Request for comment on: Market pricing vs. exchange rate pricing for LSTs and potential oracle implementations

Summary

This proposal is a temperature check on which pricing mechanism is desired by the community for liquid staking tokens (LSTs) on Compound – exchange rate pricing or market pricing. We aim to present the data made available regarding the two different pricing mechanisms and allow the community to vote on how to proceed forward. This comes in light of our collaboration with Lido to add wstETH as collateral on Base ETH Market, USDC Market on Arbitrum and Ethereum Mainnet.

Motivation

FranklinDAO encourages the community to agree on price feed preferences for LSTs to help clarify the desired ubiquitous pricing mechanism for such assets as Compound continues to scale its support of staking assets such as wstETH.

Exchange rate vs market pricing

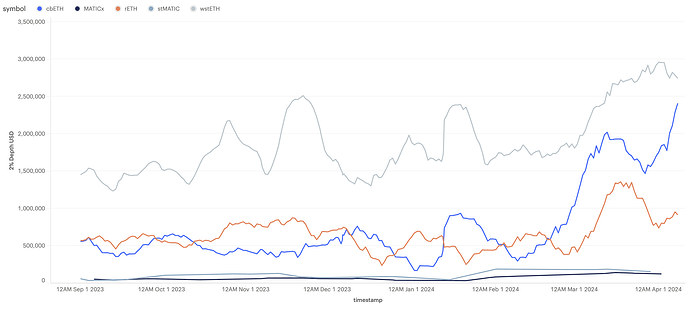

Gauntlet shared insight about the present and future liquidity of LSTs. Current data doesn’t indicate any negative price trends in LST liquidity over recent months. Although, as liquidity starts shifting to restaking protocols, and other lending protocols, LST liquidity is at risk of shrinking. Lower liquidity levels may introduce risk of market price manipulation.

To mitigate these liquidity risks, Compound could move toward exchange rate based oracles for LSTs within Comet markets – particularly correlated Comet markets.

Market pricing

In market rate pricing, the value of an asset is determined by its trading activity in the open market. It reflects demand and available liquidity in the market.

Market pricing has been the status quo, utilizing robust Chainlink price feeds in the process.

However, because of the dual sided relationship of the base asset (ETH) between its staking token (LST) and the USD value, the LST → BASE feeds may experience volatility / price fluctuations.

Exchange rate pricing

In exchange rate pricing, asset prices represent the exchange rate for redemption between a staking asset and its base.

By using the exchange rate, borrowers will have less capital at risk, and can operate with higher capital efficiency. On the other hand, using this rate could increase insolvency risk in LST/Base depegging scenarios. More information can be found here.

Risks and Mitigation

Although we do acknowledge the risks, we are confident in the robustness of Lido’s validator set and their credibility for reporting wstETH’s exchange rate. To increase trustless support of exchange rate pricing, we’re curious about the interest of the community in exploring risk mitigation strategies such as those mentioned by Gauntlet:

-

Mitigate through severe Dislocation Mechanism: Protocols may take steps such as halting new supplies or setting collateral factors (CF) to zero to prevent an increase in LST supply during rare and unpredictable market dislocations.

-

Mitigate through oracle feed threshold mechanism: Deploy a smart contract on asset Oracle feeds, especially for those reliant on exchange rates, to cap prices at a specified ratio. This safeguards against upward price manipulation and secures protocol deposits.

In addition to these risk mitigation strategies, we anticipate the risk of slashings will continue to decrease in the future as node operators become more sophisticated and adopt new technologies such as DVT and TEEs.

Proposed oracle implementation

@zetaproject proposed an oracle implementation which borrow’s from AAVE’s capped price oracle idea.

Proposal announcement

The community should discuss the details of this proposal in depth. As ideas and opinions come forward, the proposal will be amended until it reaches a final state that the community has verified and agreed on. Then it will be put it to a vote.

- An example of options to vote on for the pricing mechanism would be:

- Exchange rate pricing on correlated and un-correlated markets

- Exchange rate pricing on correlated markets and market pricing on un-correlated markets

- Market pricing on on correlated and un-correlated markets

- For oracle implementation:

- Exchange rate pricing oracle implementation 1

- Exchange rate pricing oracle implementation 2

- Market pricing oracle implementation (could be new or can just default to standard)

Considered in the conversation for this proposal should be a standardized oracle implementation that can scale with the markets for the mechanism selected (one that we can utilize for the deployment of wstETH in the aforementioned markets as collateral) with minimal exposure to price manipulation risks.

We look forward to hearing back!