If the community wishes to add the assets WBTC to following WETH Comets, Gauntlet recommends the following risk parameters:

WETH Comet on Ethereum

| Asset |

Collateral Factor |

Liquidation Factor |

Liquidation Penalty |

Supply Cap |

| WBTC |

80% |

85% |

5% |

1000 ($70M) |

WETH Comet on Arbitrum

| Asset |

Collateral Factor |

Liquidation Factor |

Liquidation Penalty |

Supply Cap |

| WBTC |

80% |

85% |

5% |

300 ($20M) |

Analysis

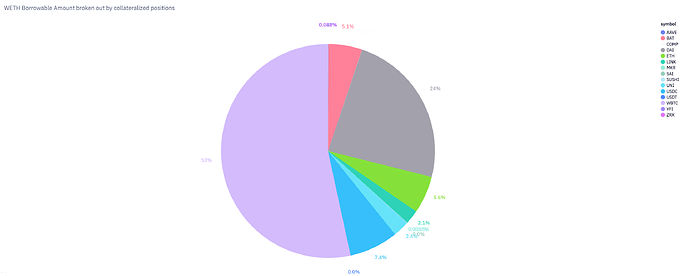

As mentioned in our recommendations for the Optimism WETH Comet, 54% of WETH borrowing is backed by WBTC collateral within the v2 markets. This position only represents $4.2M WETH borrow positions within Compound v2 but the relative market share is large across the Ethereum ecosystem. In Aave v3, $128 million worth of WETH is borrowed against WBTC on Ethereum, while $16 million worth of WETH is borrowed against WBTC on Arbitrum.

WETH Borrowable Amount by Collateralized Postions on Comp v2

Furthermore, WBTC exhibits a high correlation with WETH, boasting a correlation ratio of 0.98. This correlation creates an optimal scenario for attaining higher leverage while mitigating risk.

Next Steps

- Welcome Community Feedback

- Work with community to get asset listed on WETH Comets

1 Like

We are going to add the WBTC collateral into the markets to our backlog. Looking forward to the community feedback. WOOF team obviously supports adding WBTC as collateral, as it will definitely bring more liquidity into the protocol.

1 Like

Add WBTC to WETH market on Mainnet

PR - On-chain proposal to add WBTC in WETH Mainnet market by MishaShWoof · Pull Request #868 · compound-finance/comet · GitHub

Actions

- Run Slither. Fails.

. https://github.com/woof-software/comet/actions/runs/9758836649

. https://github.com/woof-software/comet/actions/runs/9758836649

- Forge test. Success.

https://github.com/woof-software/comet/actions/runs/9758836647

https://github.com/woof-software/comet/actions/runs/9758836647

- Gas Profiler. Success.

https://github.com/woof-software/comet/actions/runs/9758836655

https://github.com/woof-software/comet/actions/runs/9758836655

- Scan. Success.

https://github.com/woof-software/comet/actions/runs/9758836653

https://github.com/woof-software/comet/actions/runs/9758836653

- mainnet-weth Scenario. Success.

https://github.com/woof-software/comet/actions/runs/9758836660/job/26934351559

https://github.com/woof-software/comet/actions/runs/9758836660/job/26934351559

- Unit tests. Success.

https://github.com/woof-software/comet/actions/runs/9758836646

https://github.com/woof-software/comet/actions/runs/9758836646

- Eslint. Success.

https://github.com/woof-software/comet/actions/runs/9758836651

https://github.com/woof-software/comet/actions/runs/9758836651

- Contract linter. Success.

https://github.com/woof-software/comet/actions/runs/9758836672

https://github.com/woof-software/comet/actions/runs/9758836672

- Prepare migration. Success.

https://github.com/woof-software/comet/actions/runs/9759001154

https://github.com/woof-software/comet/actions/runs/9759001154

- Enact migration with impersonate. Success.

https://github.com/woof-software/comet/actions/runs/9759074803

https://github.com/woof-software/comet/actions/runs/9759074803

Description we use:

Add WBTC as collateral into cWETHv3 on Mainnet\n\n

Proposal summary\n\n

Compound Growth Program [AlphaGrowth] proposes to add WBTC into cWETHv3 on Ethereum network. This proposal takes the governance steps recommended and necessary to update a Compound III WETH market on Ethereum. Simulations have confirmed the market’s readiness, as much as possible, using the Comet scenario suite. The new parameters include setting the risk parameters based off of the recommendations from Gauntlet.\n\n

Further detailed information can be found on the corresponding proposal pull request and forum discussion.\n\n\n

Proposal Actions\n\n

The first proposal action adds WBTC asset as collateral with the corresponding configuration.\n\n

The second action deploys and upgrades Comet to a new version.

2 Likes

Proposal 273 Review

OpenZeppelin confirmed that Proposal 273 is expected to execute as intended, uses an appropriate combination of WBTC/BTC and BTC/ETH price feeds to price WBTC in ETH, and adheres to parameter recommendations from Gauntlet.

1 Like