Simple Summary

In the Polygon v3 USDC.e comet, both MaticX and stMATIC have reached their full supply cap limits. Considering their current liquidity levels, a Liquidation Penalty of 7% for both MaticX and stMATIC, and a Store Front Price Factor of 60%, Gauntlet recommends not increasing these supply caps. However, to potentially enable future cap increases, and to mitigate risk, Gauntlet proposes raising the Liquidation Penalty values for these assets.

Specifically, Gauntlet recommends:

- Increase the stMATIC Liquidation Penalty from 7% to 15%

- Increase the MaticX Liquidation Penalty from 7% to 15%

Analysis

Increasing Liquidation Penalty for assets with fully-utilized supply caps

For any asset in Compound v3 with a fully-utilized supply cap that we deem too risky to increase, our approach will be to mitigate risk by increasing Liquidation Penalty, opening up the possibility of raising the supply cap in the future. If the increased Liquidation Penalty leads to a reduction in supply, we will consider reverting them. However, if the supply persists, we should continue to incrementally increase both the Liquidation Penalty and the supply cap to optimize its TVL while mitigating risk and increasing potential reserve growth from liquidations.

stMATIC

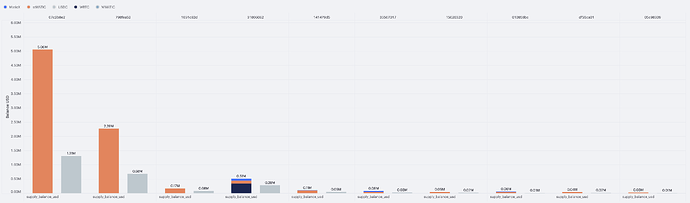

Top 10 stMATIC suppliers’ entire positions

Displayed above are the holdings of the top 10 stMATIC suppliers, with the largest contributor supplying $5.06M stMATIC (63% of the total stMATIC supply within the comet) and borrowing $1.31M USDC, resulting a borrow usage of 40%. Currently, a $5.06M stMATIC/USDC swap incurs 55% slippage. Therefore, we recommend increasing the Liquidation Penalty from 7% to 15%. Given the current Store Front Price Factor of 60%, this would increase the slippage required for liquidators to arbitrage from 4.2% to 9%.

MaticX

Top 10 MaticX suppliers’ entire positions

Displayed above are the holdings of the top 10 MaticX suppliers, with the largest contributor supplying $5.57M MaticX (92% of the total MaticX supply within the comet) and borrowing $1.01M USDC, resulting a borrow usage of 30%. Currently, a $5.57M MaticX/USDC swap incurs 47% slippage. Therefore, we recommend increasing the Liquidation Penalty from 7% to 15%. Given the current Store Front Price Factor of 60%, this would increase the slippage required for liquidators to arbitrage from 4.2% to 9%.

Next Steps

- Put up on-chain proposal