Chaos Labs has been selected to partner with Compound via the Grants program, crafting a state-of-the-art Compound Cross-Chain Analytics and Observability platform. This platform extends exhaustive analytics and observability across all EVM-compatible Compound deployments, enabling the Compound community to tap into a wealth of protocol-related data and risk information through one integrated, all-encompassing platform.

The Compound Cross-Chain Analytics and Observability platform will empower users with deeper insight into the overall risk and health of the Compound protocol across all deployments. The platform will facilitate macro-level decision-making, providing vital information about assets deployed across multiple chains, thus equipping users to make informed and strategic decisions. On top of that, it will offer granular insights into the use of Compound, trends, and real-time data analysis.

Platform Deep Dive

Cross-Chain Risk Overview

The main section of the Cross Chain Risk Monitoring Hub provides a single pane of glass to high-level metrics, aggregated across all Compound V3 chains and borrow markets, including total supply (earning and collateral), total borrow, TVL, and the sum of collateral at risk of liquidation.

The Cross-Chain Exposure by Collateral Asset displays the current protocol exposure to different assets across all chains and borrow markets and can be toggled between collateral and borrow assets. This view surfaces key information about the protocol such that Compound V3 is mostly exposed to WBTC and WETH as collateral assets and USDC as the leading borrow asset.

Backing Collateral Composition displays how asset exposure is trending over time.

The Supply, Borrow, and Collateral at Risk charts show the total supply of earning and collateral assets and total borrow, as well as the total collateral at risk - values in wallets with low health factor that is approaching liquidation - over time. Each chart can be toggled between USD amount and relative percentage.

The Supply and Borrow Dominance charts Displays, for each chain, what is the relative amount of supply and borrow on Compound V3 from the chain TVL. This is a high-level indication of market share and enables users to differentiate between protocol net growth and chain growth.

The chains breakdown table consolidates per-chain key information in an easy-to-view table, including indicators of risk and growth. The chain Health Score provides a high-level indication that the protocol growth on the chain is trending well. This metric is added after an initial ramp-up time for the protocol on each chain, is currently enabled for Ethereum and Polygon, and will be enabled for the Arbitrum chain after an initial growth period.

Markets

The Markets page consolidates information about all Compound V3 borrow markets across all chains, including borrow and supply status, APYs, and collateral at risk. The table can be filtered and exported to CSV as needed.

Clicking on any borrow market in this table opens the Market Detail view. This page consolidates all information about the market, including the borrow asset price, borrow and supply status, APYs, and collateral at risk - all with their 24h trend to surface changes. The detailed view allows users to observe and search for any wallet holding the asset. This is useful for drilling deep into accounts to see how they interact with Compound.

The Total Supply and Total Borrow charts show the amount of supply (earning) and borrowing of the borrowed assets over time.

With the Borrowers’ Market Health and Collateral At Risk charts, users can see the value to be liquidated (in USD) if prices deviate up or down. They can also observe a histogram of borrowers’ health, bucketed by their respective health scores.

The Backing Collateral Distribution over time chart shows what collateral this market uses. The chart can be toggled between USD amounts and relative percentages.

The Recent Events table consolidates all events that occurred in this market and can be filtered to show only specific event types.

Assets

The Assets page shows aggregated details for each supply. It borrows assets across all markets and chains, enabling a detailed understanding of the protocol exposure to any asset across all chains. Specifically, the Collateral at Risk and Wallets at Risk columns aggregate data from positions with low health values that are approaching liquidations across all chains to provide a clear view of liquidations at risk in case of asset price change.

Clicking on any asset in the Assets table open the asset detail page, aggregating data for the specific asset across all markets and chains, including the per-chain breakdown of exposure to this asset, that can be toggled between all collateral and collateral at risk. A Cross Chain exposure over time chart shows the historical trend of the protocol exposure to this asset, broken down by a chain.

The Cross-Chain Exposurechart details Compound exposure to assets across all deployments.

The asset detail page also shows the percentage of asset market cap that is on Compound V3 across each chain, as well as an indication of the amount of collateral that will be liquidated on different price points on each chain.

Wallets

The wallets page presents a comprehensive table that showcases all positions within the Compound V3 protocol. Users can conveniently search for specific wallet addresses or leverage the advanced filtering functionality that enables filtering wallets by liquidation risk level, chain, supply, or borrow assets.

By selecting a specific row in the wallets page, users will be directed to the wallet detail page, which displays all supply and borrows positions for this account across all chains and borrows markets. Additionally, the wallet detail page shows reward tokens and recent events to get a detailed history for the selected wallet.

Liquidations

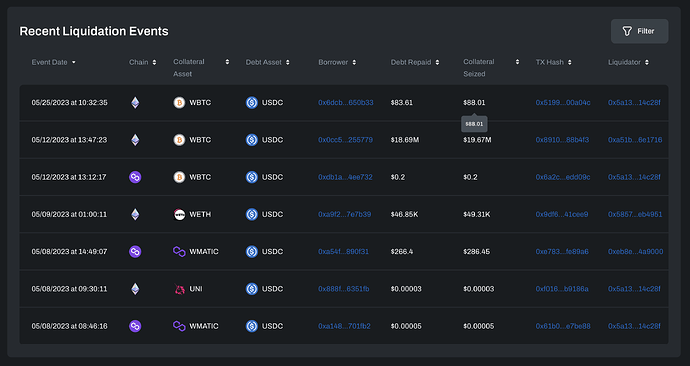

The liquidations page presents aggregated metadata on protocol liquidations from all chains and borrows markets, spanning 7, 30, and 90-day time frames. By default, data from all chains are displayed in aggregate. Users can filter and view results for specific chains or assets using the Filter button.

Moreover, the page offers a graphical representation of observed liquidation events on a daily basis, as well as a table that displays relevant liquidation events. Users can select a specific liquidation event, which will direct them to the Wallet Detail page of the corresponding account for a more detailed analysis.

Cross Chain Risk Explorer

The Cross-Chain Risk Explorer allows users to explore different risk scenarios by simulating the effect of token price changes across multiple chains. Users can simulate price changes of several assets across all chains and see the impact on the protocol as a whole and for each individual chain.

With the Advanced option, users can choose a different collateral factor value for a simulated asset and filter different networks.

The Wallets at Risk of Liquidation table displays a per-wallet breakdown of the simulated change, surfacing wallets that will have low health close to or are eligible for liquidation across all chains.

Alerts

The alerts tab offers real-time notifications on Compound V3 protocol activity. Each alert features a link to the corresponding account detail or asset detail pages. Users can subscribe to these alerts by clicking on the Join Telegram Channel and receive updates directly on Telegram.

Summary

Launching the Compound Multi Chain Risk Monitoring Hub is an exciting milestone in collaborating with the Compound community. We hope this tool empowers the community to make well-informed decisions and promotes visibility over the risk and health of the Compound protocol across all chains.

Our platform is constantly evolving and growing to meet our users’ needs. We invite the Compound community to explore the platform and provide your feedback.

If you have any questions or comments, don’t hesitate to get in touch with us on Twitter or via this form.