Fei Protocol is a rapidly growing algorithmic stablecoin built natively for the Defi ecosystem. Fei Protocol has growing support across DeFi, and its governance token, TRIBE, has recently been listed on leading exchanges including Coinbase, Binance, Huobi, etc.

The Fei community (Tribe) has demonstrated strong partnership with Compound by depositing more than 75k ETH and 50M DAI to date, a significant portion of our PCV (Protocol Controlled Value).

Fei Protocol:

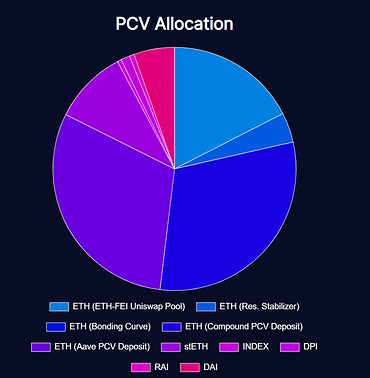

FEI is a highly scalable and decentralized algorithmic stablecoin that utilizes protocol controlled value (PCV) for peg stabilization, while maintaining highly liquid secondary markets. Users can mint FEI from ETH and other bonding curves, while FEI is always redeemable at $1 USD (with a 1% fee) for ETH at the peg price. Fei Protocol consists of two tokens, FEI the stablecoin, and TRIBE, the governance token, governing the PCV currently valued at $850 million at the time of writing.

Fei Protocol continuously develops both technical and security improvements through a well-defined governance methodology for Fei Improvement Proposals (FIP), which uses the same governance infrastructure as Compound. The same FIP methodology also extends into management of PCV (Protocol Controlled Value) and development of additional use cases and applications.

Why FEI:

FEI is one of the most decentralized and scalable stablecoins in DeFi. As a matter of its monetary policy, Fei Protocol is actively subsidizing and bootstrapping liquidity to its partner protocols with the aim of lowering rates and increasing traffic. The FEI community’s deep commitment has been already evidenced by its supply of 75,000 ETH (~$283 M) and 50m DAI into Compound. The Fei DAO can support FEI markets on Compound by providing FEI liquidity, and has already signaled approval to bootstrap 25-50m worth (Snapshot). Traders would be able to tap into the large FEI-ETH liquidity on Uni V2 ($330 million) as well as any future protocol owned or incentivized liquidity pools.

Following the example of FEI’s listing on other lending protocols; upon listing of $FEI on Compound, the Fei will be committed to introduce a proposal for a liquidity injection of FEI. Fei protocol has already deployed over 20M FEI between Rari, Kashi, and CREAM.

The inclusion of FEI will allow Fei and Compound’s dedicated and robust communities to increase their exposure and utility.

Market Details:

- User circulating FEI: 240,956,125

- Protocol Owned FEI: 193,051,159

- Protocol Controlled Value: $885,761,132

- Collateralization Ratio 368.7%

FEI protocol’s IDO was one of the seminal events of Defi this year, plagued with early price fluctuations and liquidity issues. But through robust DAO action and community voting, FEI firmly restored its peg and pursued many integrations that have allowed its ecosystem to flourish.

FEI’s peg has remained steadfast through multiple market downturns, and there is now a reserve stabilizer fund in place to buy back FEI at $0.99. Currently the protocol can redeem all FEI three and a half times over, and with the inclusion of other assets to hedge against an ETH plunge, the risk of continued departure from peg is minimal.

Fei Protocol has been the subject of multiple professional audits by premier firms such as Open Zeppelin and ConsenSys Diligence, and subject to further extensive auditing throughout its security updates.

Fei Protocol also maintains an active bug bounty program which offers up to $1.1M for critical vulnerabilities to the smart contract.

Asset Onboarding Framework Collateral Information:

-

Overview

- What is the token name and ticker symbol?

- FEI

- What does the token do?

- $1 USD pegged algorithmic stablecoin

- What additional risks might supporting this token create?

- Protocol getting hacked

- Significant disruption in underlying collateralization assets (ETH)

- What audits, if any, have been done?

- OZ - https://blog.openzeppelin.com/fei-protocol-audit/

- Dili - Fei Protocol | ConsenSys Diligence

- OZ 2 - Fei Protocol Audit - Phase 2 - OpenZeppelin blog

- Have there ever been any protocol hacks? If so, when? How were they addressed?

- The protocol has never been hacked, but two critical bugs have been reported shortly after the protocol launched via the protocol-sponsored bug bounty program. After identifying and validating the vulnerabilities, the Fei Labs team immediately stopped the affected protocol functionality with the Guardian (held in a multisig by the Fei Core team), which prevented the vulnerabilities from being exploited. No funds were lost.

-

Market Risk Information

- What venues allow for the trading of this asset?

- DEX

- Uniswap V2, Uniswap V3, Sushi, etc.

- How much liquidity is there on each of these venues?

- How has that liquidity changed over time? One way to show this is with rolling 30/60/90 averages.

Source: Dune Analytics

- What is the historical volatility of this asset?

-

Decentralization

- How is this asset distributed amongst token holders?

- GINI Coefficient

- Low (highly distributed asset)

- Largest 10 positions and the percent of total float they constitute

- Float = 250M FEI

- How is the supply of this currency controlled?

- Mint: User minted via bonding curve purchase, protocol deployments

- Burn: Stabilizer (guaranteed $1 redemption), Reweights

- Centralization scale (Centrally Backed → Permisionless)

- Permisionless

-

Asset Listing Request - to be defined with COMP community

- Collateral Factor - will be 0 for all assets until after launch

- Reserve Factor (probably should start pretty high)

- Borrow Cap -

- Interest Rate Curve

- Start with an existing interest rate curve

Engagement and Consultation Request

While expressing our desire to incorporate FEI as a collateral asset on Compound Finance’s platform, the FEI community would also like to solicit suggestion and ideas from the COMP community regarding vital details pertaining to a potential inclusion:

- Collateral factor (we are initially applying for a 0% CF)

- Reserve factor - 20%

- Borrow Cap

- Base borrow APY - 0%

- (FEI’s interest rate at Rari has flowed beneath 3% with subsidies, averaging ~45% utilization)

- % utilization of kink - 80%

- APY at kink - 5%

Any comments and insights would be greatly appreciated!

Community and Resources:

FEI Contract address: 0x956F47F50A910163D8BF957Cf5846D573E7f87CA

TRIBE Contract Address: 0x514910771af9ca656af840dff83e8264ecf986ca

Fei Protocol Contract Addresses: Contract Addresses - Fei Protocol

Project Website: https://fei.money/

Documentation: http://docs.fei.money/

Discord: Discord

Community forum: https://tribe.fei.money/

Twitter: https://twitter.com/feiprotocol

Github: Fei Protocol · GitHub

Security Audits: https://docs.fei.money/audit