Hello - its James Glasscock from Reserve Protocol.

TL;DR:

Reserve Protocol would like to invite a conversation with the Compound community to explore the deployment of an ecosystem stablecoin (“compUSD”) that provides increased safety mechanisms and drives revenue to Compound DAO. The purpose of this post is to start a conversation and receive feedback from the community.

This proposal primarily focuses on the question of whether compUSD should exist. The detailed discussion regarding the establishment of a Compound v3 market for compUSD is not within the scope of this proposal. If there is enough community support and feedback for compUSD, it would be appropriate to address the topic in a separate forum post at a later date.

About Reserve

Reserve is a free, permissionless platform on Ethereum mainnet to build, deploy and govern asset-backed currencies referred to as “RTokens.” RTokens are always 1:1 asset-backed, allowing for permissionless minting and redeeming on-chain by users without the need for any middlemen. Overcollateralization is provided by RSR governance token stakers. Each RToken can have an entirely different governance system and is governed separately by ecosystem stakers. The Reserve Protocol launched on Ethereum mainnet in Oct 2022 and completed its fifth audit in Feb 2023. See audits at bottom of this post.

Three of the RTokens already live on the protocol are High Yield USD (hyUSD) is a secure high yield savings dollar with up to 8% APY expected to outpace the rate of inflation in over 100 countries around the world. ETHPlus (ETH+) is a safety-first diversified ETH staking index with up to 4.5% APY. Electronic Dollar (eUSD) is a hyper-resilient stablecoin built to endure black swan events, recently proving itself during the run on Silicon Valley Bank.

In order to help bootstrap the ecosystem, Reserve has made a strategic investment in the Convex Finance (CVX), Curve Finance (CRV) and Stake DAO (SDT) governance to incentivize deeper on-chain liquidity for RTokens.

Observation

Compound’s USDC v3 lending market could unnecessarily expose users to concentrated and centralized counterparty risk, as illustrated in the March 9th run on Silicon Valley Bank and its impact on USDC. Moreover, the borrowed assets leak opportunity and network effects, benefiting other ecosystems without reciprocating value for Compound. Additionally, the process of establishing new lending markets requires significant effort, and with a solitary issuer to represent the debt token, the market has limited flexibility to evolve with changes in demand. Although we acknowledge the deliberate precautionary measure of employing the single base asset design in v3, we propose an additive approach to further enhance risk mitigation.

Solution: Introducing compUSD

compUSD is a dollar-denominated stablecoin concept that features 1:1 diverse asset-backing, emphasizing capital preservation and safety through umbrella overcollateralization to guard against depeg and black swan events. The compUSD (RToken) provides natively generated revenue to fund Compound ecosystem growth, with independent and flexible governance by the community, launched on the Reserve Protocol.

compUSD can provide increased safety through diversified and decentralized asset-backing, LP incentives attract liquidity providers to participate in the compUSD ecosystem, and the yield generated is used to provide affordable loans and facilitate capital activation within the Compound ecosystem. Lastly, the name “compUSD” is a placeholder for discussion purposes and we expect naming, like all RToken parameters, to be decided by the community.

Asset Backing: Diversified, Capital Efficient, Yield Bearing

The proposed compUSD RToken has the flexibility to accept any ERC-20 token as collateral, which includes aTokens, cTokens, LP Tokens and tokenized RWAs. The value peg of compUSD remains stable through permissionless on-chain minting and redemption of the underlying collateral at a 1:1 ratio. This mechanism creates an opportunity for any market participant, even with no prior relationship to compUSD such as a debt position, to capitalize on arbitrage if the secondary market price of RToken deviates from the net asset value of its underlying collateral.

compUSD preserves capital through diversification. Security comes from hedging risks. This cannot be done from a single custodian or mechanism as those are points of concentrated risk, which can lead to complete collapse. We’ve entered an age which offers many choices on the issuer front, but few choices which diversify those risks. compUSD fills in the gap by drawing in coverage while remaining maximally capital efficient.

