Abstract

This proposal requests to list YieldFi’s yUSD, a yield-bearing, fully collateralized stablecoin, as a supported collateral asset on the Compound protocol. This addition aims to enhance collateral diversity, increase capital efficiency for users, and integrate a productive stablecoin that yields attractive APY while maintaining strong liquidity and security.

Introduction

YieldFi is a permissionless on-chain asset management platform tailored for treasuries, funds, foundations, and individual investors, offering liquid yield bearing tokens across a variety of assets. Since its inception, YieldFi has rapidly grown to $110M in TVL, driven by a commitment to providing transparent, secure, and high-yield decentralized asset management.

Motivation & Context

yUSD is an ERC-20 compliant, fully collateralized, and yield bearing stablecoin issued by YieldFi. The yUSD token is designed as a cross-chain asset management vehicle, offering users 10% to 12% APY on USDT, USDC, and DAI with daily rewards and deep integration in DeFi protocols like Pendle, Morpho, Curve etc.

YieldFi’s yUSD has experienced strong growth in yield and TVL, reflecting increasing user trust and adoption. The token has no lock-in period, offers deep liquidity across several money markets, and can be withdrawn or swapped anytime. yUSD is already supported and traded on major EVM chains. Adding yUSD as collateral empowers Compound users to leverage high-quality stable assets earning yield, thus improving the protocol’s competitiveness and user experience.

Benefits

Collateral Diversity: Expands high-quality stablecoin choices, supporting looping and leveraged yield strategies.

Yield on Collateral: yUSD’s productive nature enables users to earn yield on supplied collateral while borrowing, maximizing capital efficiency.

Deep Liquidity: Well-established pools across DeFi ensure robust liquidity for yUSD interactions.

Capital Efficiency: yUSD’s strong peg and yield attributes support borrowing, leveraged farming, and a range of new DeFi strategies.

Pricing Oracles

yUSD price feeds can be sourced from established decentralized oracles (e.g., Chainlink, Pyth), referencing fundamental price i.e. exchangeRate() value

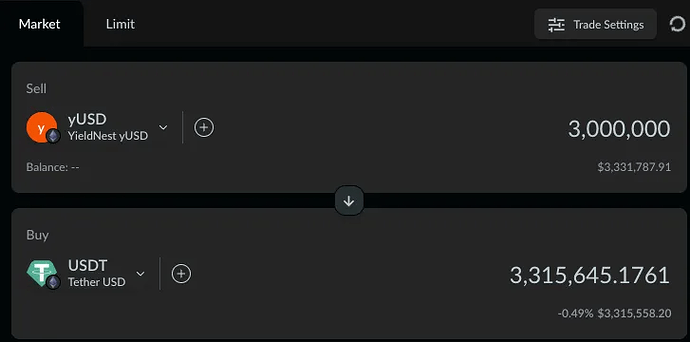

Liquidity Pools

Security Considerations

Cyfrin Audit Report

Halborn Audit Report

Cantina Audit Report

Important Links

Website

Documentation

Transparency Dashboards

Dune Analytics

Github