Collateral Onboarding Application - OUSG

We propose that the Compound DAO on-board OUSG, the Ondo Short-Term U.S. Government Bond Fund, as collateral to Compound v3, in order to safely and sustainably grow demand to borrow USDC.

OUSG is a form of tokenized US Treasuries from Ondo Finance, invested entirely in the Blackrock iShares Short Treasury Bond ETF (SHV). OUSG has an extremely low risk profile, backed ultimately by short-term US Treasuries, and a material yield, at more than 5%, making it ideal collateral to both protect the safety and soundness of Compound v3 while driving expansion and growth. OUSG has been live for almost 10 months and has nearly $170 million in assets today.

Currently (as of Nov 7, 2023), borrow rates on Compound v3 on Ethereum are 3.07% after incentives. With OUSG yielding over 5%, we know market participants who are eager to borrow USDC in order to reinvest into more OUSG, which would increase borrowing demand and thus supply yields on Compound. If OUSG is on-boarded, cUSDC will likely become a higher yielding and safer asset and will deliver yield ultimately derived from US Treasuries to the crypto-economy.

SHV, the asset behind OUSG, is a liquid, exchange-traded (NASDAQ) ETF from Blackrock, invested entirely in short-term US Treasuries, with approximately $22 billion in assets, almost $300 million in average daily trading volume, and over 5% in annualized yield (as measured by yield-to-worst). It has more than enough liquidity to safely support liquidations at Compound v3, even considering substantial future growth of Compound. It has a weighted average maturity of ~0.3 years—entailing very little interest rate risk—with a maximum weekly move ever (since inception in 2007) of less than 0.5%.

THIS PROPOSAL IS PROVIDED FOR SOLELY AND EXCLUSIVELY INFORMATIONAL PURPOSES. THIS PROPOSAL DOES NOT MAKE, AND NEITHER ONDO FINANCE NOR ANY OTHER PERSON MAKES, ANY REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AT LAW OR IN EQUITY, IN CONNECTION WITH THIS PROPOSAL OR THE TRANSACTIONS CONTEMPLATED HEREBY, INCLUDING BUT NOT LIMITED TO WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, TITLE AND NON-INFRINGEMENT, AND ANY AND ALL REPRESENTATIONS AND WARRANTIES ARE HEREBY DISCLAIMED TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW.

About OUSG

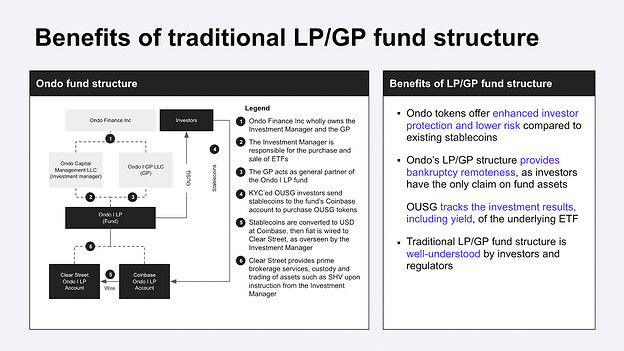

On Feb 2, 2023, Ondo launched Ondo I LP (the “Fund”) and its Ondo Short-Term US Government Bond Fund limited partnership class (OUSG), creating a tokenized vehicle with daily liquidity backed by the Blackrock iShares Short Treasury Bond ETF (SHV). OUSG represents ownership in a traditional, bankruptcy-remote Delaware limited partnership (Ondo I LP), which holds its assets at Clear Street, a prime broker and qualified custodian. The Fund receives third-party fund administration from NAV Consulting and will receive an annual audit.

Ondo Finance fully owns Ondo I GP (the general partner of Ondo I LP) and Ondo Capital Management LLC (the investment manager) (as applicable, “Ondo”), which manage or provide certain other services to the Fund, the issuer of OUSG.

