Summary

The proposal recommends listing Threshold Network’s tBTC, as a supported asset on Compound Base Market. By adding tBTC, Compound will unlock the borrowing demand for this pegged BTC asset to provide a foundational source of yield for BTC lending within the Compound ecosystem while fostering greater liquidity and user engagement. tBTC is backed one-to-one with Bitcoin.

Motivation/Background

tBTC is Threshold’s decentralized and permissionless bridge that brings BTC to Ethereum, Arbitrum, Base, Polygon, Optimism, Solana and other chains. Users wishing to utilize their Bitcoin on Ethereum, Base and other chains can use the tBTC decentralized bridge to deposit their native Bitcoin into the system and get a minted tBTC token in their EVM wallet.

Through an acquired Chainlink oracle, tBTC enables Compound users to have access a wrapped Bitcoin, which can be permissionlessly minted and redeemed, where the BTC that backs it is not held by a central intermediary, but is instead held by a decentralized network of nodes using threshold cryptography. This implies a fully decentralized and permissionless lending and borrowing experience for BTC (i.e. bridge native BTC to tBTC and borrow via Compound).

tBTC is already present Compound Ethereum market which makes it easier for assessment to add it for Base.

Also in on other markets such as AAVE Ethereum market and following its approval, tBTC’s initial supply cap was reached within 72 hours, prompting an increase to meet the overwhelming demand. This rapid adoption underscores the market’s appetite for trust-minimized BTC solutions in DeFi.

tBTC on Ethereum has a current supply of 4.641 BTC worth $450M at current price and on Base 262 BTC worth $25.1M at current price.

Benefits for Compound

- Further decentralization and trust minimization in the Compound stack.

- A range of lending options for those who wish to earn yield on their BTC.

- High User Demand, since its initial deployment on Aave’s Ethereum market, tBTC reached its initial 500 BTC supply cap within the first week. The cap has been increased multiple times, now sitting at 2200 BTC, highlighting strong user interest.

- Collaboration with the Threshold Network DAO.

- A range of lending options for those who wish to earn yield on their BTC.

- Preferable yields on tBTC through active incentive participation, boosting Compound protocol use, fees and TVL.

Specification

Ticker: tBTC

Contract Address:

Base: 0x236aa50979D5f3De3Bd1Eeb40E81137F22ab794b

Chainlink Oracle:

Base: 0x6D75BFB5A5885f841b132198C9f0bE8c872057BF

Useful Links:

Project: https://www.threshold.network/

Minting Dashboard: Threshold - tBTC

Bridge to other Chains: Portal Token Bridge | Fast and Secure Cross-Chain Transfers

GitHub: GitHub - threshold-network/tbtc-v2: Trust-minimized tokenized Bitcoin everywhere, version 2

Docs: tBTC Bitcoin Bridge | Threshold Docs

Audit: Threshold Network: Building the Bitcoin Economy

Immunfi Bug Bounty: Threshold Network Bug Bounties | Immunefi

Llama Risk Report: Collateral Risk Assessment: Threshold BTC (tBTC) - HackMD

Twitter: https://twitter.com/thetnetwork

Discord: Threshold Network ✜

Dune: https://dune.com/threshold/tbtc

https://dune.com/sensecapital/tbtc-liquidity

Emission schedule

tBTC is one-to-one backed with real Bitcoin, meaning that there isn’t an emissions schedule, but a mint and redeem function that adjusts the supply of tBTC based on native BTC coming into and out of the system.

High-level overview of the project and the token.

tBTC is a decentralized wrapped Bitcoin that is 1:1 backed by native BTC. Unlike other wrapped Bitcoins, the BTC that backs tBTC is not held by a central intermediary, but is instead held by a decentralized network of nodes using threshold cryptography.

tBTC is trust minimized and redeemable for native BTC without a centralized custodian. It can be used across the entire DeFi ecosystem.

tBTC can be used as collateral, liquidity, a store of value, and can be integrated with DeFi apps across all supported blockchains.

As with other BTC wrappers, tBTC provides cryptocurrency traders and general users with a BTC-pegged token, that can be used to generate yield whilst holding native BTC.

Positioning of the token in the Compound ecosystem. Why would it be a good borrow or collateral asset.