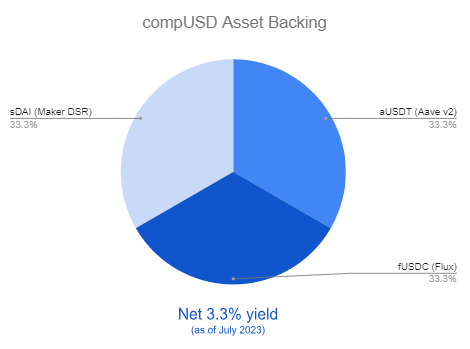

To minimize risks and ensure sufficient collateralization for compUSD while generating revenue for the ecosystem, the suggested initial basket may consist of assets external to the Compound ecosystem. This basket could include 33% aUSDT (Aave v2), 33% fUSDC (Flux Finance), 33% sDAI (DAI Savings Rate).

sDAI (Maker DSR) - sDAI is created when users deposit DAI into the Dai Savings Rate (DSR). The DSR yield comes from profit generated by MakerDAO. A primary source is the interest paid by those borrowing DAI against a variety of collateral. The interest earned on the loaned DAI is then distributed to the DSR depositors.

fUSDC (Flux USDC) - fUSDC is created by depositing USDC into Flux Finance (Compound v2 fork), a clever innovation that permissionlessly enables access to the risk-free Treasury rate by letting stablecoin holders lend to KYC whitelist investors who wish to get more exposure to US Treasuries via OUSG the Ondo Short-Term US Government Bond Fund.

aUSDT (Aave USDT) - aUSDT is created by depositing USDT into Aave v2 that allows stablecoin holders to lend permissionlessly throughout the Aave ecosystem.

As of this writing, the collective net yield of the proposed basket is generating approximately 3.3%, and varies according to market conditions.

The above referenced asset basket is for illustrative purposes of diversification and yield generation. Any persons launching compUSD or any RToken should carefully consider risk/reward tradeoffs in asset basket construction. Once launched, asset backing can be reconfigured and further diversified through governance at any time.

Revenue Generation & Growth Flywheel

With yield bearing collateral asset backing, compUSD shares auto-compounding revenue (yield) with stakeholders. Revenue shares are programmable at the launch of compUSD and again anytime through a governance vote.

The trend of stablecoins utilizing revenue to incentivize usage is gaining momentum This trend is only accelerating as projects like DAI Savings Rate and USDC pass through revenue to those using its custody service. compUSD positions itself to capture the passthrough rewards of its underlying collaterals in order to power its own incentives layer.

Table 1 illustrates a potential revenue share scenario to stimulate overcollateralization, independent governance and ecosystem growth through refilling Compounds treasury for incentives.

Table 1: compUSD Revenue Share Projections

According to the Table 1 example, 0% of revenue is allocated to compUSD holders, 20% is assigned to RSR stakers for governance and umbrella overcollateralization, and the remaining 80% is directed to Compound’s treasury (for incentives - discussed below).

If a percentage of compUSD’s yield were given to holders, it could reduce the attractiveness of borrowing debt tokens. This is because the actual cost of borrowing would additionally include the compUSD holder yield, on top of the interest charged on borrowing.

Instead, we suggest compUSD structures its incentives to activate capital rather than to commit to holders during its earliest stages (this can be modified later through governance as market traction evolves). Compound has led innovation of supply and borrow rewards using COMP emissions from the treasury. COMP rewards/emissions are up to governance and the current annual COMP reward run rate is about 600k-700k COMP per year.

compUSD revenue can be directed to Compound treasury for use as v3 compUSD supplier or borrower incentives based on current utilization rate strategies and variables. This excerpt in the Compound Discord illustrates flexibility with incentives and outcomes:

Per Paul | Gauntlet#1009 in referring to v2->v3 migration “we could allocate all the COMP to USDC borrows and none to suppliers, which would incentivize users to borrow USDC, thereby increasing utilization and supply APY, incentivizing users to supply USDC, and continuing until equilibrium is reached. But similarly, we could allocate all the COMP to USDC suppliers and none to borrowers, which would incentivize users to supply USDC, thereby decreasing borrow APY, incentivizing users to borrow USDC, and continuing until equilibrium is reached, at which point theoretically we’d have the same amount of USDC borrowed, except at a lower utilization rate. The question then becomes which utilization rate we expect to reach at each equilibrium, and which utilization rates yield the best reserve growth.”

