[Gauntlet] - Ronin Recommendations

Simple Summary

If the community wishes to deploy on Ronin, we recommend the following initial parameter recommendations for the Ronin v3 USDC, RON and WETH comets:

Risk Parameters

USDC Comet

| Asset | Collateral Factor | Liquidation Factor | Liquidation Penalty | Supply Cap |

|---|---|---|---|---|

| RON | 73% | 79% | 17% | 1M RON |

| WETH | 83% | 90% | 5% | 110 WETH |

| AXS | 68% | 75% | 20% | 150K AXS |

WETH Comet

| Asset | Collateral Factor | Liquidation Factor | Liquidation Penalty | Supply Cap |

|---|---|---|---|---|

| RON | 75% | 80% | 12% | 3M RON |

| USDC | 83% | 90% | 5% | 400K USDC |

| AXS | 70% | 75% | 20% | 300K AXS |

RON Comet

| Asset | Collateral Factor | Liquidation Factor | Liquidation Penalty | Supply Cap |

|---|---|---|---|---|

| USDC | 75% | 80% | 12% | 500K USDC |

| WETH | 75% | 80% | 10% | 500 WETH |

| AXS | 72% | 78% | 15% | 300K AXS |

Rationale

Supply Caps and Liquidation Penalty

WRON DEX TVL across majors

| Pool Type | Pool Name | Pool URL | TVL ($M) | 24H Volume ($) |

|---|---|---|---|---|

| Katana | WRON / WETH | Link | 41.82 | 1.17M |

| Katana | AXS / WRON | Link | 13.97 | 715.7K |

| Katana | USDC / WRON | Link | 13.89 | 1.85M |

| Katana-V3 | WETH / WRON 0.3% | Link | 0.84 | 181.7K |

| Katana-V3 | USDC / WRON 0.3% | Link | 0.84 | 141.8K |

Total DEX TVL : $70.52M

USDC DEX TVL across majors

| Pool Type | Pool Name | Pool URL | TVL ($M) | 24H Volume ($) |

|---|---|---|---|---|

| Katana | USDC / WRON | Link | 14.08 | 1.45M |

| Katana | USDC / WETH | Link | 2.74 | 269K |

| Katana-V3 | USDC / WRON 0.3% | Link | 0.86 | 168.5K |

| Katana | AXS / USDC | Link | 0.04 | 5.6K |

Total DEX TVL : $17.72M

WETH DEX TVL across majors

| Pool Type | Pool Name | Pool URL | TVL ($M) | 24H Volume ($) |

|---|---|---|---|---|

| Katana | WRON / WETH | Link | 41.75 | 1.45M |

| Katana | USDC / WETH | Link | 2.74 | 269K |

| Katana | AXS / WETH | Link | 1.99 | 68.1K |

| Katana-V3 | WETH / WRON 0.3% | Link | 0.85 | 308.1K |

Total DEX TVL : $47.33M

AXS DEX TVL

| Pool Type | Pool Name | Pool URL | TVL ($M) | 24H Volume ($) |

|---|---|---|---|---|

| Katana | AXS / WRON | Link | 14.12 | 325.3K |

| Katana | AXS / WETH | Link | 1.99 | 68.1K |

| Katana-V3 | AXS / WRON 0.3% | Link | 0.10 | 14.2K |

| Katana | AXS / USDC | Link | 0.04 | 5.6K |

| Katana-V3 | AXS / WRON 1% | Link | 0.02 | 850 |

| Katana-V3 | AXS / USDC 1% | Link | 0.01 | 0.24 |

Total DEV TVL : $16.28M

USDC Comet

Reviewing the liquidity pathways from the collateral assets to USDC, Gauntlet recommends aligning the LP to that of WETH, LINK and UNI on the Mainnet USDC comets.

