Gauntlet would like to thank FranklinDAO for starting this discussion about the pricing oracles for liquid staking tokens (LSTs). Gauntlet is supportive of having a community-approved strategy for Oracle implementation moving forward. At this current time, Compound is utilizing market rate based oracles that price LSTs via market exchange liquidity sources. There are concerns within the community that this can be problematic for certain LSTs that have low liquidity and might experience further deterioration in liquidity.

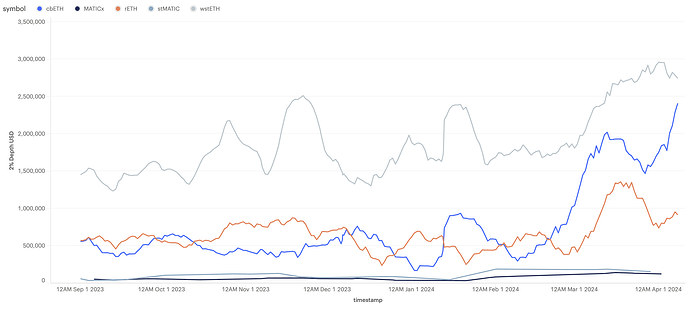

LSTs 2% Depth USD

ETH-staked assets have continued to indicate stable liquidity, while LRTs have continued to exhibit significant growth, with a total supply of 2.9M (~$10B).

LRT Supply Growth

Future Oracle Implementation

Gauntlet supports implementing exchange rate oracles for correlated Comets. Utilizing an exchange rate oracle would allow the correlated Comets to optimize risk parameters and allow the protocol to optimize for future lower liquidity staking assets that might be more at risk of market price manipulation and volatility.

During a de-pegging market event of an LST, an exchange rate oracle can provide stability and protection to the protocol and suppliers. As shown in the chart below, during the stETH price dislocation event, there was a substantial decrease in liquidity once the price started to dislocate. If Compound were to have their market rate oracle during a similar event, liquidations would have failed to happen while bad debt would be realized once the stETH market begins to repeg.

stETH Dislocation

Prior to the adoption of exchange rate oracles, Gauntlet recommends implementing mechanisms to handle dislocation and oracle feed manipulation as discussed in this forum post. This would mitigate risks associated with exchange rate oracles.

For non-correlated Comets, the capital efficiency unleashed by an exchange rate oracle is minimized compared to correlated assets, so Gauntlet recommends maintaining market rate oracles.

Gauntlet supports the following path forward for the Compound community when deciding on future Oracle implementations:

Correlated Comets

- Primary Option: Exchange Rate Oracle*

- Secondary Option: Market Rate Oracle

Non-Correlated Comets

- Primary Option: Market Rate Oracle

*Gauntlet encourages the community to work to develop the required oracle mechanisms prior to implementing the exchange rate feeds.