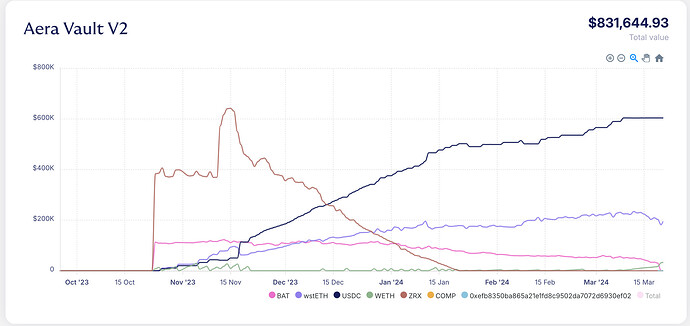

Hi folks, wanted to provide a quick update on the progress of the Aera pilot with Compound. Overall the pilot has been going well, the vault is currently valued at $780k up from an initial allocation of $500k. This is mostly due to a run up in price from ZRX.

As this has been happening we have been successfully selling out of ZRX, of which the vault is now holding $213k of USDC and $109k of wstETH. This is all while achieving <0.5% slippage and no market impact on the price of ZRX. Note though, the runup in price on ZRX and relatively flat onchain liquidity conditions will extend the time required to fully diversify out off ZRX.

We have been successfully targeting 15% volatility via our methodology. As a reminder we use 90-day historical vol as an estimator for future volatility and adjust weights of the vault accordingly to target the 15% level selected by the DAO.

We wanted to give a bit more context on volatility targeting and why its useful. Volatility Targeting can be thought of as an approach to balancing the treasury’s asset mix to avoid too much unpredictability.

The guardian regularly monitors how much the current portfolio’s value is going up or down. If the prices are fluctuating a lot (high volatility), it indicates higher risk. In response, the guardian might shift the allocation from ETH to stablecoins to reduce the overall risk.

Conversely, if the overall portfolio value is very stable and shows little change in value (low volatility), the guardian might take on a bit more risk by increasing the allocation to ETH, thereby creating a higher potential for growth (but also more price fluctuation).

The goal is keep the overall risk level of the portfolio in line with the treasury’s stated risk tolerance (a volatility of 15%). The guardian will dynamically adjust the allocations as market conditions change. This helps in managing the potential for both gains and losses in a controlled manner.

As described in the pilot, we are generating yield on the vault via wstETH, however, we are not generating yield on the USDC due to concerns we outlined in our initial post. However per @kevins comment above, we would be willing to explore depositing into compound v3 if there is broader community interest in doing so.

Lastly, onchain liquidity conditions for BAT are severely impaired, only allowing for around $300-$500 of BAT to be traded per day while still achieving the 0.5% slippage bound we initially set out. We are exploring alternative ways of diversifying out of the BAT token, including using milkman to leverage offchain liquidity. We will report back on the forums with next steps.