Summary

The Compound III USDC Ethereum market currently prices WBTC using the Chainlink BTC / USD price feed. Compound Labs proposes to upgrade the price feed for WBTC to a custom price feed that factors in the exchange rate between WBTC and BTC to protect against potential depegging events. This custom price feed is implemented by Compound Labs and has been audited by OpenZeppelin. To ensure correctness, Gauntlet has backtested the prices returned by the custom price feed.

Context

WBTC is an ERC20 token that is backed 1:1 by Bitcoin, all of which are custodied by BitGo. It is currently the largest wrapped Bitcoin product on Ethereum and allows users to use Bitcoin in Ethereum dapps, like Compound.

WBTC has historically maintained its peg with BTC well and we do not believe there are currently any issues with the peg. However, it is worth noting that in November of 2022, there was a 2% depeg due to fears around the FTX collapse. This fear was based on uncorroborated claims during a time of market turbulence, so WBTC returned to its peg shortly.

Even though WBTC is functioning perfectly well right now, Labs believes that the protocol should protect itself from any potential depegging in the future. The protocol could face heavy losses if it inaccurately prices WBTC during a depeg event.

Custom WBTC Price Feed

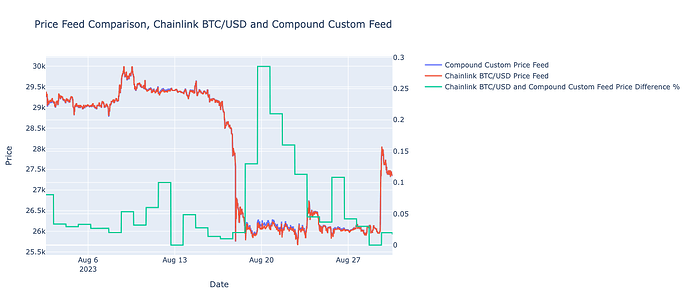

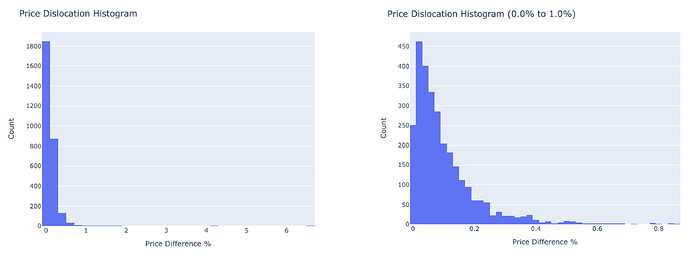

Labs implemented a custom WBTC price feed around half a year ago and got it audited by OZ. This price feed reads prices from the Chainlink WBTC / BTC and BTC / USD price feeds and multiplies them together to arrive at the WBTC / USD price.

The price feed was deployed on mainnet 3 months ago and has soaked for some time to allow for backtesting of its price history. We reached out to Gauntlet to run this backtest and they will be sharing their analysis down below. Their findings show no issues with the custom price feed.

Next Steps

We welcome any thoughts on this topic and plan to make a proposal in a few weeks after the community has had the chance to offer their opinions.