| Asset | Liquidation Penalty |

|---|---|

| RON | 17% |

| WETH | 5% |

| AXS | 20% |

Gauntlet recommends setting the supply caps to the levels suggested below for the following assets on USDC Comet:

| Asset | Supply Cap |

|---|---|

| RON | 1M |

| WETH | 110 |

| AXS | 150K |

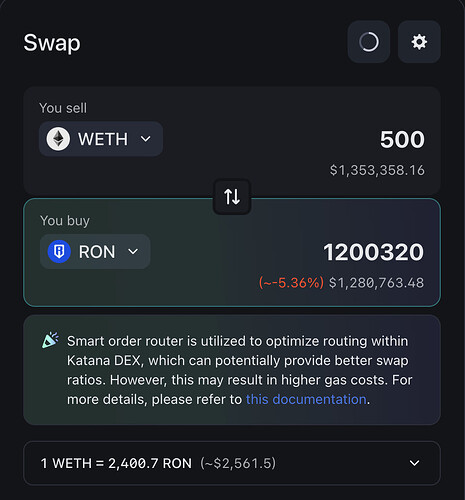

RON-USDC DEX Slippage

WETH-USDC DEX Slippage

AXS-USDC DEX Slippage

WETH Comet

For WETH Comet, Gauntlet recommends the following Liquidation Penalties:

| Asset | Liquidation Penalty |

|---|---|

| RON | 12% |

| USDC | 5% |

| AXS | 20% |

Gauntlet recommends setting asset supply caps at the levels suggested below:

| Asset | Supply Cap |

|---|---|

| RON | 3M |

| USDC | 400K |

| AXS | 300K |

RON-WETH DEX Slippage

USDC-WETH DEX Slippage

AXS-WETH DEX Slippage

RON Comet

For the RON Comet, Gauntlet recommends the below Liquidation Penalties (LP):

| Asset | Liquidation Penalty |

|---|---|

| USDC | 12% |

| WETH | 10% |

| AXS | 15% |

Gauntlet recommends setting asset supply caps at the following levels:

| Asset | Supply Cap |

|---|---|

| USDC | 500K |

| WETH | 500 |

| AXS | 200K |

USDC-RON DEX Slippage

WETH-RON DEX Slippage

AXS-RON DEX Slippage

Collateral Factors (CF) and Liquidation Factors (LF)

USDC Comet

RON-USDC - Drawdowns and Returns in the past 6 months

AXS-USDC - Drawdowns and returns in the past 6 months

For WETH, Gauntlet recommends aligning the Collateral Factor and Liquidation Factor to that of the Mainnet USDC comet.

| Asset | Collateral Factor | Liquidation Factor |

|---|---|---|

| RON | 73% | 79% |

| WETH | 83% | 90% |

| AXS | 68% | 75% |

A 1% delta between the Liquidation Factor and Liquidation Penalty as recommended by ChainRisk is too low as during extremely volatile regimes, liquidations might be inefficient if the price of WETH drops beyond 2% post absorption of collateral. We know:

Liquidation Factor ≤ (1 - Liquidation Penalty) × (1 - x)

A 1.2% price drop between blocks would require the Liquidation Factor to be below 88.9%, with Liquidation Factor of 89%, it is insufficient to liquidate collateral effectively, potentially leading to insolvency.

WETH Comet

RON-WETH - Drawdowns and returns in the past 6 months

AXS-WETH - Drawdowns and returns in the past 6 months

For USDC, Gauntlet recommends aligning the Collateral Factor and Liquidation Factor to that of the Optimism USDC comet:

| Asset | Collateral Factor | Liquidation Factor |

|---|---|---|

| RON | 75% | 80% |

| USDC | 83% | 90% |

| AXS | 70% | 75% |

As seen from above, WETH pairs are less volatile and more correlated than USDC pairs and therefore can be more risk-on in terms of CFs and LFs with respect to USDC in terms of supply-borrow distribution unlike the risk recommendations proposed by ChainRisk. Furthermore, the RON-WETH pool is the most liquid pool on Ronin which can imply a lower liquidation penalty compared to RON-USDC pair.

