[RFC] Deploy Compound III on Linea

Introduction

Hello Compound Community! This is Cameron from Consensys and Jun from PGov. We are excited to engage the compound community for feedback regarding a deployment of Compound V3 on Linea. This thread aims to be a starting point for discussion with a tentative timeline below.

Before jumping into the specifics of a potential deployment on Linea, it’s exciting to spotlight the collaboration between the protocol teams. Linea and Compound Labs have been working to integrate the protocol into Linea’s testnet voyage. This joint effort has led to exploring new functionalities, such as implementing gas-less sponsored transactions in compliance with EIP-4337 and adhering to guidelines set by Compound Labs.

Last week’s testnet voyage, “DeFi week,” was live for 7 days. During this period, Compound Contracts have facilitated over 295,000 transactions. These transactions were conducted by more than 100,000 wallets, which collectively contributed to the 333M of testnet liquidity.

Given Compound’s success on the testnet, Linea is enthusiastic about guiding users toward the protocol, thereby bolstering the establishment of Compound V3 as a premier lending market for the network.

Timeline and Scope of the RFC

In alignment with a commitment to transparency. This proposal outlines a tentative timeline below regarding a formal proposal to deploy Compound V3 on Linea mainnet. Linea Mainnet is expected to launch in mid-July.

1. Current: Request for Comment Period - the request for comment is a timeframe where we can garner feedback from community members on the network and technical aspects of a deployment.

2. July 17th: Formal Proposal - After incorporating community feedback and recommendations, we plan to post a formal proposal on the Compound forum. This proposal will adhere to the formal multichain deployment structure guidelines.

3. July 28th: Voting phase - Pending positive community feedback and discussions with core stakeholders, we aim to advance the proposal to the voting phase.

Preamble:

Type: Multichain Deployment

Title: Deploy Compound III on Linea

Author: PGov / Consensys/Linea

Proposal Introduction

Point of Contact:

PGov: @PGov

Linea: @Cameron, @befa

Email: Governance@Consensys.net

Set up a time to talk about the proposal: Calendly

Proposal Summary:

The Linea team from Consensys and PGov team are proposing the deployment of Compound III on Linea, a zkEVM incubated by Consensys, to continue broadening Compound’s multi-chain future and establish the lending market as a leading protocol on a promising zkEVM with a robust distribution network.

Overview of Proposal

- About Linea

- Proposed Markets

About Linea

Linea is a scalable L2 on top of Ethereum powered by a zkEVM tech stack incubated by Consensys, resulting from over 20 months of R&D from Consensys’s research team. This team has a track record of successful projects in the zk space, including the GNARK library and active involvement in the Merge.

Linea processes native EVM bytecode for proving and verification. This approach allows for the execution of Solidity smart contracts without needing modifications or re-audit. This also means compatibility at the RPC level with widely adopted middleware and toolsets, providing developers with a familiar environment to build using well-established tools and infrastructure.

Moreover, the network intends to align its onboarding and distribution through existing relationships with MetaMask, Infura, and Truffle communities. These products will help bootstrap the network and better serve developers, protocols, and builders.

Proposed Markets

We propose that the Linea deployment starts with an isolated USDC market with crypto majors as collateral. We also propose a conservative approach, after the applicable parties provide market and asset recommendations.

Motivation

Linea provides Compound access to an expansive and well-established user base through existing Consensys product integration. This connection facilitates a more efficient distribution and onboarding process for Linea, helping to catalyze Compound adoption on the network. This strategic alignment expands Compound’s market penetration and encourages new opportunities for user engagement.

Linea prioritizes User Experience (UX), aiming to eliminate barriers for MetaMask’s impressive community of 30M MAUs. By securing native support in the default MetaMask network dropdown list, Linea enhances user convenience and fully supports all MetaMask curated experiences. These include On/Off Ramp, MetaBridge, MetaMask Swaps, the Portfolio dApp, and the MetaMask SDK, presenting numerous opportunities for incorporating the Compound protocol.

Grant Application:

Did not apply

Non-Technical Evaluation

Over 100 global partners and protocols are committed to launching on Linea within the first week of mainnet, some of which are below.

