Preamble:

Type: Multichain Deployment

Title: Deploy Compound III on Ronin

Authors: @BaileyT @Lionel @justin_ronin from Ronin Ecosystem

Overview of Proposal:

- Ronin is an EVM-compatible Layer 1 Blockchain, optimized for near-instant transactions and negligible fees that enable millions of seamless in-app transactions. Trusted by millions making it the leading choice for Web3 games & consumer applications.

- The network currently runs on the DPoS consensus mechanism, and utilizes Chainlink CCIP for cross-chain communication.

- The Ronin Ecosystem team proposes the deployment of Compound III onto the Ronin Network, with WETH and USDC markets, and RON, WETH, USDC, WBTC, AXS, PIXEL as proposed collateral assets.

- Ronin will open up its ecosystem for permissionless smart contract deployment in Q1 2025, with a focus on growing the DeFi vertical. We are excited to propose a synergistic partnership with Compound and its community.

Links

Socials & Overview

- Website : https://roninchain.com/

- Twitter : https://x.com/Ronin_Network

- Whitepaper: Ronin Docs

Audits

- Ronin Bridge & DPoS Consensus Audits: Security audits | Ronin Docs

Token & Chain Metrics

- Dune Dashboard : https://dune.com/ronin/ronin-overview-dashboard

- Coingecko

- CoinmarketCap:

Motivation

Overview

Ronin is an EVM-compatible Layer 1 Blockchain forged for Gaming. Following a successful community-centric growth strategy, Ronin has curated a loyal userbase with 29m+ unique wallets and 4.7m MAUs, making it the #1 gaming chain by active users.

Ronin has now set its sights on furthering the ecosystem by going permissionless in Feb 2025 in an initiative known as Open Ronin. A core part of this strategy is to grow our DeFi vertical, providing users access to reputable money market protocols and increasing utilization of the $RON token.

Synergies

We believe Compound and Ronin can strongly benefit from a synergistic partnership.

Compound protocol will be positioned as the leading DeFi protocol on Ronin, a battle-tested ecosystem primed for explosive growth. Compound will share in Ronin’s massive network effects, directly servicing our ~4.7m MAUs and 50+ dApps. The majority of these users were onboarded directly into Ronin without using DeFi apps on other EVM chains, presenting an opportunity for Compound to acquire net new users.

Compound’s deployment on Ronin will also mark the protocol’s first foray into an alt-L1, furthering its reputation as the multi-chain DeFi protocol of choice.

Ronin will benefit from Compound’s liquidity and proven DeFi infrastructure, providing our community with a safe and reputable avenue for unlocking greater capital efficiency. Having a robust DeFi ecosystem also increases Ronin’s targetable audience, servicing not just retail gamers but opening the doors for traders, degens, whales, liquid funds, and other institutional investors. This userbase expansion contributes to a growth flywheel that will mutually benefit Compound as well.

Grant Application

No, we did not apply for the Compound Grants Program.

Non-Technical Evaluation

As of 16th Dec 2024:

-

Value of assets on-chain: $172m TVL, $1.1bn TVB on DeFi Llama

-

Number of protocols on the chain: ~50 protocols - Ecosystem Map

-

(#) of unique addresses on the chain: 29,469,163

-

Active Addresses: https://dune.com/ronin/ronin-overview-dashboard

- 1 Day: 835,220

- 7 Day: 1,567,299

- 30 Day: 3,384,444

Rationale

- The Ronin Community

-

Ronin is the #1 gaming blockchain by real and active users, currently recording 786k DAUs and peaking at 2.2m DAUs earlier in July 2024. It is also ranked in top 3 L1s by DAU only behind Solana and Tron, consistently recording ~60m monthly transactions in the past year.

-

Massive gamer and creator community, with over 2.5M followers on Twitter, >700k Discord members (top 6th in the world), 340k substack subscribers, >2500 creators.

-

dApps who deploy on Ronin have historically benefited from the “Ronin Effect”, with Pixels experiencing a 200x in user growth since migrating to Ronin, and hitting >700k DAUs. A recent report by Messari summarizes the Ronin Effect and its key benefits for protocols deploying on Ronin.

