Simple Summary

If the community decides to reduce incentives, Gauntlet recommends the following incentive parameters:

| Comet | Current Supply Rewards | Recommended Supply Rewards | Current Borrow Rewards | Recommended Borrow Rewards |

|---|---|---|---|---|

| WETH | 70 | 35 | 20 | No Change |

| USDC | 151 | 70 | 71 | No Change |

WETH Comet

Utilization vs Supply vs Borrow

Rewards per Day

In the WETH Comet, the increase in borrowing rewards positively correlates with the total borrow volume, suggesting a high level of borrower responsiveness to incentives. However, supply balances continue to fluctuate within a range, influenced by both incentive structures and prevailing market rates. The chart below illustrates how user borrowing behavior responds to changing market conditions, providing a clearer view of borrower elasticity.

WETH - Elasticity

The graph above underscores borrower elasticity, the horizontal distribution of borrows shows that borrowers have been adjusting their positions significantly in response to fluctuating interest rates. This adjustment is evident from the greater increase in borrow balances compared to supply balances, implying that borrowers are more sensitive to changes in borrowing rates than suppliers are to supply rate variations.

Based on this observation, if the community opts to reduce incentives, we recommend decreasing the supplier incentives to 35 COMP/day. The overall reduction in incentives would be 35 COMP/day. We advise implementing further changes in phases and monitoring user position dynamics to gauge the impact.

Reserves vs Rewards

Furthermore, as noted in the above post the WETH Comet has been making net loss with the current rewards distribution. With the recommended rewards distribution, the net losses for the comet would reduce by ~73%. Gauntlet will continue to monitor this Comet and make any recommendations as necessary.

| Rewards per day | Rewards for 14/7-21/7 | Reserves for 14/7-21/7 | PnL | |

|---|---|---|---|---|

| Current | 90 | $37.27k | $7.77k | -$29.5k |

| Recommended | 55 | $22.77k | $15k | -$7.77k |

Effect on IR

Currently incentives reduce 0.26% to the overall 2.08% Borrow APR, and increase by 0.71% to 1.42% Supply APR. The proposed change in incentives would affect the IR in the following manner

| Parameter | Current | Recommended |

|---|---|---|

| Borrow APR at kink | 2.19 | 2.19 |

| Supply APR at kink | 1.57 | 1.57 |

| Net Borrow APR at kink | 1.94 | 1.94 |

| Net Earn APR at Kink | 2.26 | 1.92 |

| Borrow Distribution | 0.24 | 0.24 |

| Supply Distribution | 0.7 | 0.34 |

Overall, this Comet should still offer competitive rates when compared to Aave which has 2.7% Borrow APR at kink.

USDC Comet

Utilization vs Supply vs Borrow

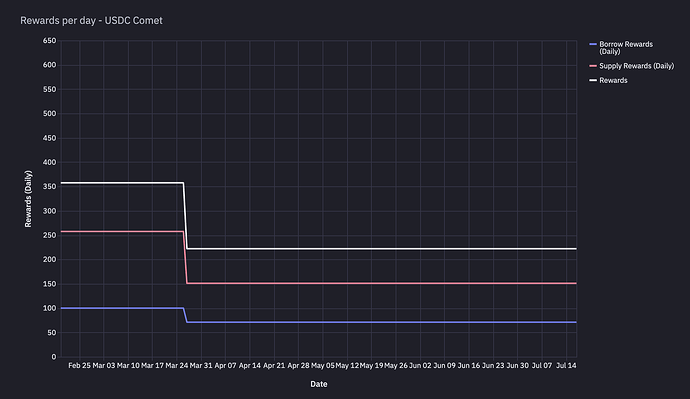

Rewards per Day

The charts above and below indicate that the recent reduction in supply and borrow rewards did not lead to an immediate impact. Although the reward reductions were implemented on March 24th, significant drops in supply and borrow balances only occurred later, on April 11th and July 2nd. This suggests that the changes in rewards and the resulting elasticity of supply and borrow positions may be unrelated. The graph below provides a deeper analysis of user position elasticity.

USDC - Elasticity

The graph illustrates two distinct regimes: one where users exhibit high elasticity in their supply and borrowing behaviors in response to changing rates, and a more recent trend showing increased inelasticity among suppliers denoted by the horizontal distribution of user positions within the red-light green spectrum. Given that users have shown a general indifference to changes in rewards and the high elasticity in borrowing remains consistent across both regimes, we recommend that if the community decides to lower incentives, supply-side rewards be reduced to 70 COMP/day. Consequently, the total rewards for this Comet would be adjusted to 151 COMP/day.

Reserves vs Rewards

Furthermore, the USDC Comet has been making net loss with the current rewards distribution. With the recommended rewards distribution, the net losses for the comet would reduce by ~39%. Gauntlet will continue to monitor this Comet and make any recommendations as necessary.

| Rewards per day | Rewards for 14/7-21/7 | Reserves for 14/7-21/7 | PnL | |

|---|---|---|---|---|

| Current | 222 | $91.94k | $5.35k | -$86.59k |

| Recommended | 141 | $57.92k | $5.35k | -$52.57k |

Affect on IR

Currently incentives reduce 0.26% to the overall 2.08% Borrow APR, and increase by 0.71% to 1.42% Supply APR. The proposed change in incentives would affect the IR in the following manner

| Parameter | Current | Recommended |

|---|---|---|

| Borrow APR at kink | 8.99% | 8.99% |

| Supply APR at kink | 6.75% | 6.75% |

| Net Borrow APR at kink | 8.63% | 8.63% |

| Net Earn APR at Kink | 7.27% | 6.99% |

| Borrow Distribution | 0.36% | 0.36% |

| Supply Distribution | 0.52% | 0.24% |

Overall, this Comet should still offer competitive rates when compared to Aave which has 9% Borrow APR at kink.

Next steps

We welcome community feedback.