About Ondo Finance

Ondo Finance provides institutional-grade, blockchain-enabled investment products and services. Ondo has an asset management arm that creates and manages tokenized financial products as well as a technology arm that develops decentralized finance protocols and blockchain solutions.

Ondo’s first core products are tokenized cash equivalents that deliver very low risk, high quality yield from U.S. Treasuries, money market funds, and similar instruments, offering on-chain investors an alternative to stablecoins where holders rather than issuers earn the vast majority of the underlying asset yield.

Ondo Finance was founded in 2021 and has raised $24 million to date. Its investors include Pantera Capital, Founders Fund, and Coinbase Ventures.

Management Team

Nathan Allman | Founder and Chief Executive Officer

Nathan previously worked at Goldman Sachs on the Digital Assets team. He also has a background in private credit investing at Prospect Capital Management. Nathan has an A.B. from Brown University.

Justin Schmidt | President and Chief Operating Officer

Justin previously ran the Digital Assets trading desk at Goldman Sachs and helped launch the broader Digital Assets team. Justin also previously worked as a quantitative equities portfolio manager within the WorldQuant arm of Millennium Partners. Justin has an B.S. and M.Eng. from MIT.

Brendan Florez | Managing Director of Strategic Operations

Prior to joining Ondo, Brendan held prior roles as a Senior Relationship Manager at Bridgewater Associates, Founder and CEO of Base Capital, and President & COO of Polyera. He has a degree in Electrical Engineering from Princeton University.

Fund Service Providers

The Fund engages regulated third-party service providers in accordance with best practices for fund management. Clear Street is the qualified custodian and broker for the Fund’s ETFs, NAV Consulting performs third-party administration services including a daily calculation of the Fund’s net asset value, and Coinbase helps to process stablecoin subscriptions and redemptions by custodying small stablecoin balances and converting stablecoins to USD and back.

We provide brief bios about each of these service providers below:

Coinbase Prime is an integrated solution that provides secure custody, an advanced trading platform, and prime services so you can manage your crypto assets in one place. Coinbase Prime is offered by Coinbase, which was founded in 2012. Coinbase has approximately 108 million verified users and 245,000 ecosystem partners in over 100 countries who trust Coinbase to easily and securely invest, spend, save, earn, and use crypto.

NAV Consulting, Inc is a fund administrator owned by the NAV Fund Administration Group. NAV Fund Administration Group is an international, privately owned fund administrator with a strong reputation for cost-effective and reliable fund administration solutions. NAV has achieved more than 30 years of year-over-year growth primarily via client referrals and maintains a remarkable 99% client retention rate. They are among the top global hedge fund administrators by number of funds, servicing more than $180 billion assets under administration.

Clear Street is building modern infrastructure for capital markets. Founded in 2018 by industry veterans, Clear Street is an independent, non-bank prime broker working to solve the industry’s most neglected problem: legacy technology. The firm has built a proprietary, cloud-native, clearing and custody system to replace the legacy infrastructure used across capital markets – improving speed, access, and service for its clients. Clear Street’s first product is its equity finance platform, which processes more than $10 billion in trades every day. The firm’s goal is to create a single-source platform to serve all investor types, across all asset classes, globally.

Subscription and Redemption Process

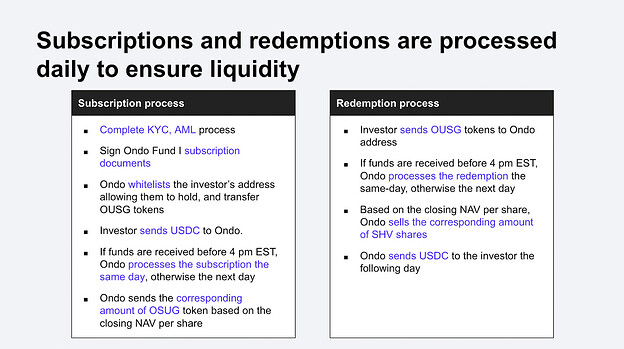

OUSG limited partnership interests are issued as tokens (“Tokens”) on the Ethereum blockchain. OUSG can be minted (i.e. subscribed to) and redeemed on any US business day (excluding federal holidays). The Fund currently accepts USDC and DAI but could accept other stablecoins at the GP’s discretion.

