[Gauntlet] - Parameter Recommendations for rsETH on V3 Unichain WETH Comet

Simple Summary

Should the community choose to onboard rsETH to the V3 Unichain WETH comet, Gauntlet recommends the following risk parameters:

WETH Comet

| Asset | Collateral Factor | Liquidation Factor | Liquidation Penalty | Supply Cap | Chain |

|---|---|---|---|---|---|

| rsETH | 90% | 93% | 4% | 1,000 | Unichain |

Liquidity Sources

| Asset | DEX | Pool_name | TVL | 24H $ Volume | Pool |

|---|---|---|---|---|---|

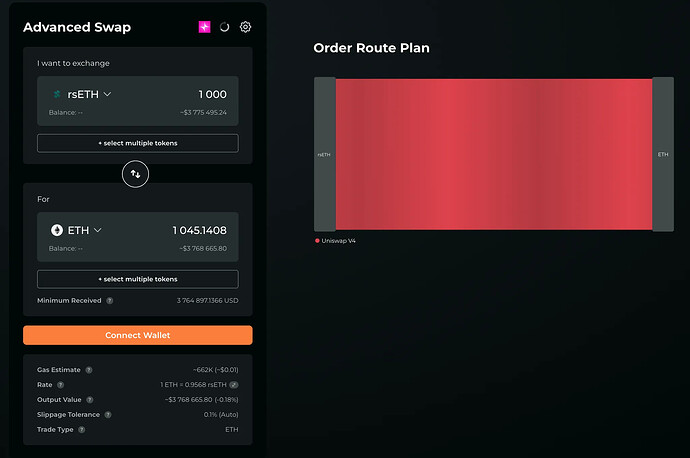

| rsETH | Uniswap V4 (Unichain) | rsETH / ETH 0.01% | $14.81M | $2,449,869 | Link |

Total TVL: $14.81M

Rationale

Gauntlet recommends aligning the Liquidation Penalty, Collateral Factor, and Liquidation Factor to be similar to rsETH on mainnet. The slippage on 1000 rsETH is minimal and could support a higher cap, but Gauntlet would like to highlight that this pool has been part of Unichain’s incentive program and has received UNI incentives for the past 3 months. The incentives for this pool ended last week, and we have observed TVL volatility following the end of the incentive program.

Gauntlet recommends a conservative approach for rsETH on Unichain initially, but plans to revisit caps based on demonstrated user demand in the coming weeks.

Next Steps

- We welcome community feedback.