Since September 18, 2023, Gauntlet has been orchestrating a deprecation process for the v2 markets, which have delivered substantial results. This initiative, which commenced in September 2023, follows a community-endorsed deprecation strategy. Through this approach, Gauntlet has been effectively encouraging users to migrate to users to Compound v3, ensuring a smooth and strategic migration aligned with community preferences.

Transition to Compound v3 Mainnet

The migration to the Compound v3 WETH and USDC Comets has been substantial. Since the initiative began, 220 users have shifted their positions from Compound v2 to the Mainnet v3 Comets, transferring a total of $365 million in supply assets. The chart below illustrates the primary contributors to this migration, showcasing significant position movements from Comp v2 to v3.

Top Migrators from Comp v2

Table of Top Migrators

| Address | Previous Supply Balance USD | Supply Balance USD | Comets |

|---|---|---|---|

| 0xe84a061897afc2e7ff5fb7e3686717c528617487 | $68,232,443 | $92,437,500 | USDC |

| 0xd48573cda0fed7144f2455c5270ffa16be389d04 | $136,139,361 | $38,255,571 | USDC |

| 0xdde0d6e90bfb74f1dc8ea070cfd0c0180c03ad16 | $75,929,767 | $36,006,325 | WETH |

| 0x0f1dfef1a40557d279d0de6e49ab306891a638b8 | $240,085 | $30,421,577 | WETH, USDC |

| 0x4f2083f5fbede34c2714affb3105539775f7fe64 | $5,497,395 | $24,193,509 | WETH, USDC |

| 0x653b9d11f32b6f0b8bd2ae2724b2de5b031f8d8d | $7,873,494 | $19,117,746 | USDC |

| 0xec6ea79dddfcf2f9185464f3efb1285c8c22380d | $4,397,083 | $11,533,239 | USDC |

| 0xc977d218fde6a39c7ace71c8243545c276b48931 | $11,764,900 | $10,069,823 | USDC |

| 0xf2eb9cd233744f22039eb32cbe391513f009a52a | $17,307,423 | $8,582,585 | USDC |

| 0x995a09ed0b24ee13fbfcfbe60cad2fb6281b479f | $684,234 | $7,853,330 | USDC |

Given wallet interoperability within the defi ecosystem, this data might not fully represent the number of migrating users, as individuals may have used different addresses or smart contracts to engage with Compound v3 Comets.

Total Balances Across Comp v2 & v3

The chart above tracks the growth of Ethereum Comets relative to Compound v2. The red line represents the total USD supply, which has remained relatively stable since early 2023, representing a balance between the decline of the v2 market and growth of v3 Comets. Focusing on USDC supply across v2 & v3 during this deprecation phase, we observe an increase in total USDC balances, rising by 7.5% since September 2023.

USDC Balances Across Comp v2 & v3

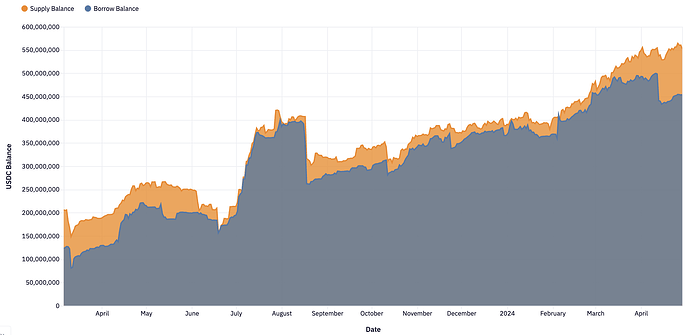

Since the community-approved deprecation strategy was implemented, Mainnet Compound v3 has experienced significant growth, with an 87% increase in the USDC Comet and a 50% rise in the WETH Comet. The charts below, which break down the performance by individual Comets and their respective base assets, illustrate robust growth in both supply (including base and collateral assets) and borrowing across these markets.

Total Supply & Borrow USD on Ethereum USDC Comet v3

USDC Supply and Borrow Balance on Ethereum USDC Comet v3

Total Supply & Borrow USD on Ethereum WETH Comet v3

WETH Supply and Borrow Balance on Ethereum WETH Comet v3

Stablecoin User Outflows

Since March 2023, the DAI supply balance has significantly decreased, falling from 545 million to 66 million by April 2024, marking an 87% reduction in the amount of DAI supplied in the Compound v2 markets. Despite incentives such as a 0.77% Earn Distribution and a 0.92% Borrow Distribution, this market has still seen a substantial decline in balances, even without specific deprecation measures targeting the DAI market. Given the substantial outflow of DAI TVL, Gauntlet recommends that the community consider initializing a DAI Comet, should the community want to maintain or recapture market share.

DAI Supply and Balance on Comp v2

Compared to other stablecoin USDT which the community opted to exclude from the deprecation process alongside DAI, has experienced minimal outflow of positions. With plans underway to launch USDT Comets, Gauntlet is ready to facilitate an efficient transition from Compound v2 to v3 once the Comet is operational.

USDT Supply and Balance on Comp v2

DAI and USDC Supply Balance

As illustrated in the chart, USDC is the only market showing a decline in supply balances comparable to that of DAI.

Deprecation Recommendation Impact

Collateral Factor Reduction

Gauntlet has been recommending a staggered deprecation strategy that methodically reduces collateral factors for low-liquidity assets. This approach is designed to minimize liquidations and prevent a poor user experience. The reduction of collateral factors will continue until collateral is disabled. You can view our most recent deprecation recommendations in the Gauntlet - Compound v2 Depreciation Phase 11 (04/12/2024). Additionally, Gauntlet has proposed adjustments to reserve factors and borrowing caps to encourage further the migration of supply and borrowing positions from v2 markets.

| Symbol | Reserve Factor | Borrow Cap |

|---|---|---|

| BAT | 50.00% | 900000 |

| MKR | 50.00% | 300 |

| UNI | 50.00% | 25000 |

| YFI | 50.00% | 30 |

| ZRX | 50.00% | 1000000 |

| AAVE | 50.00% | 12000 |

| COMP | 50.00% | 2500 |

| LINK | 50.00% | 9000 |

| USDC | 60.00% | 100000000 |

| SUSHI | 50.00% | 750000 |

The Compound v2 market continues to generate robust reserves for the protocol, as illustrated in the chart below. The pronounced decline reflects the transfer of BAT and ZRX reserves into an Aera Vault, a move aimed at diversifying and managing reserves more effectively. Since the introduction of the deprecation strategy, reserves have increased by approximately $7 million.

Reserve Generation on Comp v2

Approximately $5 million of the reserves have been generated through the USDC liquidity pool during this same timeframe (~71% of reserves), which currently maintains a reserve factor of 60%. While this rate has successfully encouraged users to transition to Compound v3, it has also led to an unintended increase in reserves due to the inelastic behavior of suppliers.

USDC Reserve Generation on Comp v2

Next Steps

- Continue with the deprecation strategy for lower liquidity assets within Compound v2.

- Develop a strategy for USDT users to transition to the USDT Comet once it launches.

- Collaborate with the community to formulate a strategy for establishing a DAI Comet.

- Plan the future direction for the Compound v2 market following the deprecation of low liquidity assets.