Alternate Governance Track: Infrastructure Readiness

TL;DR: DoDAO has successfully deployed the Alternate Governance Track infrastructure on Optimism, enabling Gauntlet to update market parameters in 2 days instead of 10 days. However, before expanding to other chains, WOOF! wants to remind the community what the new alternative governance pipeline is and how it can speed up protocol management.

Background: Solving Governance Bottlenecks

The Alternate Governance Track was originally proposed by DoDAO and successfully deployed on Optimism to address a fundamental challenge in Compound’s multi-chain strategy: the governance bottleneck for market parameter updates.

Gauntlet, as Compound’s risk management partner, regularly needs to adjust market parameters based on real-time market conditions and risk analysis. Previously, every parameter adjustment required the full governance process, creating significant delays that could impact protocol safety and capital efficiency.

Two Governance Pipelines

Traditional Governance Pipeline (Current on Ethereum)

Process Flow:

- Proposal pending period (~2 days): Community member creates governance proposal on Ethereum

- Voting Period (~2-5 days): Community votes, with automatic 48-hour extension on reaching quorum

- Proposal in queue (2 days): Proposal queued and executed on Ethereum Timelock

- Cross-Chain Relay (1 day): Message relayed to L2 and executed on local Timelock

Total Timeline: ~7-10 days

Pros:

- Community controls voting through a transparent governance process

- Full decentralized oversight of all changes

- Proven security model with extensive community participation

Cons:

- Takes significantly more time (7-10 days vs 2 days)

- Consumes more gas across multiple transactions

- Relies on cross-chain bridge infrastructure for L2 execution

- Can delay critical risk management responses to market volatility

- Overwhelm the DAO with regular proposals

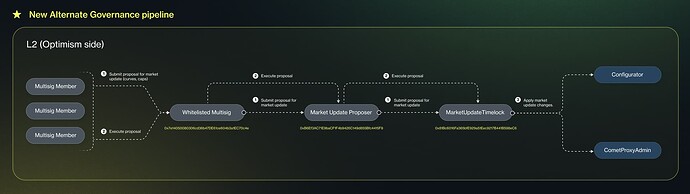

Alternate Governance Pipeline (New on Optimism)

Process Flow:

- Direct Submission: Gauntlet submits the proposal directly to MarketUpdateTimelock on L2

- Timelock Period (2 days): Proposal queued with community oversight window

- Execution: Anyone can execute after the timelock expires, applying parameter changes

Total Timeline: ~2 days

Pros:

- Actions performed entirely on the L2 network without cross-chain complexity

- Significantly faster response time for risk management

- Community retains cancellation rights through multiple mechanisms

- Lower gas costs and operational overhead

Cons:

- Currently, only Gauntlet multisig can propose updates

- Requires a monitoring infrastructure for community oversight

Security & Control

The Alternate Governance Track maintains security through multiple cancellation mechanisms:

Cancellation Authority:

- Proposal Guardian: Designated multisig wallet for emergency intervention

- Gauntlet: Can cancel their own proposals if needed

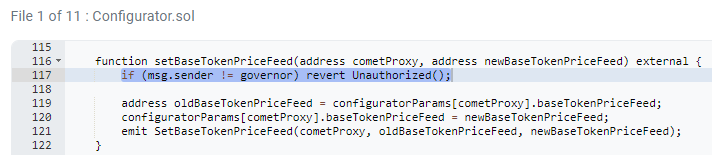

Parameter Scope Restrictions: The system only allows updates to specific market parameters, not fundamental protocol changes. Gauntlet can update the following functions:

Critical Infrastructure Concerns

Despite the successful Optimism deployment, several infrastructure gaps need addressing before broader adoption:

1. Community Monitoring Platform

Problem: Currently, the community has no dedicated interface to monitor pending Gauntlet proposals through the Alternate Governance Track.

Tally, the primary governance platform used by Compound, does not yet support this optimistic governance functionality. This creates a critical visibility gap where proposals could be submitted and executed without adequate community awareness.

Potential Solutions:

- Tally Integration: Work with Tally to add native support for monitoring optimistic governance proposals

- Custom Platform: Develop a dedicated monitoring interface that displays pending proposals and enables community interaction

WOOF! Is happy to help with any Governance platform to integrate new functionality using WOOF! capacity. If you are interested in integration, reach out to dmitriy@woof.software or via telegram: @dmitriywoof.

2. Cross-Chain Governance Support

Problem: Tally currently doesn’t support the two-step execution required for cross-chain proposals. Proposals may show as “executed” on Ethereum while remaining unexecuted on the target L2 chain.

Impact: This has already caused issues where governance proposals passed on Ethereum but weren’t executed on destination chains, creating incomplete deployments.

Solutions Needed:

- Enhanced cross-chain execution tracking in governance platforms

- Automated L2 execution triggers after Ethereum execution

- Clear status indicators for multi-chain proposal states

WOOF! Is happy to help with any Governance platform to integrate new functionality using WOOF! capacity. If you are interested in integration, reach out to dmitriy@woof.software or via telegram: @dmitriywoof.

3. Security Team Monitoring

Existing Infrastructure: OpenZeppelin has confirmed they have proper infrastructure to monitor proposals, and there are existing notification systems, including a Discord bot developed by community members for real-time alerts.

Additional Questions for Auditors: Do security teams and auditors require specialized infrastructure beyond existing solutions to monitor these optimistic governance proposals?

4. Gauntlet Operational Readiness

Gauntlet has confirmed operational readiness and has successfully used the system on Optimism. However, as we expand to additional chains, we should ensure:

- Standardized operational procedures across all chains

- Clear escalation paths for emergency situations

- Regular internal and community communication about the parameter update rationale

5. Rewards V2 Integration

With the introduction of Rewards V2 functionality, there’s an opportunity to expand the Alternate Governance Track to include reward speed management. Since reward speeds are directly connected to Rewards V2 and require frequent adjustments based on market conditions, allowing Gauntlet to update these parameters through the optimistic governance track would provide additional operational efficiency.

This enhancement would extend the current parameter scope to include more granular control over incentive mechanisms while maintaining the same security and oversight framework.

Restrictions will be extended with setBaseTrackingSupplySpeed / setBaseTrackingBorrowSpeed parameters.

Community Input Needed

We’re seeking community feedback on several critical questions:

- Governance Infrastructure: Should we prioritize Tally integration or develop a standalone monitoring platform? What specific features are most important for community oversight?

- Security Requirements: What additional monitoring or alert capabilities do auditors and security teams need?

- Chain Prioritization: Which chains should receive priority for Alternate Governance Track deployment based on TVL and risk management needs?

- Rewards speed configurations: Should the solution support the management of the speeds?

Next Steps

The Alternate Governance Track represents a significant improvement in Compound’s operational efficiency while maintaining security through multiple oversight mechanisms. However, the infrastructure concerns outlined above must be addressed to ensure responsible deployment across the multi-chain ecosystem.

Successfully Deployed:

- Optimism: Fully operational with proven track record

- Core Contracts: Audited and battle-tested infrastructure

Pending Community Decision:

- Governance platform integration strategy

- Chain deployment prioritization

- Cross-chain deployment framework (allows for deploying proposals more securely and faster - there will be a separate post)

- Enhanced monitoring capabilities

The post can be a good starting point for raising a new topic for discussion - reconsider the pipeline for deployment of collaterals and markets to make it more time-sensitive and convert the 7-10 days pipeline to at least a 4-6 days flow.