A Treasury Growth Strategy for Compound

Author: @Avantgarde

Special thanks to @PGov @pennblockchain @AranaDigital @AlphaGrowth for providing valuable feedback to this proposal (not to be assumed as a signal of their support).

TL;DR

This proposal aims to activate some of Compound’s idle treasury assets to improve capital efficiency and boost revenue, complementing Gauntlet’s reserve management with growth-focused strategies to support the protocol’s growth initiatives and long-term sustainability. The strategy has three core parts:

- Earning above average vanilla yield on staked ETH: Engage ETH yield opportunities whilst controlling risk.

- COMP Yield Strategy with option to sell at opportunistic strikes: Use COMP to generate USDC whilst allowing sales if prices exceed pre-defined strike prices. This strategy maintains COMP exposure whilst making opportunistic sales possible at higher prices. In the meantime, it generates somewhere between 15%-35% annualised net USDC-denominated yield on COMP tokens.

- USDC Yield Strategy: USDC earned on the COMP strategy will be deposited into a Compound-exclusive DeFi Yield vault, which is a diversified, conservative-risk stablecoin strategy currently generating 15% APY (realistic average 9-15%). Said USDC can be used for COMP buybacks or fund growth-initiatives.

All of the above will be executed in a non-custodial manner.

Outcomes:

- Earning higher than average vanilla yield on idle ETH assets

- Earning a USDC-denominated yield on COMP (minimum 15%).

- Build USDC buffer from COMP strategy that earns additional yield; use to finance, for example, the Delegate Compensation Program, conduct COMP buybacks if price falls below $50, and/or support other growth-related initiatives.

Ask:

- An allocation of 3000 ETH (~$9.5m) to a non-custodial Avantgarde ETH Yield Vault to earn yield.

- 69k COMP (~$5m) to run COMP strategies to generate USDC for the treasury.

- Generated USDC to be deposited into a non-custodial Compound-exclusive DeFi Yield Vault to earn yield; to be earmarked for Delegate Program, COMP buybacks and/or other growth-initiatives.

Introduction

Compound currently has about $80m and $11.5m respectively in the Comptroller and Timelock contract. The Comptroller is entirely made up of COMP, with the Timelock holding about $9.5m in ETH and some 500-700k each in USDC, COMP, and wBTC. Rather than being put to work, these tokens are sitting idle and unproductive. Given where Compound finds itself, the DAO should do what it can to be as capital efficient and growth-oriented as reasonably possible.

We believe that the results of AlphaGrowth’s recent efforts around the Growth Program has given Compound a much needed spark, and we should continue to press the gas pedal a bit more to fuel this momentum. We believe that a too conservative of an approach at this stage will only weigh on the DAO’s ability to get the protocol back on track as a leading money market and lending protocol with an upwards trajectory; or risk being outcompeted.

Proposal

This proposal seeks to set up a growth-oriented treasury strategy to complement the management of reserves by Gauntlet, with the aim of improving capital efficiency and revenue generation on treasury assets to support the DAO’s capacity to fund further growth initiatives and strengthen financial sustainability. The proposed strategy includes three core parts:

Staking the idle ETH sitting in the Timelock contract will improve capital efficiency and help the treasury generate yield, with a number of strategies available. We remain open to feedback from the community, but initially we would aim to blend a diversified portfolio of established and battle tested protocols with measured positions in dynamic opportunities that can increase yield.

Avantgarde ETH Yield Vault

A non-custodial, permissioned vault for whitelisted DAO treasuries to access diversified staking yields on ETH.

-

Targets yields on ETH in excess of vanilla staking, within pragmatic risk parameters.

-

Aims to be diversified across ETH-assets, protocols and underlying yield sources.

-

Actively managed.

-

0% protocol fee and 15% performance fee; calculated and paid out automatically by the vault.

