tl;dr The Compound Growth program aims to start a discussion regarding dicontinuation of COMP incentives on Comets on Mainnet. In its successful iteration, the strategy could see Compound save 500K-1M in COMP incentives, which can then be utilized on L2s to make COMP APRs more attractive there.

Introduction

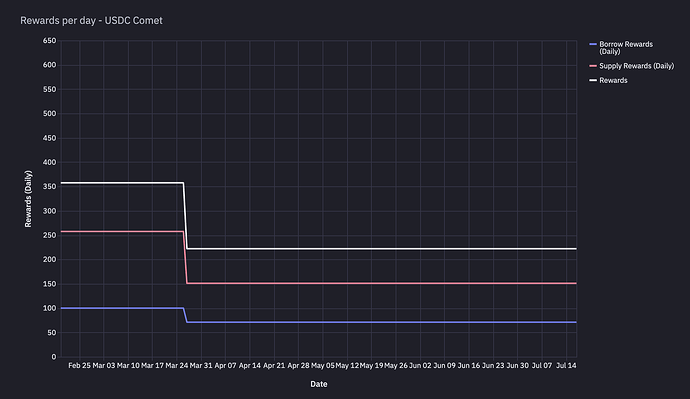

Compound currently has 2 Comets up on Mainnet: cWETHv3 and cUSDCv3. Both of these comets on Mainnet are the largest on Compound among other chains.

On an average Compound puts $30K in incentives on the ETH Comet every week. These incentives are distributed as COMP tokens to Boost Effective Earn APR and reduce effective borrow APRs. But for the amount of incentives that Compound gives, the net profit on the comet has remained negative for the past few months.

| Time Period | Reserves Accumulated (in thousands) | COMP Incentives (in thousands) | Net Profit (In thousands) | Source |

|---|---|---|---|---|

| 2024-06-30 to 2024-07-06 | 4.65 | 30.09 | -25.44 | [Gauntlet] Weekly Market Updates: Ethereum WETH - #54 by Gauntlet |

| 2024-06-24 to 2024-06-30 | 5.95 | 30.92 | -24.98 | [Gauntlet] Weekly Market Updates: Ethereum WETH - #53 by Gauntlet |

| 2024-06-17 to 2024-06-23 | 4.71 | 30.87 | -26.16 | [Gauntlet] Weekly Market Updates: Ethereum WETH - #51 by Gauntlet |

| 2024-06-10 to 2024-06-16 | 7.5 | 33.4 | -25.89 | [Gauntlet] Weekly Market Updates: Ethereum WETH - #51 by Gauntlet |

| 2024-06-03 to 2024-06-09 | 8.89 | 36.21 | -27.33 | [Gauntlet] Weekly Market Updates: Ethereum WETH - #50 by Gauntlet |

The COMP incentives on the ETH market add up to a small increase in the Net earn APR, while giving a small decrease in the borrow APR.

The Idea

We wish to start a discussion if and could the incentives on ETH Comet on mainnet be stopped.

Could Completely stopping COMP incentives on this comet have

- More positive or negative impact in terms of supply and borrow?

- Beyond reduced competitiveness of the APR, is there any potentially larger contingency in stopping COMP incentives, Could there be any domino effect like situations, where reduced COMP incentives could have much wider consequences

Compared to the competetion

-

Aave

- Aave V3 has a borrow APR of above 4% on their ETH market, Compound has a borrow APR of 1.67%. If the 0.27% of COMP incentives are removed from the borrow side, the Net APR becomes 1.91% which is still half of Aave. Removing incentives will not drastically alter the situation here

- For the supply APR of Aave V3 Ethereum Market currently hovers at 3.09%, compared to 1.83% on Compound. A third of this APR on Compound (0.62%) is COMP incentives. Reducing COMP incentives may make depositing less profitable, but compared to competition the relative competitiveness will not change

-

Spark

- APR on spark.fi is relatively similar to Compound APRs as compared to Aave. Yet even with these similar APR rates, ETH deposits on Spark’s ETH market are ~800M, almost 4 times that of Compound. We believe this is due to the fact that Spark has promised airdrop to depositors, which has caused this sizeable increase in their TVL. Spark APR is slightly higher than Compound, reducing incentives would not alter this situation.

A step towards L2 consolidation

The incentives supplied on Ethereum ETH comet amount to between $1-1.5 Million each year. The same incentives channelized to the L2 comets could make Compound APRs highly competitive. Compared to Ethereum mainnet, there is no clear consolidation of a single player on L2s, giving Compound an opportunity to put focus on these L2 landscapes.

Community feedback

We would love to get more feedback from the community and OG community members as well if such an idea to remove incentives be implemented. Is there any significant aspect that we did not take into consideration?

We know that there are risks associated with stopping incentives altogether, but the following scenarios could be implemented

- Gradually reducing incentives over time and if no significant negative impact is observed, continue to eliminate incentives.

- Have a test incentive omission, where COMP incentives on a selected market, either on the supply side or borrow side are removed for a short period of time. If there are no significant changes observed in the corresponding aspect, then continue with the testing.