Subscriptions and redemptions are processed based on the next daily NAV as calculated by the fund administrator, NAV Consulting, Inc. Ondo anticipates redemptions to take up to 2-3 business days to settle (for an investor to receive their stablecoins/USD) if the Fund does not have sufficient stablecoins or USD on hand to service the redemption immediately, as it takes two business days to access dollars and then stablecoins from the sale of the ETFs.

Investors provide the Fund with on-chain addresses that they own for the Fund to whitelist, making those addresses eligible to hold OUSG. OUSG can only be held by whitelisted addresses—transfers to any other address will revert.

OUSG Pricing (Oracle)

NAV Consulting, the Fund Administrator, has read-only API access to the Fund’s accounts, which are at Coinbase and Clear Street. On a daily basis, NAV Consulting calculates the Net Asset Value (NAV) per Token (i.e. token price) as follows:

(1) sum the current value of all the fund assets (SHV shares, cash, and stablecoins)

(2) subtract accrued fund expenses and management fees (capped at a combined 30 bps), and

(3) divide by the number of Tokens outstanding

Ondo updates the on-chain price for OUSG using the calculation provided by NAV Consulting. Once a Chainlink oracle for SHV is available (expected in March), we will create an oracle that constrains how much OUSG can move relative to how much SHV moves (since OUSG invests entirely into SHV) to mitigate the centralization risk of the Ondo team reporting the OUSG price.

Investor Qualifications

OUSG is available to both US and non-US investors. Potential investors are required to pass KYC/AML/CFT screening and be both “accredited investors” and “qualified purchasers” under Rule 501(a) promulgated under the Securities Act of 1933, as amended, and under Section 2(a)(51) of the Investment Company Act of 1940, as amended, respectively. Permissioned Token holders may redeem their Tokens daily and also may transfer their Tokens on-chain to other permissioned investors. Ondo uses smart contracts to enforce these transfer restrictions.

Taxes

Though withholding tax applies to certain types of income for non-US investors (not US investors), Ondo has agreed to pay all investor withholding taxes on behalf of the Fund. Moreover, the vast majority of income generated by OUSG (~97% for the trailing twelve months) is exempt from withholding taxes, as it is Qualified Interest Income (QII), resulting in a very low withholding tax burden.

Flow of Funds and Operational Controls

Ondo manages the flow of funds between the blockchain, the Fund’s accounts at Coinbase Prime, and the Fund’s brokerage account at Clear Street. Coinbase Prime acts as an intermediary that converts investor funds between stablecoins and US dollars, while the Clear Street accounts are where the SHV ETFs are purchased, sold, and custodied. The brokerage accounts (at both Coinbase Prime and Clear Street) are opened in the name of the Fund. Ondo implements strict operational controls with industry-leading security mechanisms for smart contract and fund management.

On the blockchain, Ondo uses Gnosis Safe multisig contracts configured to require three signers for the execution of smart contract management or token transfer actions. Each participant in the multisig is an employee of Ondo and is required to utilize a hardware wallet.

Ondo uses the following permissioned multisig contracts for their respective listed capabilities:

Ondo Cash Management Multisig:

-

Configure minimum redemption and subscription amounts on the CashManager contract.

-

Configure rate limiter parameters on the CashManager contract. (i.e. what quantity of subscriptions and redemptions can be serviced in a single day)

-

Configure fee recipients on the CashManager contract (fees are currently turned off).

-

Set exchange rates for the minting of OUSG.

-

Mint OUSG to service subscriptions.

-

Pause functionality on the CashManager contract in the event of an emergency

-

Burn OUSG in the event of an emergency.

