Deploy Compound V3 on Optimism

Preamble:

Type: Multichain Deployment

Title: Deploy Compound III on Optimism

Authors: @markg from Optimism Foundation, @bryancolligan & @sharp (Compound Growth Program)

Proposal Introduction

Point of contact(POC): @bryancolligan @Sharp

Overview of Proposal:

The Compound Growth Program, after conversations with various stakeholders and community members, identified Compound deployment on Optimism as one of the top priorities for the program. A further conversation with community members from Optimism validated our argument to expand Compound to Optimism. In line with our priorities, we propose deploying Compound V3 on Optimism Mainnet.

Note: A proposal with similar scope was also posted a year ago, but it could not be completed due to multiple factors. You can find the earlier proposal here Deploy Compound v3 on Optimism

Motivation:

Optimism is a Layer 2 scaling solution for Ethereum, designed to enhance the network’s capacity and speed while significantly reducing transaction costs. It operates on the principle of Optimistic Rollups, a technology that allows for the execution of smart contracts and transactions off the main Ethereum blockchain (Layer 1), but with the same level of security and decentralization. This is achieved by assuming transactions are valid by default and only running computations in the event of a dispute. This method drastically increases throughput and efficiency, making it an attractive option for decentralized applications (dApps) looking to scale without sacrificing Ethereum’s robust security model.

Optimism is EVM Compatible, in line with Compound’s requirements for deploying on new chains. Additionally, Optimism has introduced a novel funding mechanism known as Retroactive Public Goods Funding, which aims to sustainably fund projects contributing to the public good, leveraging a portion of transaction fees generated on the network.

Launching Compound on Optimism mainnet represents a strategic move to leverage these benefits. Compound stands to gain enhanced efficiency, reduced gas fees, and faster transactions, thereby providing more avenues for Compound users. Optimism users to gain services of the oldest, largest and most secure defi protocol. This integration demonstrates Compound’s commitment to scalability and cost-effective operations and aligns with the community’s efforts to address network congestion and high transaction fees. It positions Compound favorably in the competitive DeFi landscape, opening new avenues for growth and innovation on a platform designed for the future of decentralized finance.

Grant Application:

A developer team planned to apply to Grants for this deployment, but L2 deployment is left out of the scope of the Compound Grants program. Due to this CGP won’t be able to fund this project. The Compound Growth program will be activating its own developer fund to finance the development of this integration. In this case, the team initially applying for CGP has been enabled to move forward with the deployment. The total grant awarded to the team is $23,800 for this development.

Non-Technical Evaluation

The following statistics were recorded on Feb 6th 2024

-

TVL on the Chain: $775M

-

Amount of protocols on the chain: 181+

-

(#) of unique addresses on the chain: 110M

-

Active Addresses: Nansen

-

1 Day: 97K

-

7 Day: 534k

-

30 Day: 1.23M

Rationale

Optimism is one of the top L2s, it has considerable activity and Liquidity as a chain.

Additionally, the Optimism Grants programs provide an opportunity for Compound to apply and get some incentives to promote activity on Compound V3 which will be on Optimism. Currently Optimism has two funding mechanisms, the Optimism Grants which happen in cycles and also the RetroPGF funding for projects on Optimism. An additional Partner Fund also exists that Compound can tap into.

Proposed Markets

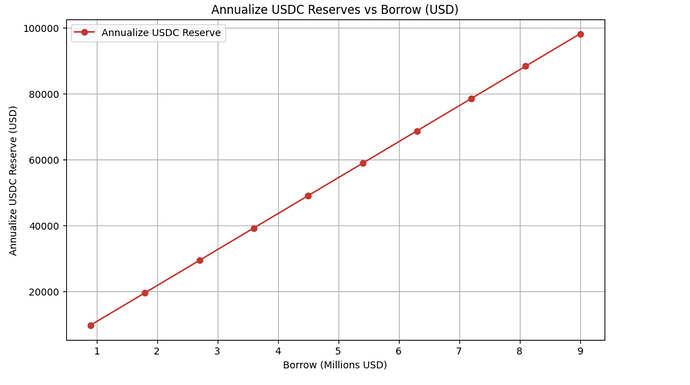

- Native USDC (64 Million)

- USDT (341 Million)

For collateral assets, we propose LINK, OP, WBTC, Wrapped ETH(wETH), LDO. We will be looking forward to the community to give more feedback in this direction.

Security Considerations

Some of the risks that should be taken into consideration:

- OP sequencer is centralized. There are plans to incorporate decentralized sequencing with teams such as Espresso in the future. However, a core security goal of Optimism is that despite the current centralization, the Sequencer should not be able to prevent users from submitting transactions to the L2 chain. Users of OP Stack chains can always bypass the sequencer and include transactions in the L2 chain by sending their L2 transactions directly to the OptimismPortal contract on L1.

- The Fault proof system is live on OP Goerli, currently at Stage 0 of fault proofs. Stage 0 means L2 state roots are posted to Ethereum L1, inputs for the state transition function are posted to L1, and a source-available node exists that can recreate the state from L1 data.

- Further risk analysis can be found here: Optimism – L2BEAT

Copyright Waiver

Copyright and related rights waived via CC0 2