Gauntlet recommends the following risk parameter updates for the Arbitrum v3 USDC Native comet:

- Increase GMX Supply Cap from 100,000 to 120,000

- Increase GMX Liquidation Factor from 60% to 75%

- Increase GMX Collateral Factor from 50% to 60%

- Increase GMX Liquidation Penalty from 7% to 15%

- Increase WBTC Liquidation Factor from 77% to 85%

- Increase WBTC Collateral Factor from 70% to 75%

- Increase WBTC Liquidation Penalty from 5% to 8%

Gauntlet recommends the following risk parameter updates for the Arbitrum v3 USDC.e Comet:

- Increase WBTC Liquidation Penalty from 5% to 8%

- Increase GMX Liquidation Penalty from 7% to 15%

Analysis

Arbitrum v3 USDC Comet

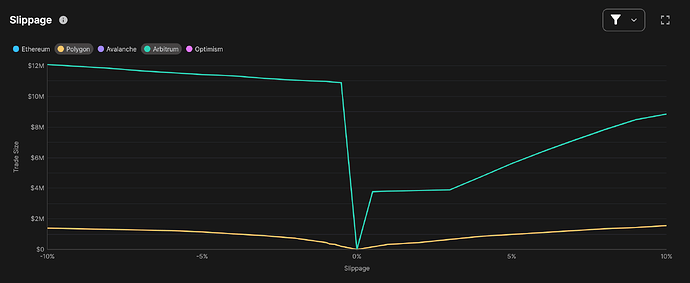

Gauntlet recommends parameter changes for the Collateral Factor, Liquidation Factor, and supply cap for GMX on Arbitrum USDC Comet. Based on our analysis of Compound’s liquidation mechanism, these changes should enhance capital efficiency while mitigating insolvency risk for GMX.

User 0x1c6b5795be43 utilizes 92% of GMX Supply Cap, with a supply position of ~$3.8M GMX. This position has grown proportionally with our last recommendation. The increase in liquidation penalty should enable the protocol to liquidate this position if it becomes undercollateralized and allow for the supply cap to increase in order to increase protocol demand for USDC.

GMX Slippage Curve

Link to chart

WBTC Top Suppliers

Gauntlet recommends increasing the liquidation factor and penalty to improve capital efficiency for WBTC. As analyzed in our Polygon Comet recommendations, raising WBTC’s liquidation penalty will expedite liquidation of large positions in the Arbitrum Comet. With significantly higher liquidity in the Arbitrum ecosystem, liquidating WBTC is less worrisome, but Gauntlet still suggests boosting the liquidation penalty while $66M in supply cap liquidity remains available.

WBTC Slippage on Arbitrum and Polygon Chain

Arbitrum v3 USDC.e Comet

Since Circle intends to continue migrating all USDC.e to USDC and eventually deprecate USDC.e within the Arbitrum ecosystem, Gauntlet will not recommend increasing users’ borrowing power. Instead, Gauntlet will recommend implementing the same risk-off recommendations from the Native market.

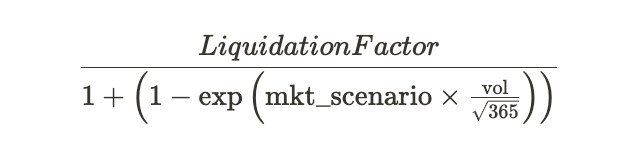

Collateral Factor Methodology

We recommend increasing the Collateral Factor of each asset to offer users increased borrowing capacity while shielding them from liquidation during volatile market conditions. When setting the CF, we take into account the historical volatility of the asset and simulate highly volatile conditions utilizing the below formula:

Next Steps

- Target on-chain proposal by April 15th