Simple Summary

A proposal to adjust five (5) parameters for five (5) Compound assets.

Abstract

Gauntlet’s simulation engine has ingested the latest market and liquidity data following the recent market crash. This proposal is a batch update of risk parameters to align with the Moderate risk level chosen by the Compound community. These parameter updates are the twelfth of Gauntlet’s regular parameter recommendations as part of Dynamic Risk Parameters.

Motivation

This set of parameter updates seeks to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets. Gauntlet recently published a blog post on our parameter recommendation methodology to provide more context to the community.

Our parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Our parameter recommendations seek to optimize for this objective function. Gauntlet’s agent-based simulations use a wide array of varied input data that changes on a daily basis (including but not limited to user positions, asset volatility, asset correlation, asset collateral usage, DEX/CEX liquidity, trading volume, expected market impact of trades, liquidator behavior). Our simulations tease out complex relationships between these inputs that cannot be simply expressed as heuristics. As such, the charts and tables shown below may help understand why some of the param recs have been made but should not be taken as the only reason for recommendation. Our individual collateral pages on the dashboard cover other key statistics and outputs from our simulations that can help with understanding other interesting inputs and results related to our simulations.

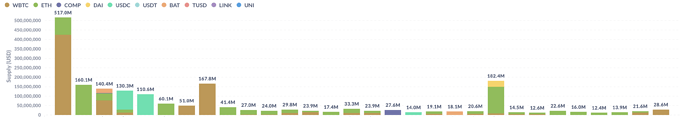

Top 30 non-recursive and partially-recursive aggregate positions

Top 30 non-recursive and partially-recursive borrowers’ entire supply

Top 30 non-recursive and partially-recursive borrowers’ entire borrows

Top USDC non-recursive supplies and collateralization ratios:

Top LINK non-recursive supplies and collateralization ratios:

Top SUSHI non-recursive supplies and collateralization ratios:

Top AAVE non-recursive supplies and collateralization ratios:

Top YFI non-recursive supplies and collateralization ratios:

Note that the above symbol-specific charts show the positions that are entirely non-recursive (i.e., don’t supply and borrow the same assets) and have collateralization ratios less than 10. The recursive and partially recursive positions, and more highly collateralized positions, are still incorporated into our simulations.

Specification

Our recent market downturn report showed that many collaterals are resilient to insolvencies, as our simulation models have predicted. We will continue to adjust risk parameters to drive increases in capital efficiency while maintaining protocol risk at safe levels. Parameter recommendations are ordered by descending cToken collateral locked.

| Parameter | Current Value | Recommended Value |

|---|---|---|

| USDC Collateral Factor | 82.5% | 84% |

| LINK Collateral Factor | 77% | 79% |

| SUSHI Collateral Factor | 70% | 73% |

| AAVE Collateral Factor | 70% | 73% |

| YFI Collateral Factor | 73% | 75% |

Dashboard

The community should use Gauntlet’s Risk Dashboard to understand better the updated parameter suggestions and general market risk in Compound.

When making recommendations, Gauntlet takes into account the entire distribution of insolvencies and liquidations from our simulations and weighs them against increases in borrows. The below metrics give the community insight into some of the insolvency and liquidation tail risks the protocol could face and Capital Efficiency improvements the protocol stands to gain. Click the collateral-specific pages linked in the Collateral Risk section for more detailed simulation metrics.

Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event.

Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event.

These parameter changes increase borrow usage by 8 basis points with no change in Value at Risk or Liquidations at Risk.

Next Steps

While Gauntlet expects to initiate a governance proposal for this set of parameter recommendations on Sunday, 6/5 (voting to begin 2 days later), we will cancel the vote should changes in our daily simulations dictate it necessary.

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.