-

Reporting is on-chain provable and auditable 24/7 via the Enzyme UI, and Avantgarde will provide additional formal reporting on the performance of assets on a quarterly basis, and can respond to interim questions as the community deems appropriate.

-

To protect participating DAOs from scrutiny, regulatory or otherwise, ownership of the vault is held by Avantgarde Treasury and controlled via a 3/5 multisig made up of two signers from Avantgarde Treasury, two signers from Avantgarde Finance, and one from Enzyme.

-

Avantgarde Finance acts as the delegated manager with certain smart contract roles & permissions (ensuring that Avantgarde can not misappropriate the funds). However, the vault will remain open to other potential DAOs interested in utilising the vault for its treasury in a similar manner (this would require Avantgarde to whitelist them as a permissioned depositor).

-

Any changes made to the vault won’t go into effect until after a 7-day cooldown period (please note that there is no reason to expect any such changes, and if there were, Avantgarde will make sure to communicate those on the forum with at least two weeks’ notice).

-

The DAO can withdraw from the vault at any time. Please note that the ETH Yield Vault may hold positions that accrue rewards on third party protocols which ideally should be claimed prior to a withdrawal. Hence, while the DAO could withdraw instantly and receive its deposit in the tokens held in the vault, the optimal way would be for the DAO to communicate its desire to withdraw in advance to facilitate liquidity management within the vault and ensure a seamless withdrawal process.

We will begin by implementing a strategy to earn USDC yield on COMP tokens which can be used to fund other initiatives, buyback COMP, or grow the treasury without sacrificing long-term token exposure. The strategy aims to effectively monetize COMP’s appreciation potential while maintaining a source of stable revenue; allowing the treasury to generate revenue by agreeing to sell COMP tokens only if a set “strike” price is reached within a specific timeframe (aka “duration”). Regardless of whether the sale occurs, the treasury earns a premium, creating a consistent source of income while maintaining control of the tokens until the set strike price is met.

Below we include an example to show how the strategy basically works. This example is purely for educational purposes, and the cited duration and strike parameters, as well as the yield and earnings are purely hypothetical and on the conservative end. Actual durations and strike targets will be adjusted dynamically to achieve the highest yield within good risk parameters.

We will target a minimum 15% yield net of fees per annum (p.a.), but believe we can achieve upwards to 30% in the current market. Indicative quotes for the premium and APY can be simulated at MYSO Finance.

Example:

COMP price at time of execution = $72.46 per COMP

Strike prices:

- 34.5K COMP at 94.20 (half the allocated COMP at 130% strike)

- 34.5K COMP at 108.69 (half the allocated COMP at 150% strike)

Estimated annualized gross premium (received upfront):

- Minimum 15% p.a. (projected $750k p.a. on $5M notional)

Duration: 180 days (for example)

Possible Outcomes:

- COMP > strike

- DAO earns an estimated $375k upfront ($750k p.a.)

- If COMP is sold at the 30% strike price of 94.20:

- Total proceeds = 34,500 COMP x 94.20 = $3,251,700 USDC

- Initial cost (based on baseline price) = 34,500 COMP x 72.46 = $2,499,870

- Gain from sale = $3,251,700 - $2,499,870 = $751,830 (excluding premiums)

- If COMP is sold at the 50% strike price of 108.69:

- Total proceeds = 34,500 COMP x 108.69 = $3,748,805 USDC

- Initial cost (based on baseline price) = 34,500 COMP x 72.46 = $2,499,870

- Gain from sale = $3,748,805 - $2,499,870 = $1,248,935 (excluding premiums)

- If all COMP are sold:

- Total gain from sales (+ premium): $1,248,935 + $751,830 = $2,000,765 ($2,375,765)

- The USDC is then deposited into the DeFi Yield Vault.

- Avantgarde makes a new proposal to the DAO to top up the strategy (at much higher levels).

- If COMP is sold at the 30% strike price of 94.20:

- COMP < strike

- DAO has earned an estimated $375k in 6 months ($750k p.a.)

