The new price oracle has been deployed: UniswapAnchoredView | 0x6D2299C48a8dD07a872FDd0F8233924872Ad1071

A simulation of the new price oracle and cMKR is ready as well. Here is the snippet. I’ll post the link to the Github fork with all of the simulations tomorrow.

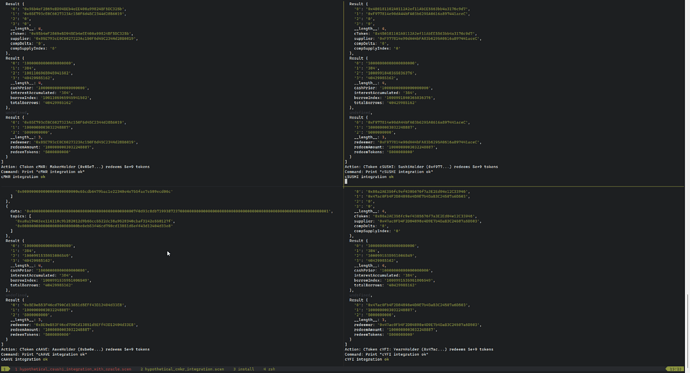

`#!/usr/bin/env yarn repl -s

PrintTransactionLogs

– Token holder addresses for mocking

Alias CompHolder “0x7587caefc8096f5f40acb83a09df031a018c66ec”

Alias MakerHolder “0x05e793ce0c6027323ac150f6d45c2344d28b6019”

Alias CUSDCHolder “0x5e34bc93a7506ecc8562ade4d5c8b090247a6349”

Web3Fork “https://mainnet-eth.compound.finance/@12884400” (CompHolder MakerHolder CUSDCHolder)

UseConfigs mainnet

– update to the new oracle implementation

Alias NewOracle “0x6D2299C48a8dD07a872FDd0F8233924872Ad1071”

– Delegate and propose update

From CompHolder (Comp Delegate CompHolder)

From CompHolder (GovernorBravo GovernorBravoDelegator Propose “Update Oracle” [(Address Comptroller)] [0] ["_setPriceOracle(address)"] [[(address NewOracle)]])

Print “New Oracle Set”

– Fast forward, vote, queue, execute

MineBlock

AdvanceBlocks 14000

From CompHolder (GovernorBravo GovernorBravoDelegator Proposal LastProposal Vote For)

AdvanceBlocks 20000

GovernorBravo GovernorBravoDelegator Proposal LastProposal Queue

IncreaseTime 604910

GovernorBravo GovernorBravoDelegator Proposal LastProposal Execute

– Delegate and propose update

From CompHolder (Comp Delegate CompHolder)

From CompHolder (GovernorBravo GovernorBravoDelegator Propose “Add MKR Market” [(Address Comptroller) (Address Comptroller) (Address cMKR)] [0 0 0] ["_supportMarket(address)" “_setCollateralFactor(address,uint256)” “_setReserveFactor(uint256)”] [[(address cMKR)] [(address cMKR) 0] [250000000000000000]])

– Fast forward, vote, queue, execute

MineBlock

AdvanceBlocks 14000

From CompHolder (GovernorBravo GovernorBravoDelegator Proposal LastProposal Vote For)

AdvanceBlocks 20000

GovernorBravo GovernorBravoDelegator Proposal LastProposal Queue

IncreaseTime 604910

GovernorBravo GovernorBravoDelegator Proposal LastProposal Execute

– Assert cMKR market supported

Assert True (Comptroller CheckListed cMKR)

– Ensure accrue interest works

CToken cMKR AccrueInterest

– Mint test

From MakerHolder (Erc20 MKR Approve (Address cMKR) 10e18)

From MakerHolder (CToken cMKR Mint 10e18)

Assert Equal (Erc20 MKR TokenBalance cMKR) (10e18)

– Borrow test

From CUSDCHolder (CToken cMKR Borrow 1e18)

Assert Equal (Erc20 MKR TokenBalance CUSDCHolder) (1e18)

Assert Equal (Erc20 MKR TokenBalance cMKR) (9e18)

– Repay borrow test

From CUSDCHolder (Erc20 MKR Approve (Address cMKR) 1e18)

From CUSDCHolder (CToken cMKR RepayBorrow 1e18)

Assert Equal (Erc20 MKR TokenBalance CUSDCHolder) (0)

Assert Equal (Erc20 MKR TokenBalance cMKR) (10e18)

– Redeem test (note: 50 cMKR == 1 MKR initially)

From MakerHolder (CToken cMKR Redeem 50e8)

Print “cMKR integration ok”`

Expect to see a governance proposal for adding MKR to the protocol tomorrow or in the next few days.