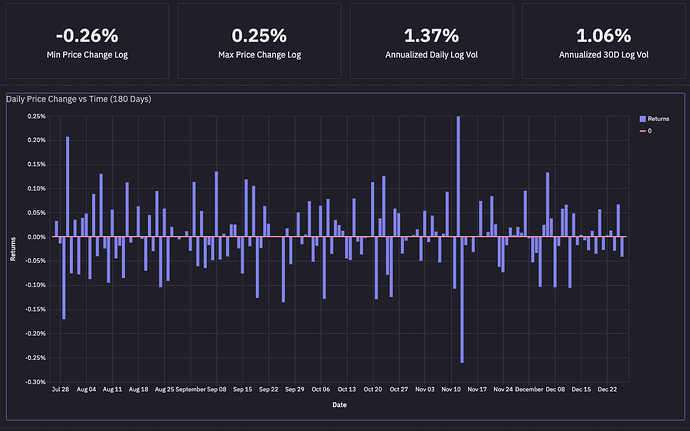

Volatility Analysis

Trading Volume to Market Capitalization Ratio

A trading volume to market capitalization ratio of 8.77% indicates a good level of liquidity, making it easier to buy or sell the cryptocurrency close to its true value on exchanges.

Historical Volatility Performance

The highest price of deUSD was **1.02** and the lowest price of deUSD was **0.9782.**The historical price data includes:

Historical Price:

Historical Market Cap:

Liquidity Analysis

Token On-Chain Liquidity

The market capitalization of deUSD over the last 24 hours was approximately $235.8 million, while the average daily trading volume stood at around $12.3 million across decentralized exchanges. Although the market cap is relatively modest, it is considered appropriate for listing. The trading volumes is reasonable, given the asset’s market cap and risks can be further mitigated through suitable recommendations for asset risk parameters.

Slippage

The DefiLlama slippage estimator (Token Liquidity) tool shows that a deUSD-> ETH trade of $10M (10,000,000 deUSD) over Odos will produce around 1.08% trade slippage in deUSD.

Supported CEXes & DEXes:

CEXes:

No Supported CEX.

DEXes:

The deUSD token is actively traded across a variety of decentralized exchanges (DEX), including Curve, Uniswap PancakeSwap.

sdeUSD Analysis

Market Data:

All data given below are as per 23rd December, 2024

About:

Staked deUSD (sdeUSD) is the staked, yield-bearing version of deUSD.

Market Cap: $152.6 Million

At $152.6 Million, the market cap indicates a moderate level of investor interest and market presence for deUSD.

24h Volume: $14.9K

The 24-hour trading volume of $14.9K indicates minimal trading activity, suggesting that deUSD is not actively traded among investors, primarily because a significant portion of the tokens is staked, resulting in minimal trading.

Circulating Supply: 152,154,298 sdeUSD

The circulating supply of 152,154,298 Million sdeUSD tokens reflects the total number of tokens currently available for trading, calculated as the total coins created minus any coins that have been burned.

Fully Diluted Value: $152.6 Million

The fully diluted valuation (FDV) of $152.6 million provides a glimpse into the potential market capitalization of sdeUSD, assuming all tokens are issued. With no limit on total supply, this figure represents the valuation derived from the current circulating supply of tokens.

Current Rankings

Volatility Analysis

Historical Volatility Performance

The highest price of sdeUSD was **1.13** and the lowest price of deUSD was **0.9452.**The historical price data includes:

Historical Redemption Rate:

The current redemption rate for staked Elixir deUSD to Elixir deUSD stands at 1.01725227. The graph illustrates the historical redemption rate, showing a consistent upward trend.

Historical Price:

Historical Market Cap:

Liquidity Analysis

Token On-Chain Liquidity

The market capitalization of deUSD over the past 24 hours was approximately $152.6 million, while the average daily trading volume was around $14.9K across decentralized exchanges. The market cap is relatively modest, making it suitable for listing. However, the trading volume is notably low, primarily because a significant portion of the tokens is staked, resulting in fewer tokens are for traded by users.

Slippage

sdeUSD can be redeemed for deUSD at the established redemption rate, after which deUSD can be swapped for other tokens. However, directly swapping sdeUSD for tokens like ETH can result in significant slippage. For instance, swapping just 1,000 sdeUSD directly for ETH incurs a slippage of 18%.

Supported CEXes & DEXes:

CEXes:

No Supported CEX.

DEXes:

The sdeUSD token is actively traded across Decentralized exchange like BalancerV2 and Uniswapv3.

Note: Chainrisk recommends to observe the performance of the asset for a few more months before taking the decision to list sdeUSD as a collateral asset on compound, major reasons being low trade volume and high slippage on swaps.

If the community shows significant interest in lisiting deUSD, Chainrisk will move forward with providing parameter recommendations on the same.