- COMP has not been sold.

- Strategy repeated to bring in another $375k for the next 6 months.

This pattern repeats.

Note: Myso takes a 15% fee on premiums (not sales) generated, which includes a referral fee.

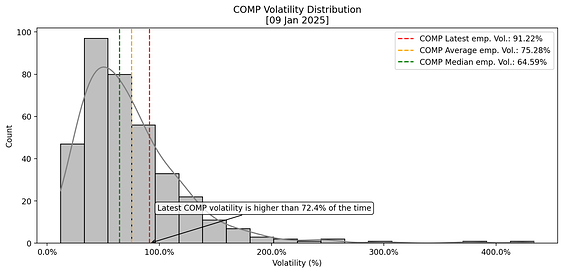

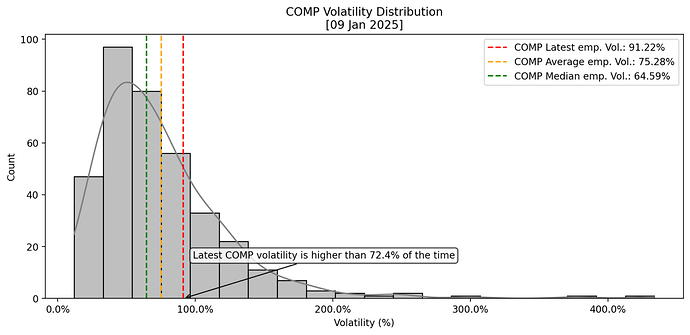

Note: option premium and yields may fluctuate as they depend on COMP’s current price volatility, where the higher the volatility the higher the option premiums one can generate. The above indicative premiums are calculated as of 9 January 2024 where COMP had a slightly above average realized short-term volatility of 91% p.a.

COMP Yield Operations

Execution of this strategy will be done through the MYSO v3 protocol, which eliminates the need for institutional trading firms to take custody of COMP tokens or rely on off-chain legal agreements. The entire process is decentralized, secure, and transparent, ensuring maximum returns while retaining full asset control for the COMP treasury.

When a loan is successfully matched with a trading firm, the underlying COMP coins are locked in a segregated timelock escrow smart contract (audit report: Omniscia Audit Report). Upon match, the counterparty must automatically pay the premium to initiate the start. If the limit price is reached at maturity of the loan, the trading firm should pay the agreed strike price; otherwise, the coins automatically unlock after expiry, returning to the COMP treasury, eliminating counterparty risk.

To ensure competitive pricing, the COMP treasury can initiate a Dutch auction similar to a Balancer Liquidity Bootstrapping Pool (LBP). The auction starts with a high tbd target premium that gradually decays over time until a tbd minimum acceptable premium is reached. All parameters, including premium decay rates and auction duration, are fully customizable. Institutional trading firms are automatically notified about the auction, creating a competitive environment where the firm offering the best premium wins, maximizing the to-be-received option premium for the treasury.

Additionally, MYSO v3 includes additional features for advanced treasury management. To be more specific, the COMP treasury can define an “earliest exercise date,” ensuring coins can only enter circulation between the specified earliest exercise and expiry date (i.e., European option exercise). Moreover, while the coins are locked, the treasury can retain full voting power over its COMP tokens if desired.

In summary, the COMP treasury can efficiently operationalize on-chain strategies using MYSO v3 as follows:

- On-chain settlement without counterparty risk: COMP are locked on-chain through segregated escrow smart contracts, removing the need for trust in trading firms.

- Competitive bidding through Dutch auctions: transparent auctions ensure the highest possible premiums.

- Advanced treasury control: the COMP treasury can control when coins enter circulation (if the option is in-the-money) and retain voting power if needed.

There are two potential sources of USDC to be generated from the COMP yield strategy: first the guaranteed up-front premium, then the potential sale in case the COMP price is above the respective strike prices at expiry.

