Building off Getty’s discussion of COMP distribution speeds, I think we should be more intentional about how COMP is distributed.

The objective of the COMP rewards program was initially to distribute the token to our users. The sad truth is that an overwhelming amount of the COMP rewards are being farmed and instantly sold off, making the rewards program ineffective in achieving the initial goal. I believe there’s a clear need to re-evaluate how best to distribute the token to our community. This is something that will evolve over time, so it doesn’t mean we have to completely figure this out before changing the existing program.

Rather than distributing massive amounts of tokens arbitrarily to markets, I propose changing the existing rewards program (as just one of our rewards programs) to utilize COMP rewards to:

- Strategically incentivize growth while maximizing profits (minimizing losses), and

- Maintain minimum market sizes

When a market first launches, we don’t see much activity until the market receives COMP rewards. There’s little incentive to deposit into it when there’s no borrowing demand (or rewards), and there’s no borrowing demand because there aren’t enough tokens to borrow to make the cost of the borrow transaction worth it.

A market needs to have great enough incentives for depositors to provide enough liquidity to make the cost of borrowing worth it.

Assuming this is the direction the majority of COMP holders want to take, it begs the question of how to get there. Here’s my action plan as a series of proposals.

Action plan

1. Normalize existing rewards across all markets

Before reducing COMP rewards across all markets, it makes sense for each market to start off with about equal (weighted) footing.

Existing rates

We start off by looking at the existing at existing rates:

| Market | Supply Speed (COMP per block) | Borrow Speed (COMP per block) |

|---|---|---|

| Stables | - | - |

| DAI | 0.067 | 0.067 |

| USDC | 0.067 | 0.067 |

| USDT | 0.00965 | 0.00965 |

| TUSD | 0 | 0 |

| USDP | 0 | 0 |

| FEI | 0 | 0 |

| Total (Stables) | 0.14365 | 0.14365 |

| Non-stables | - | - |

| ETH | 0.01075 | 0.01075 |

| WBTC | 0.01075 | 0.01075 |

| UNI | 0.0014625 | 0.0014625 |

| BAT | 0.0014625 | 0.0014625 |

| COMP | 0.005 | 0 |

| ZRX | 0.0014625 | 0.0014625 |

| LINK | 0.0014625 | 0.0014625 |

| MKR | 0 | 0 |

| AAVE | 0 | 0 |

| YFI | 0 | 0 |

| SUSHI | 0 | 0 |

| Total (Non-stables) | 0.03235 | 0.02735 |

| Total | 0.176 | 0.171 |

Appendix A. Current COMP distribution across active markets

Asset classes

Active markets have been split up into two different classes: stables and non-stables. Most borrowing activity on Compound is with stablecoins. They’re great to borrow because their value is stable and slowly decreases over time. The use-case of non-stablecoins is different; borrowing activity is presumed to be mainly for shorting, staking, and strategic governance.

Therefore, this proposal will normalize rewards specific to their asset class.

Normalization variables

Now, the big question is how to normalize rates for every asset class. Let’s consider three different variables:

- Market cap

- Should we apply the same level of rewards if, say, one coin’s market cap is 10x bigger than another?

- Current market size

- Should we scale rewards based on the current market size?

- Risk

- Should we offer fewer rewards for riskier assets as another avenue of risk management?

My intuition tells me we should scale rewards using these three variables; market cap, current market size, and risk all matter.

In addition to these three variables, I believe there should be a base rate for all assets to ensure that all markets will get at least some rewards.

Normalization variable weighting

I propose the following weights for calculating rewards:

- Base weight: 25%

- Market cap weight: 25%

- Current market size weight: 25%

- Risk weight: 25%

Normalization formula

Then to derive the coin’s COMP speeds, the formula (for each class) would be:

base_rate = (total_rate * 0.25) / num_assets

mc_rate = (total_rate * 0.25) * (coin_market_cap / total_market_cap)

cms_rate = (total_rate * 0.25) * (coin_total_supply_or_borrow / total_supply_or_borrow)

r_rate = (total_rate * 0.25) * (coin_collateral_factor / total_collateral_factor)

comp_speed = base_rate + mc_rate + cms_rate + r_rate

Appendix B. Proposed COMP reward rate formula

We use collateral factor as the risk weight for simplicity.