Adding support for tBTC on Compound Base Market as an asset would allow tBTC holders to obtain a yield on their tBTC holdings. Currently it has only cbBTC as BTC token option for collateral.

tBTC is the only way to permissionlessly borrow and lend BTC in a decentralized manner. This gives Compound direct access to the 1.9 trillion market of BTC, for which centralized competitors provide limited access to.

History of the project and the different components: DAO and products.

tBTC was created by a decentralized effort of contributors at the Threshold Network DAO, and extensively utilizes the Threshold Network’s threshold cryptography to create a secure BTC asset. tBTC is a product launched on Threshold Network, on which many other decentralized applications are being built.

Threshold Network DAO was born out of the first on-chain merger between two decentralized protocols, Keep Network and NuCypher early in 2022. The DAO has successfully operated since that time, and supports an active community of contributors that work towards building tBTC liquidity and usability.

Threshold Network operates thUSD a decentralised overcollateralized stablecoin backed by tBTC and ETH, meaning that users can mint thUSD by locking up tBTC or ETH as collaterals. The stablecoin is designed to maintain a 1:1 peg with the US dollar while leveraging Bitcoin liquidity in a trust-minimized manner.

It also operates TaCO (Threshold Access-Controlled Off-Ramps) which is designed to provide decentralized and permissionless access control for off-ramping assets from crypto to fiat. It leverages Threshold cryptography to enable secure, private, and censorship-resistant transactions, allowing users to move assets without relying on centralised intermediaries.

How is tBTC currently used?

tBTC is used across a variety of chains and use cases. Some key utilities include Aave, GMX, EigenLayer, Synthetix, Morpho, Symbiotic, collateral asset for crvUSD, thUSD and solvBTC.

A comprehensible list can be found here:

https://defillama.com/yields?token=TBTC & tBTC Linktree | Linktree

Token & Protocol permissions (minting) and upgradability, multisig?and signers?

For tBTC, wallets are created periodically based on governance. In order for the wallet to move funds, it produces signatures using a Threshold Elliptic Curve Digital Signature Algorithm, requiring 51-of-100 Signers to cooperate. The 100 signers on each wallet are chosen with our Sortition Pool, and the randomness is provided by the Random Beacon. More can be found here - Wallet Generation | Threshold Docs

The Threshold Council multisig is a 6/9 Gnosis Safe multisig with 9 unique signers that form the Threshold Network Council. The Council has limited upgrade privileges over the smart contracts. However, those privileges do not include any custodial power over deposited BTC.

Council Multisig Ethereum Address: 0x9F6e831c8F8939DC0C830C6e492e7cEf4f9C2F5f

Council Multisig Base Address: 0x518385dd31289F1000fE6382b0C65df4d1Cd3bfC

Social channels data (size of communities and activity)

Discord: 10,175

Twitter: 38,400

Github: 4,596 commits

Number of transactions: 2.393.648 (across all chains)

Number of token holders: 15.918 (across all chains)

Market Risk Assessment

Market Cap of the token

$444,000,000 or 4,636 BTC

Maximum and current market cap of the token within the last 6 months on Base

Max: 42,806,600 or 447 BTC

Current: 25,100,000 or 262 BTC

The largest exchanges where the token is listed and its respective liquidity

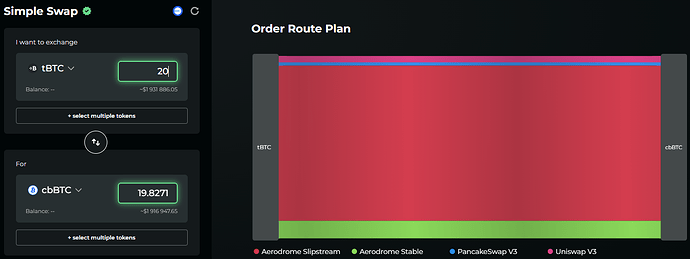

Aerodrome CL1-tBTC/cbBTC pool with 2,013,857 USD TVL

Aerodrome sAMM-tBTC/cbBTC pool with 946,194 USD TVL

Aerodrome CL200-tBTC/USDC pool with 895,203 USD TVL

Aerodrome CL200-tBTC/WETH pool with 864,288 USD TVL

Aerodrome vAMM-tBTC/USDC pool with 523,349 USD TVL

Aerodrome vAMM-tBTC/ETH pool with 225,419 USD TVL

Aerodrome vAMM-tBTC-/USDbC pool with 101,640 USD TVL

Aerodrome CL200-tBTC/T pool with 95,638 USD TVL

Curve Finance tricrypto tBTC/ETH/crvUSD pool with 1,133,432 USD TVL

Pancakeswap tBTC/cbBTC pool with 39,109 USD TVL

Liquidity example with no significant price impact

List all of the privileged roles in the token contract. This can include whitelisted EOAs, Multi-sigs or DAOs.