-

Upgrade the OUSG implementation contract in the event of an emergency.

-

Execute a multicall function in the CashManager contract for the scenario in which a user accidentally transfers tokens to the CashManager contract.

- Can send stablecoins it has possession of through the CashManager contract to service redemptions.

Please note that Ondo uses role-based access control (RBAC) in its smart contracts and reserves the right to deploy additional multisigs to utilize a more secure and granular RBAC scheme.

Ondo has worked with Coinbase to establish security policies that minimize employee access to the Fund operations and accounts. In order to perform critical actions on the account, a consensus of three employees must be reached and validated by each employee’s respective Yubikey hardware authentication device. These critical actions include adding trusted withdrawal blockchain addresses, transferring funds on the blockchain or between Fund accounts, and changing user access levels. For withdrawals of a notional value larger than $500,000 the consensus requirement increases to four employees. All consensus configuration changes require a consensus of three employees and a video call with a Coinbase representative.

The Fund accounts at Coinbase are only permitted to send US dollar wire transfers to the Fund’s accounts at Clear Street. The Clear Street account wires are sent and received through its bank, BMO Harris, while Coinbase wires are sent and received through its bank, Silvergate Bank. It is not possible for the Fund to “fat finger” a wire to another account. In order to get another account approved to receive a wire transfer, the Fund would have to first receive a wire transfer from that bank account to the Fund’s Coinbase account, and then work with a Coinbase representative to configure the bank as a trusted withdrawal destination.

With respect to the Fund’s brokerage account at Clear Street, Ondo employees only have read-only permissions to the Clear Street portal. All money transfers and trades are instructed over electronic communication channels and are strictly confined to sending (or receiving) money via wire to (from) the Fund’s Coinbase Prime account or purchasing and selling the SHV ETF. In order for a new bank account to be approved as a new destination for outgoing wire transfers, the following criteria must be met:

- One of the Fund’s authorized personnel has to ask for the new account to be added over email.

- The new bank account must be under the “Ondo I LP” name.

- The authorized person must give verbal confirmation on a phone call with a representative from Clear Street.

Fees

Ondo charges 0.15% annualized management fees and caps fund expenses at a maximum of 0.15% per year. Blackrock also charges ETF management fees of 0.15%.

Legal Documents

The OUSG subscription docs, limited partnership agreement (LPA), and private placement memorandum (PPM) are available here. You can find detailed risk factors on the offering in the PPM.

Integration with Compound

Compound v3 is uniquely well-suited to support OUSG as collateral in part because it does not create permissionlessly traded cTokens for collateral assets. Permissionlessly traded cOUSG would pose an issue as it would violate the transfer restrictions of OUSG. Since this is not relevant with Compound v3 (whereas it would be relevant for Compound v2 and most other lending protocols), Compound is able to support OUSG with no technical modifications. Ondo would whitelist the relevant Compound contracts as eligible to hold OUSG. Whitelisted investors would then be able to post OUSG as collateral to Compound, and they could borrow USDC supplied by anyone. If a borrower becomes eligible for liquidation (i.e. the aggregate collateral factor of its assets becomes negative), then whitelisted OUSG holders will be able to purchase that borrower’s OUSG at a discount, supplying the stablecoins needed to make the account whole.

Risk Parameters

We are open to discussing with the Compound community what the ideal launch parameters should be. We suggest the following parameters as a conservative approach:

- Collateral Factor: 90%

- Liquidation Collateral Factor: 92%

- Liquidation Penalty: 2%

We would highlight again that the OUSG collateral, backed by SHV, represents very short-term US Treasuries, so there is little interest rate risk. The max weekly move since 07 (SHV’s inception) is less than 0.5%. With liquidations triggered at 92% LTV, the max weekly move could happen more than 10 times in a row before lenders start to risk accruing bad debt (including a buffer for the liquidation penalty).