Non-stable rewards changes

Additionally, I propose we move all non-stable borrow rewards over to supply rewards. When looking at the borrow-side for these markets, we see most of the markets with borrow rewards having a negative net rate. We are paying users more than the interest they are accruing, and for what purpose? Doing so incentivizes a decrease in our liquidity and adds insolvency risks. By moving these rewards over to the supply side, we should see an increase in liquidity and decrease in insolvency risk.

Proposal changes

Finally, here’s what the normalization and non-stable distribution changes would look like for supply speeds:

| Market | Current Supply Speed (COMP per block) | Proposed Supply Speed (COMP per block) |

|---|---|---|

| Stables | - | - |

| DAI | 0.067 | ~0.04256 |

| USDC | 0.067 | ~0.05182 |

| USDT | 0.00965 | ~0.03011 |

| TUSD | 0 | ~0.00684 |

| USDP | 0 | ~0.00622 |

| FEI | 0 | ~0.00609 |

| Total (Stables) | 0.14365 | 0.14365 |

| Non-stables | - | - |

| ETH | 0.01075 | ~0.01633 |

| WBTC | 0.01075 | ~0.01573 |

| UNI | 0.0014625 | ~0.00325 |

| BAT | 0.0014625 | ~0.00308 |

| COMP | 0.005 | 0.005 |

| ZRX | 0.0014625 | ~0.00285 |

| LINK | 0.0014625 | ~0.00303 |

| MKR | 0 | ~0.00256 |

| AAVE | 0 | ~0.00267 |

| YFI | 0 | ~0.00265 |

| SUSHI | 0 | ~0.00254 |

| Total (Non-stables) | 0.03235 | 0.0597 |

| Total | 0.176 | 0.20335 |

Appendix C. Proposed COMP supply rate changes

And for borrow speeds:

| Market | Current Borrow Speed (COMP per block) | Proposed Borrow Speed (COMP per block) |

|---|---|---|

| Stables | - | - |

| DAI | 0.067 | ~0.04414 |

| USDC | 0.067 | ~0.05057 |

| USDT | 0.00965 | ~0.02986 |

| TUSD | 0 | ~0.00677 |

| USDP | 0 | ~0.00622 |

| FEI | 0 | ~0.00609 |

| Total (Stables) | 0.14365 | 0.14365 |

| Non-stables | - | - |

| ETH | 0.01075 | 0 |

| WBTC | 0.01075 | 0 |

| UNI | 0.0014625 | 0 |

| BAT | 0.0014625 | 0 |

| COMP | 0 | 0 |

| ZRX | 0.0014625 | 0 |

| LINK | 0.0014625 | 0 |

| MKR | 0 | 0 |

| AAVE | 0 | 0 |

| YFI | 0 | 0 |

| SUSHI | 0 | 0 |

| Total (Non-stables) | 0.02735 | 0 |

| Total | 0.171 | 0.14365 |

Appendix D. Proposed COMP borrow rate changes

Note: The net COMP rewards rate (per block) remains unchanged at 0.347.

Discussion of changes

Stablecoin reward rate changes

We see reward rates for DAI and USDC decreasing - the rewards for the other stablecoins have to come from somewhere. The reward rate for DAI decreases more than that of USDC as USDC’s market cap is about 5x than that of DAI. I expect Compound’s market share of the USDC market to increase because of this.

We see the reward rate for USDT increase significantly. While Tether may lack transparency of their reserves, there’s still demand for it. Moreso, the risk of it losing its peg actually increases its borrowing demand. I expect Compound’s USDT market to increase dramatically with this significant change.

