Hello!

I’m on the team with Fuji Finance, and we were recently approved by the Compound Grants team to build the first cross-chain migration tool. I wanted to take the opportunity to introduce ourselves, what we are building for the Compound community, and what our V2 (launching soon) enables.

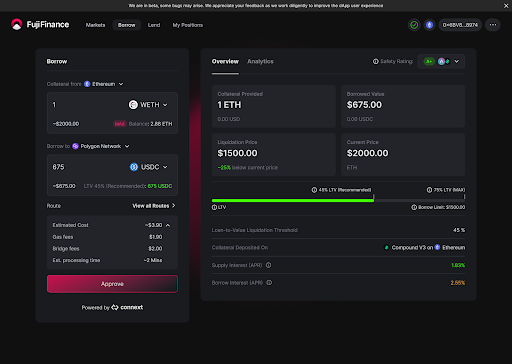

Fuji is building the first cross-chain money market aggregator, enabling users to deposit, borrow, and repay a position from any chain. The protocol helps to optimize deposit and borrow rates on money markets, and has supported Compound since the initial V1 launch about 2 years ago, where Fuji built the first borrowing aggregator. The team is in the process of launching our V2 (cross-chain money market aggregator), which will be going live soon! We have been in beta testing since March, and things are progressing very well. We are extremely excited to offer this to the community.

Right now, Compound is currently in the process of going through a variety of new Compound V3 deployments, allowing the protocol to go multi-chain, with the most recent being Polygon and Arbitrum. Other deployments, as discussed in the Compound community calls, are Polygon’s zkEVM, Base, among others! The big difficulty with this, is that it can be incredibly hard to bootstrap liquidity on new chains, or how to incentivize users to migrate liquidity across multiple networks. Liquidity can be quite sticky! However, with this cross-chain migration tool, users will be able to, in one-click, migrate their existing position from Compound V2 or V3 on Chain A to Compound on Chain B, helping liquidity to move liquidity across chains in a seamless manner. There are big advantages to migrating your position to an L2, especially since it will now make maintaining your position significantly cheaper than doing it on Ethereum mainnet. In addition, the on & off ramp process is becoming much more streamlined with various major centralized exchanges supporting them.

The biggest difficulty that we are beginning to see, especially in the DeFi ecosystem is, as many of these L2s continue to evolve, this is only going to create more and more liquidity fragmentation. This problem began to arise about 12-18 months ago with the rise of Alt-L1s, and L2s, but this is only going to get worse since it is incredibly easy to spin up a new L2, comparatively speaking. Because of Fuji’s infrastructure, this is a problem we are able to help solve. We are able to tap into liquidity from multiple chains, and multiple money markets on the same network, helping to unify liquidity, to minimize slippage and utilization rates when using DeFi.

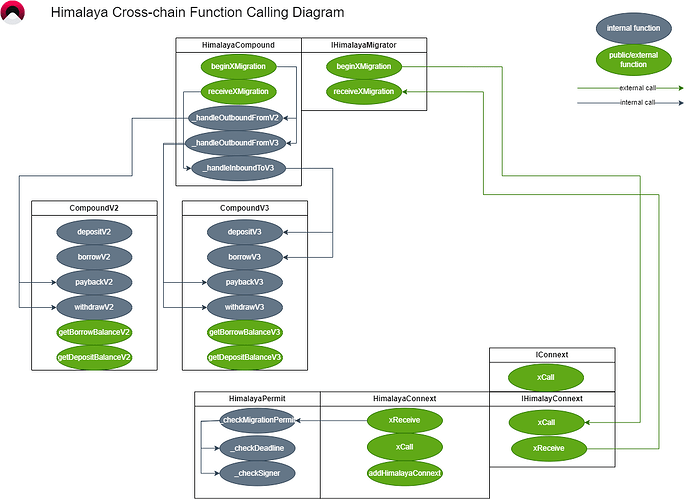

Let’s take a look at how things work for Fuji behind the scenes ![]()

Fuji uses ERC-4626 for the Vaults, which exist on each individual chain. It’s important to note that the Vaults themselves do not store funds on any bridges, while the router contracts have the capability to move liquidity/messages across chains if the user elects to have this functionality. An interesting fact about ERC-4626 is that it allows you to easily manage yield bearing tokens inside of the vault. Unfortunately, debt-tokens are not compatible with the vault standard. Because of this, the Fuji team ended up building an extension of ERC-4626, making it compatible with money markets (specifically debt tokens), and this new standard will later be introduced as an EIP to the Ethereum community.

These vaults are a layer on top of existing money markets, like Compound! We actually have support for both Compound V2 and V3, and we are planning on supporting all of the new Compound V3 deployments on other chains too. Since not every money market has the same security guarantees, the only money market(s) you will have exposure to are the ones that the vault directly connects with, which is able to be visualized & understood through Fuji’s UI. These isolated vaults are very different from an isolated pool on a money market since we can tap into the liquidity from multiple markets/networks, helping to minimize any potential slippage/impact on utilization ratios on individual money markets.

From a messaging/liquidity perspective, we are working with Connext Network as our official launch partner. The reason why we are working with Connext is their focus on security. They are building a trust-minimized bridge, which leverages the use of canonical bridges, where applicable. This means when passing messages from Chain A → Chain B, it would go through the native bridge of Chain A, back to Ethereum, post the message there, and then ultimately to the destination chain using its native bridge, which would be Chain B in this example. Long term, we want to give additional optionality to users based on Speed, Security, and Cost, so we will support other bridge solutions as well.

As a part of the Cross-chain migration tool that Fuji is building for the Compound community, we will be initially building this with Connext, but also with the mindset that other bridges will be able to be supported as well, depending on how the Compound community sees the tool evolving.

We’re incredibly excited to be building, not only on top of Compound, but alongside the Compound ecosystem, and bringing value to your community. If you want to stay in the loop on Fuji’s progress or become a part of our growing community, you will be able to find out more information below.

Keep climbing!

Website: https://fuji.finance

Twitter: https://twitter.com/fujifinance

Discord: Fuji Finance

Telegram: Telegram: Contact @fujifinancedao