RON Comet

USDC-RON - Drawdowns and returns in the past 6 months

WETH-RON - Drawdowns and returns in the past 6 months

AXS-RON - Drawdowns and returns in the past 6 months

| Asset | Collateral Factor | Liquidation Factor |

|---|---|---|

| USDC | 75% | 80% |

| WETH | 75% | 80% |

| AXS | 72% | 78% |

For USDC Comet

Targetted Reserves: 20M USDC

Storefront price factor: 60%

Seed reserves: $50k

For WETH Comet

Targetted Reserves: 5000 WETH

Storefront price factor: 70%

Seed reserves: 25 WETH

For RON Comet

Targeted Reserves: 20M RON

Storefront price factor: 70%

Seed reserves: $50k

IR Curve Parameters

Gauntlet recommends aligning the IR parameters to those comets on Mainnet :

USDC Comet

Recommended Parameter Adjustments

| Parameter | Recommended Value |

|---|---|

| Annual Borrow Interest Rate Base | 0.015 |

| Annual Borrow Interest Rate Slope Low | 0.05 |

| Borrow Kink | 0.9 |

| Annual Borrow Interest Rate Slope High | 3.4 |

| Annual Supply Interest Rate Base | 0 |

| Annual Supply Interest Rate Slope Low | 0.054 |

| Supply Kink | 0.9 |

| Annual Supply Interest Rate Slope High | 3.034 |

Utilization vs APRs & Reserve Factor

WETH Comet

Recommended Parameter Adjustments

| Parameter | Recommended Value |

|---|---|

| Annual Borrow Interest Rate Base | 0.01 |

| Annual Borrow Interest Rate Slope Low | 0.0155 |

| Borrow Kink | 0.9 |

| Annual Borrow Interest Rate Slope High | 1.26 |

| Annual Supply Interest Rate Base | 0 |

| Annual Supply Interest Rate Slope Low | 0.0216 |

| Supply Kink | 0.9 |

| Annual Supply Interest Rate Slope High | 1.125 |

Utilization vs APRs & Reserve Factor

RON Comet

Gauntlet recommends setting the IR curves mirroring those recommended for the S Comet on Sonic:

| Parameter | Recommended Value |

|---|---|

| Annual Borrow Interest Rate Base | 0.01 |

| Annual Borrow Interest Rate Slope Low | 0.017647 |

| Borrow Kink | 0.85 |

| Annual Borrow Interest Rate Slope High | 1.5 |

| Annual Supply Interest Rate Base | 0 |

| Annual Supply Interest Rate Slope Low | 0.0225 |

| Supply Kink | 0.85 |

| Annual Supply Interest Rate Slope High | 1.339 |

Utilization vs APRs & Reserve Factor

Incentive Parameters

For USDC Comet

Our COMP rewards recommendations are designed to offer appealing distribution APRs when the comets are first launched and when supply caps are highly utilized.

Gauntlet is recommending supply rewards to incentivize a more significant inflow of supply tokens into the protocol. This is important in the early stages of protocol growth before borrowers can join. Daily COMP rewards are subject to change as TVL rises and the markets evolve.

| Daily COMP Supply Rewards | Daily COMP Borrow Rewards |

|---|---|

| 2 | 1 |

With the above utilization and the present Interest Rate curve, for Stablecoin comets:

- Supply APR: 6%

- Borrow APR: 4.8%

Given the current COMP price of $50 at 90% utilization:

- Supply Distribution APR: 4.31%

- Borrow Distribution APR: 2.39%

This results in the following Net APRs:

- Net Supply APR: 9.17%

- Net Borrow APR: 3.61%

For WETH Comet

| Daily COMP Supply Rewards | Daily COMP Borrow Rewards |

|---|---|

| 2 | 1 |

With the above utilization and the present Interest Rate curve, for WETH comets:

- Supply APR: 1.94%

- Borrow APR: 2.4%

Given the current COMP price of $50 at 90% utilization:

- Supply Distribution APR: 1.8%

- Borrow Distribution APR: 1%

This results in the following Net APRs:

- Net Supply APR: 3.74%

- Net Borrow APR: 1.4%

For RON Comet

| Daily COMP Supply Rewards | Daily COMP Borrow Rewards |

|---|---|

| 1 | 0 |

With the above utilization and the present Interest Rate curve :

- Supply APR: 1.94%

- Borrow APR: 2.5%

Given the current COMP price of $50 at 90% utilization:

- Supply Distribution APR: 1.85%

- Borrow Distribution APR: 0%

This results in the following Net APRs:

- Net Supply APR: 3.76%

- Net Borrow APR: 2.5%