We see rewards rates for the other stablecoins becoming non-zero. This should promote competition among stablecoins while simultaneously decreasing centralization of the stablecoins. I expect these markets to increase significantly with these changes.

Non-stablecoin reward rate changes

Note: This discussion excludes the COMP market which remains unchanged - the COMP supply reward rate acts as a defacto staking rewards mechanism.

We see all supply rewards rates increasing since the borrow rewards were moved over. We should see an increase in deposits across all of these markets after this change. I expect Compound’s market share of users who borrow stablecoins against their non-stablecoin collateral to increase.

We see all borrow rewards rates being cut to 0 - no more net negative rates for borrowing these assets. We’ll see more realistic borrowing activities after this change.

Conclusion

This proposal aims to normalize all rewards rates in a clear and consistent manner, providing a formula for calculating rewards rates.

We address the problem of non-stablecoin borrowing rates being net-negative by moving these rates to the supply side.

I expect Compound to become more competitive in the decentralized borrowing and lending sector through this proposal.

Success metrics

Important metrics in determining the success of this proposal’s ability to increase competitiveness are (+) revenue and (+) TVL (relative to the overall sector).

2. Rewards decay schedule

About a month after the first proposal to normalize rewards rates, giving time to analyze and interpret results, we begin the rewards decay schedule.

There are a number of ways of going about addressing the COMP farming issue, such as:

- Immediately dropping rewards to zero

- Gradually reducing rewards to zero

- Gradually reducing rewards to an equilibrium where profits are maximized

If I’ve learned anything from managing a product with 8000-12000 monthly active users for a number of years, it’s that the slightest change will almost always impact at least one user. So the first approach is totally out of question - it’s too big of a change.

The second approach is an improvement - it gives time for market participants to adjust their financial planning and/or business logic. But what if users migrate to other platforms in such an amount that revenue loss exceeds the value of COMP being distributed to users? This seems counterproductive.

Finally, we have the third approach - finding the equilibrium where profits are maximized. In this approach, rewards will continue to decay (for a market) until profits (for that market) decrease. At that point, we will be near equilibrium for that market, and the COMP rewards for that market will be frozen at a halfway point between the newly set rate and the previous rate for that market. Rates will be frozen for 3 months, then will be re-tested.

This proposal, or rather series of proposals, uses the third approach.

The question still remains of how often to decay rewards, and by how much.

I propose stablecoin and non-stablecoins rewards decay at 6% and 1%, respectively, every 28 days.

This gives us the following exponential decay formulas.

stableRewardsRate(t) = 0.14(1-0.06)^t

Where t is delta time, measured in 28 day intervals

Appendix K. Proposed stablecoin rewards rate decay formula

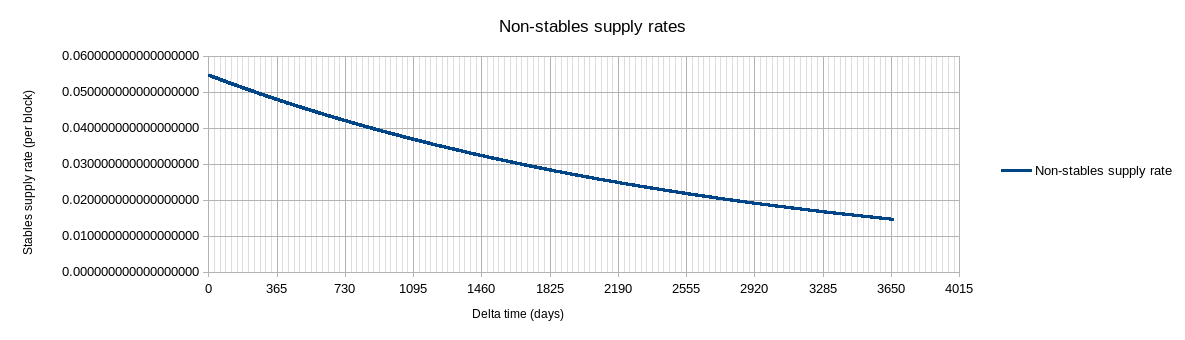

nonstableRewardsRate(t) = 0.0547(1-0.01)^t

Where t is delta time, measured in 28 day intervals

Appendix L. Proposed non-stablecoin rewards rate decay formula

Discussion

Stablecoin rewards decay

Appendix E. Proposed stable supply rewards rates w/ decay rate of 6% every 28 days

