[Gauntlet] Polygon v3 USDT Comet Initial Asset Listing Recommendations

Simple Summary

Gauntlet is excited for the community to add a USDT Comet to Polygon. We recommend the following initial parameter recommendations for the Polygon v3 USDT comet.

Risk Parameters

| Asset | Collateral Factor | Liquidation Factor | Liquidation Penalty | Supply Cap |

|---|---|---|---|---|

| Matic | 65% | 80% | 15% | 5M ($3.5M) |

| MATICx | 60% | 70% | 20% | 2.6M ($2M) |

| WBTC | 75% | 85% | 10% | 90 ($5.6M) |

| stMATIC | 60% | 70% | 20% | 1.5M ($1.1M) |

| WETH | 80% | 85% | 5% | 2,000 ($6.1M) |

Storefront Price Factor: 60%

Gauntlet recommends keeping the Store Front Price Factor at the same value as the Polygon v3 USDC.e Comet.

Target Reserves: 20,000,000

After Gauntlet’s forum post analyzing Target Reserves, Gauntlet recommends increasing the Target Reserves for this market based on historical reserve growth and our recent recommendation to increase Ethereum USDC Comet’s Target Reserves.

IR Curve Parameters

Gauntlet recommends the following IR parameters for USDT Comets:

| IR Parameter | Value |

|---|---|

| borrow per year interest rate base | 0.015 |

| borrow per year interest rate slope low | 0.0833 |

| borrow kink | 0.9 |

| borrow per year interest rate slope high | 4.3 |

| supply per year interest rate base | 0 |

| supply per year interest rate slope low | 0.075 |

| supply kink | 0.9 |

| supply per year interest rate slope high | 3.6 |

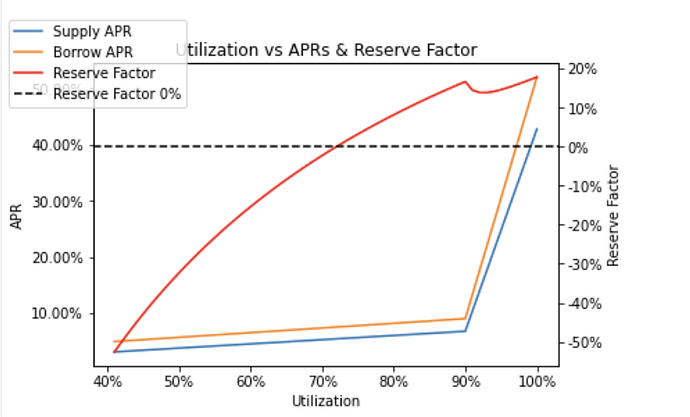

The chart above demonstrates that the generation of Comet USDT reserves will be positive when utilization exceeds 73%.

Incentive Parameters

Our COMP rewards recommendations are designed to offer appealing distribution APRs when the comets are first launched and when supply caps are highly utilized.

Gauntlet is recommending higher supply rewards to incentivize a more significant inflow of supply tokens into the protocol. This is important in the early stages of protocol growth since USDT supply are required before borrowers can join. Daily COMP rewards are subject to change as TVL rises and the markets evolve.

USDT Comet Incentives

| Daily COMP Supply Rewards | Daily COMP Borrow Rewards |

|---|---|

| 8 | 4 |

Assuming full usage of supply caps and current liquidation factors, the total borrowing power would be $14.91M.

Here’s a breakdown based on our assumptions:

- Borrow Usage (80%): This leads to a borrowing volume of $11.9M.

- Utilization (90%): Corresponding to a supply volume of $13.25M.

With the above utilization and the present Interest Rate curve:

- Supply APR: 6.75%

- Borrow APR: 9.00%

Given the current COMP price of $89:

- Supply Distribution APR: 1.23%

- Borrow Distribution APR: .69%

This results in the following Net APRs:

- Net Supply APR: 7.98%

- Net Borrow APR: 8.31%

The chart above illustrates the Distribution Annual Percentage Rates (APRs) across various supply levels, assuming a 90% utilization rate. It’s noteworthy that APRs exceeding 2% will persist until the market’s supply reaches $9M. These incentive distributions are strategically designed to accelerate the USDT Comet. The current projected net APRs are within reasonable ranges.

Next Steps

We welcome community feedback.