Simply Summary

Gauntlet recommends the following adjustments to risk parameters:

- Decrease WBTC Supply Cap from 1500 WBTC to 750 WBTC

- Decrease WETH Supply Cap from 20000 WETH to 2500 WETH

- Decrease WMATIC Supply Cap from 20M to 8M WMATIC

- Decrease MaticX Supply Cap from 6M to 2M MaticX

- Decrease Daily Comp Supply Rewards from 16 COMP to 8

- Decrease Daily Comp Borrow Rewards from 7 COMP to 3

Analysis

Cap Recommendation

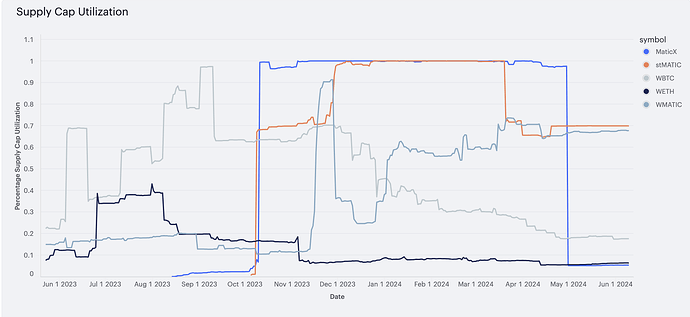

The supply caps on the USDC.e comet are being under-utilized for sustained periods and are generally trending downwards.

Gauntlet recommmends reducing caps for the assets mentioned above to adjust for utilization. Should caps breach the 75% threshold, Gauntlet will proactively adjust caps based on market conditions. The current changes in Supply caps will not deviate caps to above the 75% threshold.

Comp Rewards Recommendation

In relation to incentive cost per USDC.e balances, we have seen incentive costs double for borrows and increase by 75% for supplies compared to historical performance. Given the maturity of the comet and the outlfows of supply/borrow balances, Gauntlet recommends lowering further incentives from the USDC.e Comet.

Gauntlet recommends reducing Supply Rewards to 8 COMP and Borrow Rewards to 3 COMP. This will bring the Net Supply APR at kink to 7.7% and the Net Borrow APR at kink to 8.5%.

The protocol turns a Daily Net Profit at 78% utilization, with Daily USDC Reserve Growth at 73%.

Next Steps

- Submit On-chain proposal on Jun 24th