What is RAI?

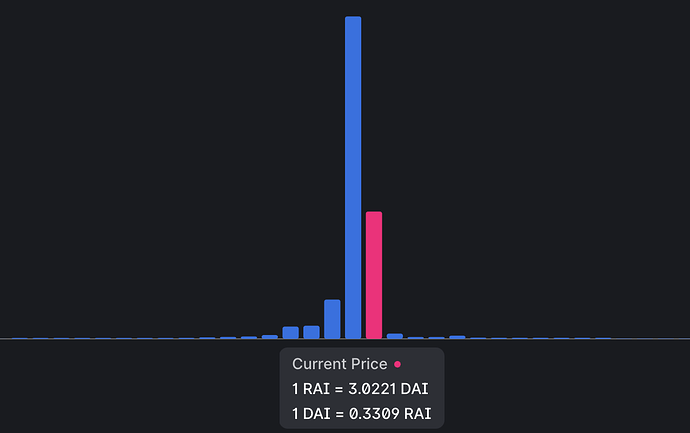

RAI is an incarnation of the early design for Single Collateral Dai: it is solely backed by ETH, meant to have less governance as time passes, and uses a funding rate to automatically balance market forces and keep itself stable.

This funding rate can be either positive or negative. A positive rate is similar to the stability fee in SAI or DAI, meaning that RAI borrowers would pay a fee by having their RAI debt increase in value. A negative rate can compel market participants to sell RAI when it is traded at a premium compared to its floating “target price” — something that is missing from all pegged coins currently on the market. The target price is the price that the protocol wants RAI to have on the open market.

For more details on RAI, you can check out the videos and FAQs on the Reflexer website.

Why should RAI be added to Compound?

RAI is currently the only real stablecoin that is not 1:1 pegged to fiat and is also solely backed by ETH. It offers a unique value proposition to protocols that want to diversify their stable asset risk and maintain censorship resistance.

Historically, Compound proved to be extremely prudent in choosing which assets to include in the protocol. RAI seeks to minimize risk on all fronts by removing human governance, maintaining purity with ETH collateral, and automating the vast majority of parameters in the protocol. For these reasons, we believe RAI fits Compound’s approach to add safe assets to the system.

Technicals

- Token Etherscan link: 0x03ab458634910aad20ef5f1c8ee96f1d6ac54919

- Contract code verified and open-source? Yes

- Team: Members · People · reflexer-labs · GitHub

- Experience in the respective field: Certain team members received grants for stablecoin R&D and all team members have prior experience in building or auditing L2 scaling solutions or DeFi protocols

- Whitepaper: whitepapers/English/rai-english.pdf at master · reflexer-labs/whitepapers · GitHub

- Audits: GitHub - reflexer-labs/geb-audits: List of audits for the whole suite of GEB related smart contracts

- Governance structure: 3/5 multisig

- 3 core team members and 2 anons

- 24h delay on changing anything

- Number of contract transactions: More than 20,000

- Age of the token: 8 months

- Social channels:

- Twitter: https://twitter.com/reflexerfinance

- Discord: Discord

- Pausability: Can trigger settlement for the whole protocol after a 24 hour governance delay

- Upgradeability: Can upgrade the whole protocol besides the ERC20 RAI contract and the core contract that contains data about each position minting RAI

- Restrictions on transfers: No

- Total supply: 33,169,412

- Circulating supply: 32,583,538

- Token distribution

- Number of unique holders: 2476

- Addresses holding >= 10% of supply: 3

- CEX liquidity: $400K

- DEX liquidity: $53M (as at November 15, 2021)

- Uniswap V2

- Total liquidity: $16M

- Volume (24h): $635k

- Transactions (24h): 20

- Uniswap V3

- Total liquidity: $37M

- Volume (24h): $891k

- Transactions (24h): 35

- Uniswap V2

- Market cap: $98M (as at November 15, 2021)

- Price volatility: Sub 1% per day

- Supporting oracles: Chainlink RAI/ETH, Chainlink RAI/USD

- Underlying assets

- How quickly can the amount or value of any underlying assets change?

- RAI is solely backed by ETH. ETH experienced sharp 30%+ drops over a couple of days

- How quickly can the amount or value of any underlying assets change?

- Insurance:

- Nexus Mutual

- What’s covered:

- Contract bugs

- Economic attacks, including oracle failures

- Governance attacks

- Amount staked: 96.194k NXM = ~$16.747M

- Capacity: $19.1M

- Max individual coverage length: 365 days

- Cost: 2.60% annually

- What’s covered:

- Nexus Mutual

Proposal parameters

- Collateral factor: 0%

- Borrow cap: 4M RAI

- COMP borrow/supply speeds: 0

- Interest rate model: Same as DAI

- Reserve factor: 25%

I could be wrong about this…

I could be wrong about this…