- The Ronin Liquidity

-

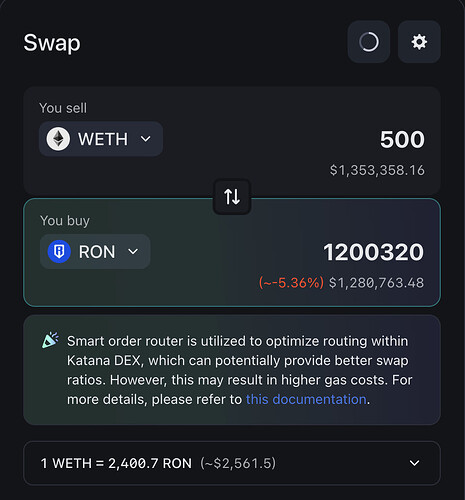

Katana is Ronin’s DEX of choice, with $174m in TVL. There have been minimal $RON incentives to bootstrap till date, presenting an exciting yield opportunity for the Compound community to leverage.

-

The Ronin NFT marketplaces in aggregate have maintained ~$200k in daily volume transacted, placing it near Magic Eden and x2y2.

-

The Ronin bridge has $1.2bn in TVB across 7 key assets including USDC, WETH, WBTC and AXS. These assets are mostly used for utilization on the chain due to the limited DeFi opportunities, but poised for growth in Open Ronin.

-

There is ~$520m worth of $RON tokens currently staked across 30 validators and 277k delegators, a substantial amount of liquidity that can be tapped into.

-

Ronin users are hungry for high quality liquid opportunities as shown by Wild Forest’s recent 3.3x oversubscribed $2m community sale.

-

The Ronin Incentive Fund has reserves of ~$230m in $RON incentives that can be deployed in multiple phases. ~$33m is available immediately to support and catalyze the growth of the chain.

- The Ronin Roadmap

-

Ronin will open up its ecosystem for permissionless smart contract deployment in Q1 2025, with a focus on growing the DeFi vertical. The team has revamped the Developer Journey to equip and support new builders to come onboard. It is in mutual interest for bluechip DeFi protocols like Compound to deploy early to build traction, familiarity and stickiness with the net-new Ronin user base.

-

Builders will soon be able to leverage the polygon CDK to launch their own ZK L2s on top of the Ronin mainnet, opening the door to faster and more accessible consumer experiences on Ronin. This presents an exciting opportunity for Compound to scale horizontally together with Ronin.

-

Ronin has partnered with Chainlink to utilize CCIP as the bridge infrastructure of choice for greater security, as well as their data feeds for secure and reliable pricing data. The oracle infrastructure has already been set up, and on track to integrate more price feeds by January 2025.

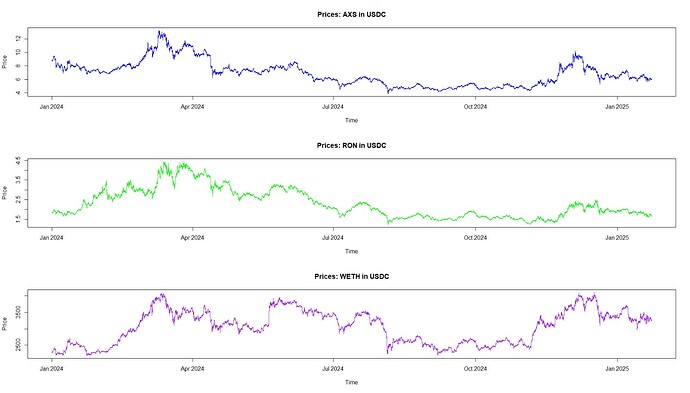

Proposed Markets

Proposed based on current DEX TVL, Volume, and Holder Count, and asset familiarity. Ronin is looking forward to Compound community’s feedback.

| Market | Collateral Assets |

|---|---|

| WETH Market | RON, USDC, WBTC, AXS, PIXEL |

| USDC Market | RON, WETH, WBTC, AXS, PIXEL |

Security Considerations

Some of the risks that should be taken into consideration:

-

Validator set currently of 30 total validators, consisting of 12 trusted Governing Validators (GVs) and 18+ Rotating Validators (RVs). With the opening of Ronin and staking incentives, we anticipate even more RVs to come online, further reducing centralization risk.

-

Bridge

- Bridge migration to using more secure Chainlink CCIP infrastructure, on track for completion before Open Ronin in February.

- Whitehat Bridge 2024:

- Ronin Validator Bridge 2022

-

Ronin will be opening up its ecosystem to enable permissionless deployment in Q1 2025. There are multiple ongoing risk assessments, with more information to be shared publicly once available.

Copyright Waiver

Copyright and related rights waived via CC0 2