Appendix F. Proposed stable borrow rewards rates w/ decay rate of 6% every 28 days

We see stablecoin rewards rates rapidly decline over the next 1.5 years, followed by a slower decline, hitting a total of ~0.001 COMP/per block after about 6 years on both the supply and borrow sides.

Stablecoin rewards are starting from a high point, and many of the rewards today are being farmed out - a behavior we want to discourage. Compound already has large stablecoin markets with stable interest rates, so rewards for them are less useful w/ great costs.

Non-stablecoin rewards decay

Appendix G. Proposed non-stable supply rewards rates w/ decay rate of 1% every 28 days

On the other hand, rewards for non-stablecoins have a much more gradual decay rate. First of all, the non-stablecoin reward rates are starting at a much lower point, and that gives us more legroom. Second, the web3 ecosystem is rapidly growing, with many more coins being introduced. As Compound grows, more and more non-stablecoin markets will be added, and rewards will continually be spread across them. Hence the need for a much lower reward decay rate.

Overall rewards overview

Appendix H. Proposed total rewards rates decay

Overall, we see a rapid decay of rates for about the first 2 years, followed by a slower decay leading to a total rewards rate of about 0.02 COMP per block after 10 years.

Appendix I. COMP distributed since start of proposed decay schedule

After about 10 years, we’ll see about 1,755,000 COMP distributed through this rewards program.

Appendix J. COMP remaining since start of proposed decay schedule

This leaves us with about 910,000 COMP remaining (excl. Compound payroll), and about 590,000 COMP remaining taking into account the current Compound payroll streams. This allows us ample room for other rewards programs and work contracts to fuel the growth of Compound over the next decade.

A 28 day decay interval is used to give us about 3 weeks to analyze results before submitting a subsequent proposal.

Conclusion

We address the COMP farming problem by gradually reducing rewards rates in a predictable, transparent, and well-defined manner. Rather than dropping rewards to zero, we instead use an exponential decay formula with freezing conditions to maximize profits.

Stablecoin rewards rates decay at 6% every 28 days since they’re starting at a much higher rate and they are the main target of COMP farming.

Non-stablecoin rewards rates decay at 1% every 28 days since they’re starting at a much lower rate and rewards will continually be spread across a growing list of markets.

Financial planning has been done on a 10-year time frame to ensure the long-term success of the protocol with an ample amount of COMP left over for other rewards programs and work contracts.

Success metric

The success metric of each of these proposals is (+) gross profit, that is, revenue minus cost of rewards.

Summary of action plan

The first step of this action plan is to normalize all rewards rates in a simple, transparent, and well-defined manner. Normalization is weighted by market cap, current market size, and risk, on top of a base weight; all of which are weighted at 25%.

About a month after normalization, we start decaying rewards rates of the two asset classes - stablecoins and non-stablecoins. Stablecoin rewards rates decay by 6% every 28 days given the high starting point and being the main target of COMP farming. Non-stablecoin rewards rates decay by 1% every 28 days given the lower starting point and with these rewards spread across a larger and growing list of markets.

Normalization will occur with each of these decay schedule proposals to rebalance rewards as global and local markets change.

After about 10 years, we’ll see approximately 1,755,000 COMP distributed through this rewards program with this decay schedule. With this and the current protocol payroll streams, there will be about 590,000 COMP left to be distributed. This allows us ample room for other rewards programs and work contracts to fuel the growth of Compound over the next decade.