As compUSD TVL grows, the native incentives generated create a sustainable lending market which is decreasingly reliant on traditional COMP incentives from the treasury.

The revenue generated by compUSD incentives can be converted into COMP before distribution or distributed directly as compUSD, aligning it with the currency used in the lending market. This approach can contribute to driving network effects for the new Compound v3 lending market.

At a $1 billion market capitalization, compUSD could generate revenue of $26.6 million for the Compound treasury, about 60% the current COMP emissions rate used for incentives.

Umbrella Overcollateralization

Although certain assets in the compUSD collateral basket may have their own safety mechanisms (e.g. Surplus Buffer Maker DAI, FDIC on some USDC), RTokens provide added umbrella overcollateralization covering the combined assets backing in the basket . The RSR governance token holders play a crucial role in providing umbrella overcollateralization for the compUSD RToken. This overcollateralization serves as a safeguard for compUSD holders in the unlikely event of a collateral token default. It is important to note that umbrella overcollateralization functions as first loss capital.

RSR holders have the flexibility to choose whether to stake their tokens on a single RToken or divide their RSR tokens among multiple RTokens. By staking on a specific RToken, they can earn a portion of the revenue generated by that particular RToken.

If any of the assets in the compUSD basket were to default, the protocol would sell the failing collateral to purchase a predetermined emergency collateral basket. This process may temporarily result in the RToken being below its targeted peg. As a subsequent step, RSR stakers who have staked on compUSD would have their RSR seized, and those funds would be used to make up any shortfall. The ultimate outcome of compUSD redemptions can be reliably predicted due to the on-chain overcollateralization.

Similar to RTokens diversifying risk, the RSR overcollateralization mechanism is distributed and siloed across various RToken staking opportunities. As of this writing other RTokens eUSD, ETH+ and hyUSD have an overcollateralization buffer of 18%, 5% and 17% respectively. Comparatively, the FDIC provides about 1.3% coverage on deposits socialized across all member banks. Similarly, the Maker DAO Surplus Buffer provides 1.7% coverage socialized across all stakeholders.

Permissionless Mint & Redeem

Anyone can mint or redeem compUSD 24/7 on-chain at Register.app or alternative user interfaces developed for the Reserve Protocol, as well as by directly interacting with the underlying smart contracts on-chain.

Anyone can deposit the required collateral baskets to mint compUSD. In return for depositing the required collateral baskets, the depositor receives 1:1 equivalent amount of compUSD. Anyone can deposit the required compUSD to redeem their collateral. In return for depositing compUSD, the depositor receives a corresponding amount of collateral assets

The gas fees of minting and redeeming compUSD on Ethereum may discourage retail users, who have alternative options such as swapping compUSD from a CEX or DEX with minimal slippage or accessing it through a lending market.

Additionally, there is a question as to why collateral holders would be willing to deposit their assets to mint compUSD if it means giving up a percentage of their yield.

The process of minting and redeeming compUSD will mainly be driven by two groups:

-

Firstly, market makers and yield farmers who have calculated that the combined yield from compUSD (which is zero in this proposal) and Curve LP yield is higher than the original collateral receipt token yield. Minters would be exchanging a 3.3% collateral yield for a much larger LP yield. For example: The eUSD, an RToken with around 2.3% yield-bearing collateral, directs its entire revenue towards overcollateralization and does not provide any yield to eUSD holders. However, the LP yield on Convex Finance currently ranges from 9% to 20%, meaning LPs are leveraging the 2.3% yield on the collateral for the higher LP yield.

-

Secondly, arbitrageurs play a role in equalizing the price across markets. Since RTokens like compUSD will always mint and redeem on-chain at $1, arbitrageurs capture the difference between the mint price and the trading price. For example: consider a RToken that is pegged to $1.00. If its price falls to $0.98, arbitrageurs would buy it from the open market and redeem it at the protocol for $1.00 worth of collateral, earning $0.02 per bought RToken. On the other hand, if the price rises to $1.02, arbitrageurs would mint it at the protocol for $1.00 and sell it on the open market, earning $0.02 per sold RToken.

In summary, the minting and redeeming of compUSD will primarily be carried out by specialists, while the majority of compUSD users will acquire the token through CEX, DEX, or lending markets.