We propose to deposit the USDC generated from the strategy into a Compound DeFi Yield Vault on Enzyme, which is a diversified, conservative-risk stablecoin strategy currently generating 15% APY (realistic average 9-15%) as an alternative to the reserves managed on Aera.

As it grows in size over time, this vault could be used to buy back COMP when market momentum and conditions are less favourable, or finance various growth-related initiatives. For now, the strategy will generate a guaranteed USDC premium and allow the treasury to lock in profits at higher prices for a rainy day, should the market continue to trend higher.

Compound DeFi Yield Vault

A non-custodial, permissioned vault exclusively for the Compound DAO to access on-chain yields within DeFi, focusing on the largest, most battle-tested protocols.

-

Currently yielding around 15% (annualized), realistic average expectations 9-15% APY.

-

Aims to be diversified across stablecoins, protocols, and underlying yield sources.

-

Balances the level of yield with risk and capacity.

-

Actively managed.

-

0.5% protocol fee and 7.5% performance fee; calculated and paid out automatically by the vault.

-

Reporting is on-chain provable and auditable 24/7 via the Enzyme UI, and Avantgarde will provide additional formal reporting on the performance of assets on a quarterly basis, and can respond to interim questions as the community deems appropriate.

-

Ownership will be held by the Compound Governor Timelock.

-

The DAO can withdraw from the vault at any time. Please note that the vault may hold positions that accrue rewards on third party protocols which ideally should be claimed prior to a withdrawal. Hence, while the DAO could withdraw instantly and receive its deposit in the tokens held in the vault, the optimal way would be for the DAO to communicate its desire to withdraw in advance to facilitate liquidity management within the vault and ensure a seamless withdrawal process.

-

Avantgarde Finance acts as the delegated manager with certain smart contract roles & permissions (ensuring that Avantgarde can not misappropriate the funds).

-

Any changes made to the vault won’t go into effect until after a 7-day cooldown period (please note that there is no reason to expect any such changes, and if there were, Avantgarde will make sure to communicate those on the forum with at least two weeks’ notice).

Reporting

- Quarterly Reports: Detailed written reports on the strategies performance and results.

- Community Call Updates: Regular updates to the Compound community highlighting achievements and performance while allowing for open dialogue and feedback on the execution.

Key Outcomes of the Proposal

- Earn around 4-5% on staked ETH

- Earn c 15-35% annualised net USDC-denominated yield on COMP.

- Earn yield on the generated USDC, currently 15% (realistic avg. 9-15%).

- Only diversify into market strength, not weakness.

- Mitigate market impact on COMP by limiting capacity and strategy implementation.

- Build a USDC buffer earmarked for the Delegate Compensation Program, other growth-related initiatives, and/or consider buybacks if COMP falls below, say, $50.

Fee Summary

- ETH Yield Vault: 15% performance fee.

- COMP Yield Strategy: 15% on premium only.

- DeFi Yield Vault (USDC): 0.5% protocol fee and 7.5% performance fee.

About Avantgarde Finance

Avantgarde is a DeFi native asset management, advisory and research firm that specializes in running non-custodial onchain asset management strategies, leveraging DeFi protocols and tools to deliver solutions for DAOs, Foundations, and Institutional clients.

Avantgarde has been active in DeFi since 2016, notably as co-founders of the onchain asset management protocol Enzyme, and brings decades of TradFi experience to help DAOs and Foundations optimise treasury management strategies, improve financial sustainability, and support long-term growth. Past and current clients include Arbitrum, Gitcoin, Nexus Mutual, Apecoin among others.

We also serve as active delegate here on Compound, as well as on Uniswap, Safe, Morpho, and Paraswap, where we’ve participated in initiatives such as the Uniswap Bridge Assessment Committee, contributed with R&D to various proposals in line with our expertise, instigated RFP processes as well as spearheaded governance proposals.