Summary

Proposal to add rsETH market to Compound V3 on Ethereum Mainnet

References/Useful links:

- Website: https://kelpdao.xyz/restake/

- Documentation: Introduction | Kelp

- GitHub Public Repo: https://github.com/Kelp-DAO/KelpDAO-contracts

- Audits: Audits | Kelp

- Discord: Kelp DAO

- Twitter: https://twitter.com/KelpDAO

Price feeds

Background

Kelp DAO was founded by Amitej G and Dheeraj B, who previously founded Stader Labs, a multichain liquid staking platform with $750M+ in TVL.

About rsETH

rsETH is a Liquid Restaked Token (LRT) issued by Kelp DAO designed to offer liquidity to illiquid assets deposited into restaking platforms, such as EigenLayer. It aims to address the risks and challenges posed by the current offering of restaking

- Kelp has more than 213k ETH worth of assets restaked by over 20k users.

- DeFi integrations across Balancer, Curve, Pendle, Maverick

- rsETH is present on 5+ L2s including Arbitrum, Optimism, Blast, Scroll, and Mode

By providing liquidity for the restaked positions, rsETH allows for a seamless experience to engage with DeFi protocols and maximize rewards.

Motivation

From Compound’s perspective, any new asset is a source of additional revenue and expands the ecosystem as a whole. LRTs are a great use case for Compound as it is one of the fastest growing ecosystems.

With rsETH being one of the top LRTs, integrating it as a collateral asset will create new demand on Compound. This will be beneficial for both Compound and Kelp.

Specifications:

-

Governance: Kelp token isn’t live yet as TGE hasn’t happened yet. The protocol is planning to transition to decentralized governance after TGE.

-

Oracles: Kelp works with Chainlink, Redstone, and API3 to create price feeds of rsETH.

-

Audits: Kelp’s smart contracts are audited by Sigma Prime, MixBytes and Code4rena.

Sigma Prime Report: https://kelpdao.xyz/audits/smartcontracts/SigmaPrime.pdf

MixBytes: https://kelpdao.xyz/audits/smartcontracts/mixbytes.pdf

Code4rena: (Code4rena | Keeping high severity bugs out of production)

-

Centralization vectors: Centralization vectors currently are around upgradeability via proxy 3 on 5 multi-sig and front-end hosting. We will move to on-chain upgrades post-TGE.

-

Market History: Kelp has seen meteoric growth in TVL in the last few months with TVL over 200k ETH and >20k holders of rsETH.

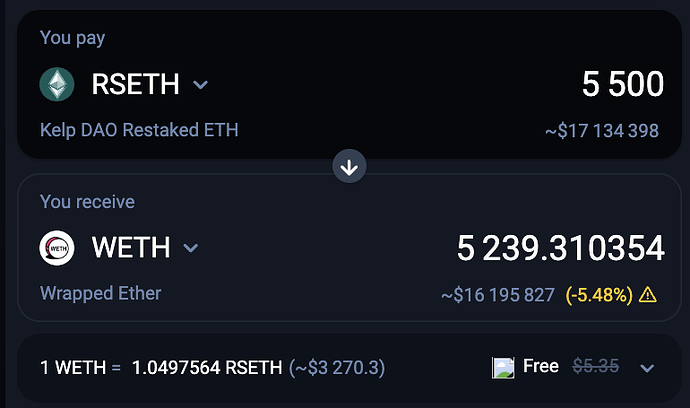

rsETH also has deep liquidity available across pools on Balancer, Curve, and Uniswap v3

Balancer - rsETH/ETH:

Balancer - rsETH/ETHx: Balancer

Uni - rsETH/ETH: Uniswap Info

Uni - rsETH/ETHx: Uniswap Info

Curve - rsETH/sfrxETH: Curve.fi

Parameters

Looking forward to hearing feedback from Compound Community and risk managers regarding parameters.

Collateral Factor

Liquidation Factor

Liquidation penalty