N/A

Is it pausable?

No

Does it have a blacklist or whitelist?

No

Smart contract risks

Codebase & On-chain Activity

Provide a Github repository for the underlying token contracts

- GitHub - keep-network/tbtc-v2: Trustlessly tokenized Bitcoin everywhere, version 2

- tbtc-v2/solidity/contracts/token/TBTC.sol at main · keep-network/tbtc-v2 · GitHub

Provide Etherscan links with verified contracts

Security Posture

What audits, if any, were performed? Provide links to the reports if they exist.

Provide emergency contacts with their responsiveness levels and response availabilities

security@threshold.network

Multi-Chain Strategy

Will the token include implementations on other networks?

tBTC is available on Ethereum, Arbitrum, Optimism, Polygon PoS, Base, Solana, Verus, BOB.

If so, will the tokens be natively minted on the other networks or bridged across?

Natively/Direct mintable on Ethereum and soon on Arbitrum and Base

Are there any mitigations in the contracts in case a bridge becomes inoperable or compromised?

There are 8 guardians in place who can halt bridging from L2s

Token contract Behavior

Does the token have more than one address ?

No

Does the token use a compiler version greater than 0.8.0 or the SafeMath? If not, explain how the protocol deals with possible overflows and underflows

v0.8.4

During the execution of the token’s functions, does the token execute external code chosen by the caller or receiver? 2 If so, please explain the reasoning behind this decision.

No

How does the token contract deviate from a standard implementation of ERC20? Any additional features that the Compound DAO should know about?

ERC20WithPermit to enable MisfundRecovery.

Is it burneable?

The token is burned when users redeem for native BTC. It also exposes EIP2612 permit functionality. See: solidity-contracts/contracts/token/ERC20WithPermit.sol at main · thesis/solidity-contracts · GitHub

Does the token contract have a fallback function? If so, when does it revert?

It does not have a fallback

Does it have a fixed supply? If no, who can mint?

The token can be minted by users depositing native BTC.

Is it a rebasing token?

No

Does the token charge fees on transfers?

No

Does it implements any transfer hooks? Or hooks on any method?

No hooks

Is the contract performing arbitrary delegatecalls? If the answer is yes, indicate who can make these calls and to what contracts.

No

Is it flash mintable? If yes, please provide more information on this feature

No

Is it flash loanable? If yes, please indicate who offers the service.

No

What are the typical gas costs for calling each of the standard ERC20 functions?

Can be checked on transactions tab here:

Price Feed Behavior

Is the price feed supported by ChainLink?

Yes – 0x6D75BFB5A5885f841b132198C9f0bE8c872057BF

How often will price updates be posted?

1-hour updates

At what price difference threshold will price updates be posted?

0.5%

Can the AggregatorV3Interface functions for this price feed ever revert when called?

The price feed’s AggregatorV3Interface will never revert unless it is deprecated with no latest price answer.

Does the bytecode of the custom price feed match an audited version?

Yes

Upgradability

Is it upgradeable?

No

Who is authorized to make an upgrade?

N/A

Can an upgrade happen instantaneously or is there a time-lock delay?

N/A

Which components are upgradable?

N/A

How does the upgradeability design work? Who manages it and are how upgrades performed?

N/A

Does it emit an event when the implementation is updated?

N/A

Community Check

The community should review the following items before approving a new asset.

• Veracity of the info provided.

• Correct configuration of any new contracts (oracle, custom price feeds, asset).

• Documentation quality.

• Favorable results in the execution of the token test suite or integration simulations.

Additionally, we look forward to the community to suggest

• Collateral Factor

• Reserve Factor

• Borrowing Limit

Risk parameters

Suggest waiting for the feedback from risk teams for suggested parameters