Summary

Compound Growth program proposes launching USDT market on Polygon network.

Motivation

USDT on Polygon has a total supply of $841 Million [Source]. The Growth program is already pushing USDT Markets on ETH mainnet, Arbitrum and Optimism. Compound USDT market on Polygon opens up a huge market for Polygon ecosystem users to earn on their USDT holdings. This also helps the Compound protocol to attract more TVL and in turn generate more revenue.

Point of Contact: @bryancolligan @sharp

Proposed Collateral

We propose adding the following asset as collaterals for the market

- Matic (MATIC)

- Stader Matic (MATICx)

- Wrapped Bitcoin (WBTC)

- Staked Matic (stMATIC)

- Wrapped Ether (WETH)

We invite the community to suggest and give inputs for any other collateral assets.

Relevant Documents and Links

Website: https://tether.to/

Twitter: https://twitter.com/Tether_to/

CoinMarketCap: Tether price today, USDT to USD live price, marketcap and chart | CoinMarketCap

CoinGecko: https://www.coingecko.com/en/coins/tether

PolygonScan: https://polygonscan.com/token/0xc2132d05d31c914a87c6611c10748aeb04b58e8f

Next Steps

USDT is the top token with the highest number of holders in the OP market. Standing at around 3.5M Users, it is way higher than the existing USDC.e token with 2M Users on the Polygon Network. Adding the market to Compound will provide an additional opportunity for the growth of the protocol.

We invite the community to consider this application for listing the USDT market and welcome suggestions in this direction.

Additionally, we look forward to the community to suggest

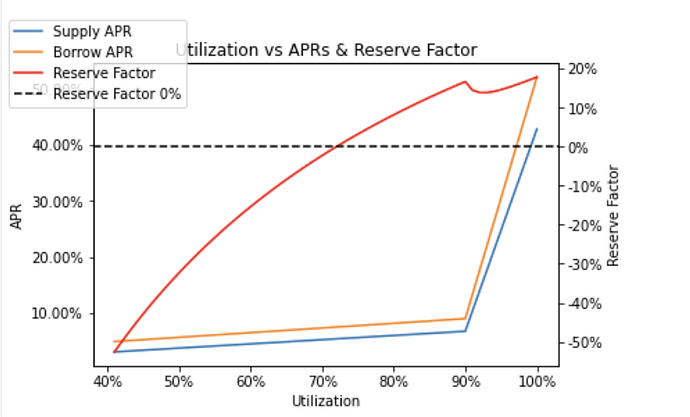

Collateral Factor

Reserve Factor

Borrowing Limit