Governance and Censorship Resistance

The Reserve protocol, which underpins compUSD, operates autonomously to manage the asset backing and emergency collateral. The protocol’s functionality including asset-backing and behavior can only be modified through governance parameter changes, which are subject to the decision-making of a decentralized community of RSR stakers. This decentralized governance structure ensures that no single entity can unilaterally control or manipulate compUSD.

compUSD exhibits censorship resistance through multiple avenues. Firstly, compUSD is minted on the Ethereum blockchain in a permissionless manner, there are no intermediaries.

Furthermore, compUSD’s asset backing is diversified and securely held in decentralized smart contracts. Any attempt to blacklist or restrict compUSD would necessitate blacklisting a significant portion of the DeFi ecosystem. This broad distribution of assets makes it challenging for any entity to censor or manipulate the value of compUSD.

Liquidity Incentives

Stablecoins need liquidity to enable direct access to market opportunities. Loans need liquidity to reduce external costs of liquidations. In many cases, liquidity providers prefer isolating risk to a single side of a liquidity pair, but are open to more exposure to risk. As such many liquidity providers migrate to service the highest paying opportunities. Liquidity incentives play a crucial role in bootstrapping liquidity and ensuring it is available when you need it.

Reserve Protocol recently announced a $20m DeFi investment in Convex Finance (CVX), Curve Finance (CRV), and Stake DAO (SDT) governance ecosystems. By boosting its CVX, CRV and SDT holdings, Reserve can incentivize deeper on-chain liquidity by redirecting Curve ecosystem incentives to compUSD pools on Curve.

A future endeavor may include governance electing to direct a portion of compUSD revenue towards additional liquidity incentives.

Complexity Wrapper

As a Compound v3 debt token, compUSD can act as a complexity wrapper to reduce market fragmentation.

The market can service compUSD, which can rebalance internally as needed to reduce exposure and resolve defaults while maintaining a single unit of account for debt. This allows a simplified market experience while allowing the debt note to adapt to risk collectively. compUSD wraps asset-backing, diversification, overcollateralization and revenue generation into a single dynamic package, governed by the community.

Adoption: Why Hold compUSD?

The incentives for adopting compUSD vary depending on the levels of compUSD supply and demand. This can be observed at different milestones such as 0 to 20 million, then to 100 million, then to 1 billion supply. As compUSD integrates different use cases, its flywheel and network effects start to take shape.

Increased safety. compUSD offers increased safety through its diverse and more decentralized asset-backing. This approach mitigates concentration and counterparty risks associated with a single collateral issuer. Additionally, compUSD implements umbrella overcollateralization provided by the RSR governance token holders, offering an added layer of protection against potential collateral defaults.

LP incentives. Reserve has made a substantial investment in incentivizing on-chain liquidity for RTokens deemed safe with strong community backing. As one of the top holders of governance power in the Curve ecosystem, Reserve directs incentives towards liquidity providers, which encourages existing LPs supporting RTokens to mint and provide liquidity for compUSD. This strategy aims to attract a significant number of the 60+ LPs already engaged in supporting RTokens to participate in the compUSD ecosystem.

Affordable loans. compUSD’s purpose is to expedite capital activation within the Compound ecosystem. To achieve this, 80% of compUSD’s revenue is allocated to the Compound DAO to be used as incentives for a compUSD v3 lending market (to be proposed separately), thereby enabling the lowest borrower interest rates in both DeFi and TradFi. Initially the TVL and revenue of compUSD will start from zero and be insufficient to drive organic incentives. Considering the long term benefits for the Compound DAO, we will propose separately (out of scope in the proposal) allocating COMP incentives during an initial bootstrapping of the compUSD v3 lending market.

Savings, remittance, payments (future). We envision compUSD adoption extending beyond the crypto-native community, and Reserve have already demonstrated the potential in this regard. The first RToken, eUSD, initially deployed by MobileCoin for the MOBY payments app, was recently adopted by the RPay app in Latin America. RPay was recently recognized in a 2023 IMF Working Paper for its contribution to preserving savings and safeguarding livelihoods against volatility caused by hyperinflation. Since its 2020 inception, RPay has facilitated over $5.8 billion in cumulative stablecoin volume with non-crypto users across Latin America.