Services and compensation

Who is TylerEther

Ever since a young boy, I’ve always had a passion for math and science. I remember when I was in the first grade, I once failed a math quiz and was required to stay in during recess to improve my math. The embarrassment; I told myself never again would I be prevented from enjoying recess with my friends. Shortly after, I managed to convince my mother to buy me math workbooks so that I could practice my math with her help in grading my work. I felt so powerful with the knowledge to perform addition, subtraction, and even basic multiplication and division by the end of second grade. I knew then and there that I’d never miss recess again.

I later started my coding journey when I was 10 years old, making my first website - featuring a flaming cursor! I was 12 years old when I created my own custom RuneScape private server to play amongst my brothers. I was 13 years old when I got into bot development at SRL. It was through SRL that I learned of Bitcoin in 2010. After becoming a community developer there at 14 years old, I eventually wanted to create something of my own.

It was then at almost 15 years old when I decided to create my own RuneScape bot - TRiBot. It took just over 3 years of development, community management, and many failed attempts at gaining traction before TRiBot took off. Shortly after going from about 10 active users to about 10,000 in a matter of months, I founded TRILEZ SOFTWARE INC. at the age of 18. I operated the company while attending university to later graduate with a BSc. in computer science with a minor in mathematics.

Who is TRILEZ SOFTWARE INC.

TRILEZ SOFTWARE INC. (“Trilez”) was initially founded in 2013 as a RuneScape botting company, serving over 400,000 unique users with over 30 all-remote independent contractors contributing to a vibrant script marketplace.

The goal of our flagship product, TRiBot, was to enhance the gameplay of all players. Rather than mindlessly grinding in the game, our users were able to instead enjoy life more. We all loved the game, so a lot of focus was put on ensuring our bots did not harm the game. Hence we put a lot of effort into making our bots as human-like as possible, mainly through tuning the bots’ reaction times to be the same as players (so bots didn’t have a competitive advantage), encouraging limited use of our bots, and having an AI chat component.

Since we were operating in such a niche market, our growth was limited and I ended up taking on responsibilities in many different areas. Through Trilez I learned many different skills - product management, people management, community management, business strategy, research and innovation, marketing, dev-ops, cloud computing, Java/JVM, C++, networking, security, the list goes on.

We flash forward to 2021 when the rights to TRiBot were transferred to new ownership, pivoting Trilez to be a web3 company. It’s just me at the company for now while we find our footing in web3.

Since pivoting to web3, Trilez has:

- Added a LINK market

- Added support for splitting COMP rewards between suppliers and borrowers and promptly fixed the newly introduced proposal 62 bug [1][2]

- Performed a temperature check for retroactive COMP token distribution to early users

- Added a USDP market

- Added a FEI market

- Prepared a RAI market listing proposal

- Been working with Getty & GFX Labs to introduce various other assets including stETH and RAI

- Been working to create a market listing framework; the template for which has been used in the RAI proposal

- Started working on a multi-chain evaluation framework and has started writing automated deployment and configuration scripts

- Created Pythia - a decentralized, fully on-chain price and liquidity oracle providing manipulation resistant price feeds (still a work-in-progress), built with Compound in mind

- The intention of v1 is to be used with Compound’s L2 deployments since it’s too costly in gas to be used on mainnet

- A v2 has been roughly planned out to consume much less gas with some trade-offs

Services offered

The following services offered are exclusively in relation to COMP rewards program(s), in no particular order.

1. Development and maintenance of the rewards normalization model(s)

The rewards normalization model created and shared above will continue to be maintained, and improved upon or changed if need be.

One possible improvement may be the following:

- Trading volume normalization parameter

- Investigate whether rewarding markets partially based on [logarithmic] trading volume can increase profit and TVL

2. Regular rewards normalization

Proposals will be submitted every 28 days to normalize rewards rates as per the normalization formula and methodology as outlined above. These proposals will be in tandem with rewards rates decay.

