Summary

A proposal for continuous market risk management to optimize yield, capital efficiency, and mitigate depositor losses.

Background

For almost two years now Gauntlet has formally and informally worked for Compound to perform market risk assessments, contribute to treasury management, optimize incentives, calibrate risk parameters, and upgrade the protocol. During that time Gauntlet has been able to refine our core models and agents specifically for autonomous interest rate protocol’s like Compound.

As the protocol continues to decentralize to the community our position is that dynamic risk parameters are a vital component to growth. Most protocol upgrades and maintenance impact market risk of the protocol. For example, the seize function and liquidator behavior. Or the introduction of Chainlink Price Feeds which has and will continue to facilitate the onboarding of new assets. How should the community reason about initial borrow caps? When should collateral factors be raised or lowered? How do individual assets and their parameterizations affect insolvency risk?

Proposal

In the following sections, we will outline the case and goals for dynamic risk parameters. The initial proposed scope has target metrics Gauntlet aims to improve. Those metrics are:

- Risk-adjusted yield for Depositors

- Capital efficiency for Borrowers

- Mitigate Depositor losses

Gauntlet will improve the metrics above while controlling for protocol insolvency risk.

Illustrated in the governance example below are the benefits from a previous parametrization initiated and executed by Gauntlet. Additionally, we describe two initial areas for optimization that have been identified.

Compound Proposal 039

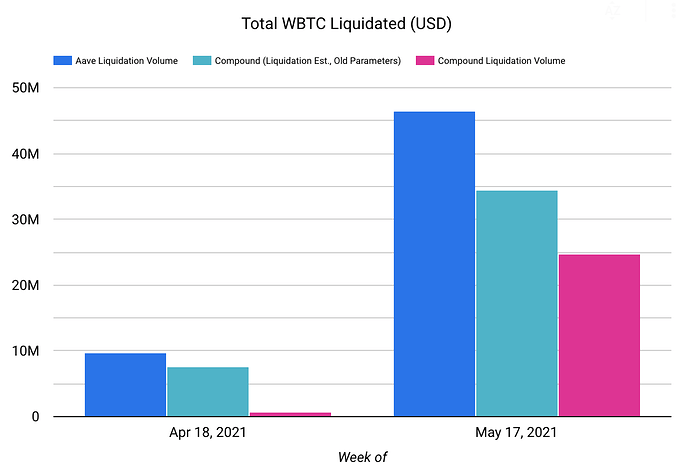

The ZRX, BAT, and WBTC Parameter Update governance proposal sought to change collateral factors with a primary focus on lowering WBTC. See the full thread for details.

To measure impact of this change we can look at the total WBTC liquidated on both the Aave and Compound protocols during the weeks of April 18-24, 2021 and May 17-23, 2021. The total liquidity available on the Compound and Aave was similar during these weeks. In addition, the volume of WBTC liquidated on Compound was less than 10% of the volume on Aave in April, which was closer to our parameter change. From there we mapped Compound positions from 2021-02-21 against the subsequent price movements. If users held unchanged positions, which is not uncommon, from before the collateral factor update through single-day price drops of 20% in April and 41% drop in May, then there would have been ~$7M to $9M additional collateral available for liquidation on each occasion.

Capital Efficiency for New Assets

Currently, the collateral factors for AAVE, LINK, MKR, SUSHI, and YFI are conservative. As the supply of these assets grows, ensuring any individual asset does not contribute outsized risk to the protocol is key. Existing simulation outputs suggest increasing collateral factors for all five assets by approximately 15% is optimal. Doing so would allow users to borrow an additional $31M in assets.

Making early capital efficiency improvements like this are possible because Gauntlet runs daily off-chain simulations. Informed by market data (liquidity, slippage, etc.) we will adjust collateral factors lower or higher as needed.

Reserve Factor Support

Gauntlet will also support reserve factor parameterization which is a key lever in driving revenue and growth (increasing yields/reducing interest paid). Previous conversation surrounding Reserve Factor Standardization has been had but no further analysis has been performed into the optimal settings to track default probabilities. Gauntlet concurs that:

While a secondary parameter for risk, the reserve factor is a primary parameter for revenue and growth of the protocol. For example, when changing borrow caps consideration should also be given for the new optimal reserve factor.

Expectations

-

Risk Parameter Updates

- Coverage of all markets except Legacy (e.g., WBTC) and Deprecated (e.g, SAI, REP)

- Supported Risk Parameters: Collateral Factor, Close Factor, Borrow Cap, Reserve Factor, and Liquidation Incentive

- Market conditions will determine the frequency of updates. For that reason, no SLA will be preset.