Holder yield (future). As compUSD scales to higher supply and larger revenue generation, compUSD governors may elect to direct a portion of revenue back to the compUSD holders, accruing directly on-chain, accessible in any wallet, in effect creating a DeFi savings account.

Additionally, grants and hackathons can be directed towards the development and integration of new payment methods for compUSD, expanding its range of use cases.

Reserve Protocol Audits, Bug Bounty and Testing

Reserve Protocol has prioritized security of the platform and its users by undergoing multiple audits conducted by leading security organizations. These include:

- Trail of Bits: Report date: Aug 2022, review report: (link)

- Solidified: Report date: Oct 2022, review report: (link)

- Ackee: Report date: Oct 2022, review report: (link)

- Halborn: Report date: Nov 2022, review report: (link)

- Code4rena: Report date: Mar 2023, review report: (link)

Reserve additionally offers a $5M Immunefi bug bounty (#3 in bounty size at the time of writing), and obtains ongoing audits with Code4rena for every new protocol release. This culminates in a smart-contract ecosystem tested and verified in real-world scenarios, and which is designed to prevent loss.

The first RToken, eUSD, was recently stress-tested with inclusion of USDC in its asset-backing basket at the time of the run on Silicon Valley Bank. Circle’s USDC reserves were held at the bank, which led to USDC depegging from $1 down to 88 cents. Through eUSD’s decentralized ‘self-healing’ capability, eUSD was able to autonomously recapitalize and return to $1 peg without the need for regulator or bank backstops.

Call To Action: Request for Comment

In 2021, Compound had been developing Gateway - an initiative that combined a new stand-alone distributed ledger and a multi chain bridge with a new unit of account CASH and CDP like Maker. Our understanding is in 2022, Compound put Gateway on hold and pivoted to launch a Compound presence on EVM-compatible chains as fragmented markets, initially. This is Compound v3 Comet.

However, now that v3 is launched and scaling, we believe the Compound community may have renewed interest in launching a native stablecoin, seeking a design that diversifies risk, amplifies Compound network effects, and provides revenue to the ecosystem.

Given the increasing availability of diverse real world assets, coupled with innovations in complexity wrappers for asset baskets, incentives and safety, this is a request for comment from the community to discuss the merits, risks, and opportunities of Compound deploying its own stablecoin and potentially utilizing the Reserve Protocol in the aforementioned design or a modified design.

Suggested Development Approach

This proposal primarily centers around the existence of compUSD and the desired asset backing and revenue sharing configuration. The main objective of this discussion is to gather feedback from the community rather than providing an extensive development plan. However, for context, we outline three initial phases: Explore, Deploy, and Bootstrap Supply.

Explore: The exploration phase focuses on determining the level of support from the Compound community and incorporating their feedback. Discussions revolve around the composition of the asset backing basket for compUSD, as well as identifying variables for a risk assessment with Gauntlet. Strategy, liquidity, and incentives for the associated compUSD v3 market are discussed and vetted. A detailed proposal is prepared, outlining the specified parameters for the deployment of the Compound v3 market for compUSD. If there is sufficient community support, an on-chain vote will be submitted to support the launch of compUSD and its associated Compound v3 market.

Deploy: During the deployment phase, collaborators within the Reserve ecosystem work on developing any necessary collateral plugins. The Compound community takes the lead in evaluating and designing the branding for compUSD. The Compound community also configure the parameters and proceed with deploying the compUSD RToken, which can be done in just a few minutes at the only cost of Ethereum gas fees..

Bootstrap Supply: The goal in the Bootstrap Supply phase is to reach a supply of 50 million compUSD tokens. Efforts are made to assist with DeFi liquidity through collaboration within the Reserve ecosystem. COMP emissions allocation is specifically initiated for the compUSD lending market. Additional mechanisms and initiatives are explored to develop a growth strategy from 50 million to 500 million compUSD tokens.

We estimate the above development approach can be completed in 45 to 120 days at negligible external incremental costs to Compound DAO.

If you are still reading, THANK YOU. We would welcome your critical feedback or improvised ideas on this post.