3. Development and maintenance of the rewards decay models

The rewards decay models created and shared above will continue to be maintained, and improved upon or changed if need be.

4. Regular rewards decay

Proposals will be submitted every 28 days to adjust rewards rates as per the decay schedule and methodology as outlined above. These proposals will be in tandem with rewards rates normalization.

5. Establishment of a minimum market size

Discussion of a minimum market size will be facilitated to establish minimum market sizes. Rewards to establish and maintain such minimum market sizes will be evaluated over time.

6. Establishment of the methodology for when to increase rewards for a market

While rewards may be high at the moment, there will eventually be a time where increasing rewards for a market will lead to an increase in profit. When this occurs, a data science based methodology will be established for increasing rewards for a market. This will likely manifest into the creation of an optimization algorithm.

7. Development and maintenance of reward chart dashboard(s)

Public dashboard(s) will be created to visualize and analyze the performance and effectiveness of Compound’s COMP rewards.

These dashboard(s) will be promptly created as they are key in analyzing the effectiveness and longevity of our rewards program(s) as well as driving decisions.

8. Exploration of additional rewards programs

The following items in no particular order will be explored should they bring significant value to the protocol:

- Referral programs (with sybil resistance)

- Incentivizes user-growth

- COMP lock-up rewards programs

- Incentivizes long-term commitment to the protocol

- COMP-ETH DEX liquidity rewards programs (on Ethereum and more importantly, L2s)

- Incentivizes COMP price stability, lower slippage on trades, and greater availability

- cToken DEX liquidity programs (on Ethereum and/or L2s)

- Incentivizes cToken-underlying liquidity to save on gas vs. minting/redeeming and provides entry/exit liquidity in cases where users are unable to normally do so (paused markets, transfer restrictions, etc.)

9. General engineering services

Software engineering services such as UI adjustments, smart contract development and testing, automation, and any other general engineering work needed to execute on the other services mentioned.

The following services which fall outside of the COMP rewards program(s) are included as well.

10. Multi-chain deployment, research, and management

Research into the deployment of Compound to other chains will continue to be performed. Using the data gathered, we will work with the community to establish base criteria, processes, and anything else needed for successful deployment on other chains.

Deployment scripts and configuration scripts will be finalized and made public, which will be used to deploy and configure Compound on other chains.

11. Market listing, research, and management

We will continue to list new markets with continual and agile improvement of related processes and requirements, including updated deployment scripts and/or tools.

12. Protocol development, research, and maintenance

We will continue developing and maintaining the protocol and its codebase. Research will be utilized and conducted to further improve the protocol.

Priorities

With so many services listed, work priorities may not be clear. With that being said, here are our current priorities:

- Scaling Compound to other chains

- Adding borrow factors and other tools such as velocity limits to allow the protocol to safely support many assets

- Scaling supported assets

Direction

The direction of the existing protocol with Compound Gateway in development remains unclear, so it begs the question of how useful will these services be?

Compound Gateway is taking a different direction of the existing protocol, where only USDC (maybe other stablecoins as well) will be borrowable. While this may improve the efficiency of borrowing stablecoins, the use-cases of borrowing other assets are overlooked.

Our vision is to have Compound Gateway and the existing Compound Protocol be competing products all under the same roof. In doing so, users more comfortable with the existng protocol can continue using it, and the existing protocol will continue to serve the use-cases of borrowing other assets, such as:

- Staking borrowed assets

- Users who have stakeable assets but whom are unwilling to take on the risks and responsibilities of managing such stakes can lend out these assets to others who specialize in managing stakes

- Quick liquidity for OTC desks

- OTC desks can borrow assets to perform quick trades for their customers and can then subsequently slowly buy back the token to repay their debts while avoiding slippage

- Strategic governance

- Some users may be contributing to multiple projects simultaneously while not having the capital to hold meaningful amounts of tokens to participate in the governance of each and every project, so instead, they can strategically borrow against their bags to have more of a say

- Shorting tokens

With that being said, Compound Protocol will continue to be developed to maximize the number of borrowable assets in a safe and capital efficient manner.