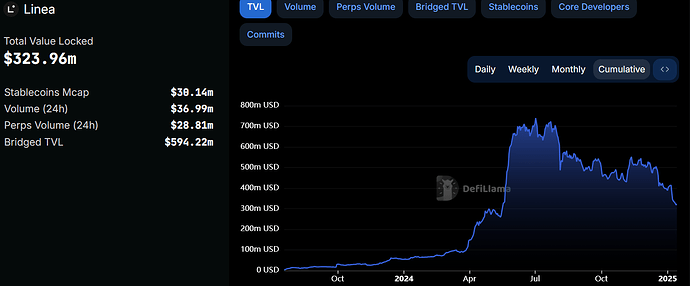

Linea’s testnet has handled over 2 million transactions under private beta and over 40 million transactions under public beta. Many of these transactions are users of the ongoing Voyage quest, a crucial initiative designed to help stress-test the network. The network has also shown unprecedented developer activity, with over 4.3 M unique addresses deploying over 2M contracts, showcasing a vibrant and engaged developer community.

Security Evaluation

We identified the following considerations to be aware of. These considerations resulted from consultation with our internal team, Linea, and external stakeholders.

- Linea’s sequencer and prover are centralized

- The team is committed to decentralizing the sequencer and prover within the first 12 months of operation

- A multi-sig can upgrade core smart contracts

- The team is looking to mitigate centralization risk through the use of a security council within the first 12 months of operation

- Low liquidity markets

- A primary variable for risk analysis is liquidity data. As Linea does not expect to have accurate liquidity data by the time this proposal goes live, the team is looking into how best to mitigate risk for protocol stakeholders

Technical Evaluation and Considerations

- Technical Implementation

- Cross-chain Governance

- Oracles

Technical Implementation - Linea onboarding engineers will handle all technical deployment under advisement from all applicable stakeholders, including Compound Labs, OpenZepplin, and Gauntlet.

Please see a list of deployed testnet contract addresses here.

comet 0xa84b24A43ba1890A165f94Ad13d0196E5fD1023a

configurator 0x079f68Fa440A0F04d741a5Aba7DA8fE9DfB0AA8B

rewards 0x44411C605eb7e009cad03f3847cfbbFCF8895130

bridgeReceiver 0x06F066A9C0633507EAc640D89442C77748C3a2a8

l2MessageService 0xC499a572640B64eA1C8c194c43Bc3E19940719dC

l2TokenBridge 0xB191E3d98074f92584E5205B99c3F17fB2068927

bulker 0xad6729C101691A63F7d1e4CcbaD04bC8c6818a22

fauceteer 0x953d0A78eeC15E76266792fE163dC5316F5c2aca

Cross-chain Governance - The smart contracts deployed on Linea will be the same as the mainnet contracts, using the compound cross-chain governance process. The Layer 1 (L1) Timelock will manage the Linea contracts, transmitting messages to the Layer 2 (L2) BridgeReceiver through the native message-passing bridge. Please refer to the link provided for more comprehensive information on Compound III’s multi-chain governance approach.

Oracle - Linea currently does not have Chainlink integration. In looking for a suitable alternative for the deployment, the Linea team conducted a competitive analysis of oracles operating on the network. The analysis considered factors including Total Value Secured (TVS), data sources, aggregation methods, security, and market adoption. The evaluated on-chain oracle services were: Pyth, Redstone, and Umbrella (Deployed on testnet Compound integration).

The Linea team proposes to begin the discussion with Pyth as the oracle provider. Pyth’s first-party data is directly sourced from various trusted institutions, including exchanges, trading firms, and market makers. Pyth’s architecture and design enable secure and cost-effective high-frequency price feeds. The service has obtained audits for various networks, found here. Lastly, they have shown promising market adoption, including 1.7B TVS, and primary oracle integration at Synthetix and Venus.

Other Considerations

Sponsorship – PGov did not receive any sponsorship to contribute to this proposal.

Market Backstop Discussions – The Linea team is assessing the viability of having a safety module to backstop protocol losses that occur directly from oracle or liquidity manipulation for the first 60 days of operation. This would not be smart contract enabled. These discussions are ongoing and not finalized. According to the feedback on this proposal, The team will provide more details on this topic.

Copyright Waiver

Copyright and related rights waived via CC0.

License Exemption

We are requesting an exemption from the community that will allow the Linea network to obtain a Compound Business Source License (BSL) to use the Licensed Work, update compound-community-licenses.eth, and deploy it on the linea network, provided that the deployment is subject to Ethereum Layer 1 Compound Protocol governance and control.