-

Communications

- Risk parameter change steps:

- Forum post (e.g.,Reduce COMP emissions by 20%)

- Community discussion and revision

- Off chain polling

- On chain vote

- Post-mortem

- Quarterly, Gauntlet will poll the community to determine the preferred risk tolerance of the community. The outcome of this vote will determine the risk and capital efficiency tradeoffs Gauntlet will target.

- Monthly forum posts and participation on community calls with explanations of risk parameter changes and any anomalies observed including but not limited to:

- Discord Developer & Twitter Spaces Community Calls

- Risk Dashboard (refer to the next section)

- Quarterly Risk Reviews will provide a detailed retrospective on market risk.

- Risk parameter change steps:

-

Out of Scope

- Protocol development work, (e.g. Solidity changes that improve risk/reward)

- Formalized mechanism design outside of the supported parameters.

- In line with keeping the scope small, Gauntlet will not look to manage the following at the outset:

- Enabling or disabling a currency for borrowing

- Setting interest rate strategies

- Optimizing COMP emissions

Risk Dashboard

As part of this engagement, Gauntlet will build a Risk Dashboard and API for the community to provide key insights into risk and capital efficiency.

Please note, all numbers are for illustrative purposes only and do not reflect the current or possible future state of Compound.

The dashboard focuses on both the system-level risk in Compound and the market risk on an individual collateral level. Our goal is to help convey our methodology to the community and provide visibility into why we are making specific parameter recommendations.

The two key metrics are Value at Risk (VaR) and Borrow Usage.

Value at Risk conveys capital at risk due to insolvencies and liquidations when markets are under duress (i.e., Black Thursday). The current VaR in the system breaks down by collateral type. We currently compute VaR (based on a measure of protocol insolvency) at the 95th percentile of our simulation runs assuming peak volatility in the past year. We do this using Compound’s current parameters as well as after modifying the parameters to the Gauntlet Recommendations.

Borrow Usage provides information about how aggressively depositors of collateral borrow against their supply. Defined on a per Asset level as:

where U is the utilization ratio of each user:

We aggregate this to a system level by taking a weighted sum of all the assets used as collateral.

To show Gauntlet’s impact, we measure these using the current system parameters and expected results (based on our simulations) if Compound were to implement the parameter recommendations suggested.

Cost

Gauntlet charges a service fee that seeks to be commensurate with the value we add to protocols. Gauntlet also wants to provide a strong signal of our alignment with the protocol. Using our prior COMP Contributor Grants proposal we propose a service fee using the Contributor Comp Speed grant functionality. At the start of every quarter for one year Gauntlet will create a proposal to update the service fee payment in accordance with the forumla below.

The formula to calculate Gauntlet’s service fee has four components:

- An asset multiplier to track risk management complexity

- A proxy for capital efficiency

- A marginal base fee

- VWAP (Volume Weighted Average Price) of COMP

The asset multiplier calculation is log(Number of Assets, 10)*. New assets on the protocol add complexity to risk management. While the market risk optimization problem does not grow linearly, consideration should be taken when onboarding assets.

The most straightforward proxy for capital efficiency is the total borrowed for risk-managed assets. Capital efficiency is realized by borrowing demand. The total borrowed amount is calculated as the 30-day average and rounded down to the nearest $1B.

Gauntlet’s risk management marginal base fee is derived from a conservative estimation of the impact from dynamic risk parameters.

| Marginal Base Fee | Total Borrow |

|---|---|

| 10 bps | $0 - $5B |

| 5 bps | $6B - $10B |

| 2.5 bps | $11B - $15B |

| 1.25 bps | $16B - $20B |

The VWAP of COMP for the previous 30-days. Whether the price should be fixed or calculated quarterly, different communities have different opinions on how this aligns incentives. We will defer to the preference of the community but will default to calculating quarterly.

*Gauntlet quarterly service fee denominated in COMP (table above calculated at $464)

Growth and drawdown examples

*Log value is the minimum of the tier range except in the “<= 10” column, where it is 10. For example Column “21-25” returns log(21,10)

** When Total Borrow < $3b, there is no basis point fee. The formula is log(Number of Assets,10) * $1,200,000 / 4 )

About Gauntlet

Gauntlet is a simulation platform for market risk management and protocol optimization. Our prior work includes assessments for Compound, MakerDAO, Liquity, and Aave. Gauntlet’s continuous parameter optimization work includes Balancer, SushiSwap, Benqi, Aave, and Acala.

Thanks to @tarun, @wfu, @shaan, @jmo and many others for assistance on this proposal.