Performance review process

Trilez’s performance will be reviewed once per quarter, taking place as a forums discussion.

The success metrics as outlined above will be analyzed and presented, and an analysis and discussion of the effectiveness and longevity of the COMP rewards program(s) will be presented.

Additionally, an outline of work conducted and our progress on existing initiatives will be included in our quarterly report.

Compensation model

Trilez is seeking compensation in the form of an initial fee with a base rate plus performance bonuses. This compensation package exclusively covers the services offered in this proposal.

All dollar figures are in USD.

Initial fee

The requested initial fee is $500K in COMP at present value ($116 @ Feb 28) to cover existing and prior work relating to the COMP rewards program as well as the proposed normalization model and decay schedule.

Base rate

The requested base rate is $4M/year, paid via stream, 75% in DAI and 25% in COMP. In being paid mostly in DAI, we mitigate the need to sell COMP to cover our expenses.

The value of COMP being paid will be determined using a moving 4-month average and will be updated quarterly.

Performance bonuses

The requested performance bonus is 10% of gross profit increases - directly or indirectly attributed to rewards program(s) management - paid quarterly in COMP and capped at $2M/quarter.

The value of COMP being paid will be determined using a moving 4-month average and will be updated quarterly.

With this performance bonus, Trilez is incentivized to increase the protocol’s gross profits by up to $20M/quarter.

It will be up to Trilez to provide sufficient proof of attribution of gross profit increases and to convince COMP holders of the validity of said proof.

Justification

First and foremost, I’d like to say that the industry is in a talent crunch, and Compound is in dire need of talent and of people bold enough to continue pushing ourselves past our current limits and assumptions.

Compound has taken the courageous leap of redefining how we work - through a DAO with no single leader. This has presented many challenges; the grants program is paused indefinitely due to staffing issues; governance is disorganized; execution of brilliant ideas and needed changes takes time; and more. This makes it hard for Compound to retain leadership in the industry and to continue growing, but I believe we can make this work. Compound has come a long way, and we have much to be proud of, but we’re far from finished.

By approving this proposal and compensation model, I will be committed to growing Compound through Trilez and will have the necessary resources to do so. I’ll be able to hire top talent (which can be costly) to invest in Compound’s future. It’s my belief that by hiring top talent, we’ll have maximum impact with as little management overhead as possible, making us an efficient and effective powerhouse.

Furthermore, I imagine myself as an active investor in the protocol. The more COMP Trilez holds, the more valuable it will be to continue investing resources into Compound - and this goes outside of the services being offered today.

With that being said, let’s get into the value that this proposal will bring.

Utilizing rewards can be a very effective way to grow Compound, but the way we go about it is key. There are some problems with the current rewards system that are addressed in this proposal:

- COMP being farmed through recursive stablecoin lending and borrowing

- There’s no established methodology for COMP rewards rates across various markets

- The perceived general consensus that reward rates are too high

- It takes a while for new markets to receive COMP rewards, with 7 markets without rewards

Tackling the above problems will bring significant value to users and COMP token holders.

In addition to improving the existing COMP rewards program, Trilez will bring about further rewards programs, further fueling the growth of Compound.

For instance, incentivizing cToken-underlying DEX liquidity will allow for reduced gas costs of “depositing” and “redeeming” coins up to a certain degree, depending on liquidity. UI adjustments will be made to capitalize on this - choosing whichever is cheaper for the end-user (i.e. to mint cTokens, or to trade underlying for the cToken).

By approving this proposal, Trilez will be committed to the growth of Compound with laser focus.

Over time, Trilez will slowly hire top performing employees to fulfill the various roles we create for the management of Compound’s rewards programs.

Lastly, compensation should cover any legal, regulatory, and/or lobbying costs accrued. After all, the regulatory uncertainty presents itself as a large barrier to entry.