Over the last couple of months, the Gauntlet team has built the infrastructure to ingest market data and run simulations and economic stress tests on the Compound V3 ecosystem. These simulations inform parameter recommendations for the protocol.

We are excited to announce that Gauntlet has launched the Compound V3 Risk Dashboard. The dashboard reflects Gauntlet’s recommendations for the V3 protocol, specifically for Ethereum | USDC Comet.

There are two goals for the initial dashboard launch. First, to help the community understand our methodology and recommendations. Second, to communicate how these recommendations mitigate risk and increase capital efficiency for the protocol.

Value at Risk (VaR), Liquidations at Risk (LaR), and Borrow Usage (MU) are topline measures of Risk and Capital Efficiency, respectively. VaR conveys capital at risk due to insolvencies when markets are under duress (i.e., Black Thursday). VaR represents insolvencies the protocol might have to cover in such an event. LaR conveys capital at risk due to liquidations when markets are under duress. Liquidations are a healthy part of a financial ecosystem but impact user experience and should therefore be considered when setting risk parameters. We currently compute VaR and LaR at the 95th percentile of our simulation runs, assuming higher than normal volatility.

As shown below, the front page of the dashboard shows Gauntlet’s recommendations and the impact of the recommendations on VaR, LaR, and Borrow Usage. There are tradeoffs between risk and capital efficiency. For example, decreasing the collateral factor may reduce insolvency risk, but the drawback is reducing capital efficiency for users.

This first page has a very similar structure to the current Compound V2 Dashboard, with the impact of our recommendations on VaR, LaR, and Borrow Usage at the top, and a collateral summary table at the bottom:

Clicking into a given collateral takes you to the detail page, where the majority of new development work can be seen. Compound V3 has a number of new parameters that we’ve incorporated into our models (Liquidation Factor, Storefront Price Factor, Supply Caps, as well as Reserve Targets). The first parameters are:

- Liquidation Collateral Factor - the threshold at which a loan becomes eligible for liquidation

- Liquidation Factor - inverse of the liquidation penalty (1-liquidation penalty); represents the portion of collateral put up for sale to liquidators so long as the reserve target is not met

- Borrowing Collateral Factor - loan to value at origination

- Storefront Price Factor - discount given to seized collateral when sold to the open market

- Supply Cap - the upper limit of how much can be supplied to the protocol for a given asset

- Reserve Target - determines the amount of a given collateral the protocol seeks to retain as an insolvency backstop

You’ll also notice that, unlike Compound V2, collateral assets in each V3 Comet do not have traditional “Borrow Caps” as only the stablecoin USDC can be borrowed against this collateral in the current V3 instance. Compound V3 likewise does not have set reserve factors as a percentage of interest paid, instead collecting reserves through an updated liquidation mechanism if current reserve is less than target reserve.

We have included heatmaps on this dashboard, which show the expected impact on the net insolvent % of collateral assets, collateral liquidated, and system collateralization ratios at different volatility (y-axis) and parameter settings (x-axis). The purpose of these charts is to answer questions around what would theoretically happen to this collateral should volatility spike and how would the risk profile change had we selected different parameter settings for Liquidation Collateral Factor or Liquidation Factor. Toggle between parameters by clicking on the right arrow on the respective row in the table. Note that Compound 3 allows multi-collateral positions, where a parameter change in one collateral asset may impact the VaR and LaR of other assets in the same Comet. This, combined with the effect of large positions, results in heatmaps often not changing monotonically.

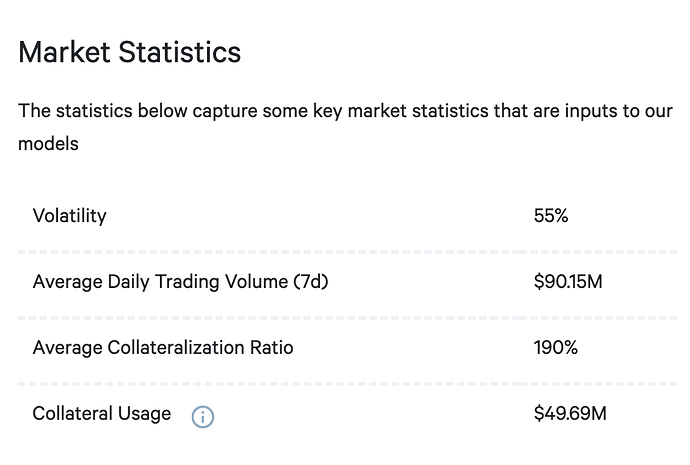

A note about the ETH collateral asset: as native Ethereum is not an ERC-20 token, what is technically deposited into the collateral contract is wrapped Ethereum (WETH). For simplicity, we have followed Compound’s naming convention and labeled the asset as ETH on the collateral pages, however, you’ll notice in our market statistics (the inputs to our simulations) we are using values describing WETH liquidity, which would be the asset liquidators require and therefore generates a better approximation of expected behavior.

In addition to what is displayed on the dashboard, we will be providing support and analyses on parameter settings for liquidator points. Since these changes may be relatively infrequent, we will make these proposals directly in the forums with the requisite data to facilitate community decisions.

We hope the Risk Dashboard is valuable for the Compound community and governance participants. We look forward to expanding the scope to include additional V3 Comets on Polygon and Optimism should they launch next year. Feel free to provide feedback directly to us using the Send Feedback button on the dashboard!