Compound Migration and Polygon Comet Update (4/21/23)

Simple Summary

The migration has been successful so far in attracting new users to the Ethereum v3 USDC comet and increasing borrows. Since the most recent proposal was executed on 4/5/23, we’ve seen total collateral token supply increase by 23.6% and total USDC borrows increase by 47%.

Our analysis suggests we can further accelerate the migration and growth of both the Ethereum v3 USDC and Polygon v3 USDC comets by shifting rewards in favor of supplies and/or updating the IR curves to increase USDC supply and decrease utilization. This will allow large USDC borrowers to initialize larger positions, which will allow for more rapid growth while these protocols are in their early stages. We will assess the tradeoffs of each approach and release a concrete proposal next week.

Recap of second migration proposal

Phase 2 of the V2 → V3 proposal was executed on 4/5/23, with the following changes:

- Decrease v2 daily USDC supply COMP rewards from 211.20 to 161.20 (-50)

- Decrease v2 daily USDC borrow COMP rewards from 211.20 to 161.20 (-50)

- Decrease v2 daily DAI supply COMP rewards from 211.20 to 161.20 (-50)

- Decrease v2 daily DAI borrow COMP rewards from 211.20 to 161.20 (-50)

- Increase v3 daily USDC borrow COMP rewards from 281.41 to 481.41 (+200)

As a result of the proposal, we saw the following net borrow APYs for stablecoins in the protocols on 4/6/23:

|

v2 DAI |

v2 USDT |

v2 USDC |

v3 USDC |

| Borrow APY |

2.99% |

4.05% |

3.14% |

3.81% |

| Borrow Distribution |

1.40% |

0.43% |

1.12% |

5.86% |

| Net Borrow APY |

-1.59% |

-3.62% |

-2.02% |

+2.05% |

Below are the net borrow APYs for protocols in the protocols as of 4/20/23:

|

v2 DAI |

v2 USDT |

v2 USDC |

v3 USDC |

| Borrow APY |

3.34% |

4.33% |

3.68% |

4.98% |

| Borrow Distribution |

1.28% |

0.44% |

1.04% |

3.59% |

| Net Borrow APY |

-2.06% |

-3.89% |

-2.64% |

-1.39% |

The total USDC supply in v3 on 4/20/23 is $239M, and the total USDC borrows are $197M, resulting in a utilization of 83% and $42M USDC available to be borrowed.

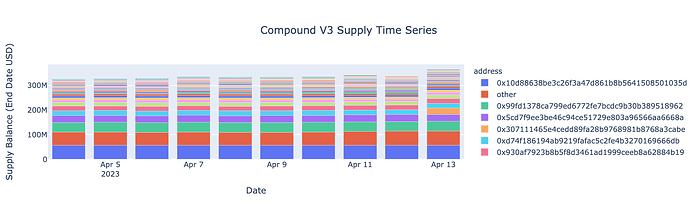

Below is a time series of total v3 collateral supply balances of top users from 4/4/23 (the date prior to the most recent proposal execution) to 4/19/23. Supply balances are normalized by token prices on 4/19/23 to get a better sense of true token supply increases. The “Other” category accounts for all users with ≤ $2M total collateral supplied, and these users account for 14.4% of the total v3 collateral. Using these normalized metrics, the supply has increased 23.6% from $322M on 4/4/23 to $398M on 4/19/23, in large part due to the user with address 0x307111465e4cedd89fa28b9768981b8768a3cabe who joined the protocol on 4/13/23 and supplies $50M ETH.

Below is a time series of total v3 USDC borrow balances of top users from 4/4/23 (the date prior to the most recent proposal execution) to 4/19/23. The “Other” category accounts for all users with ≤ $1M total USDC borrowed, and these users account for 12.6% of the total USDC borrowed. The borrows have increased 47% from $127M on 4/4/23 to $187M on 4/19/23, in large part due to the user with address 0x307111465e4cedd89fa28b9768981b8768a3cabe who joined the protocol on 4/13/23 and borrows $36M USDC.

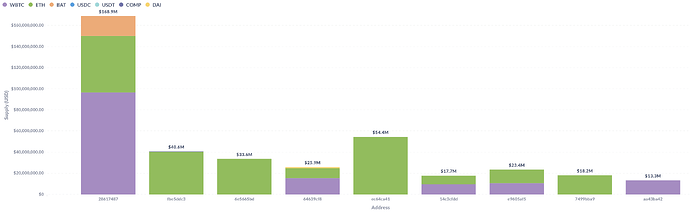

Below are the top v2 non-recursive borrowers who still remain in the v2 protocol.

Notable v2 non-recursive borrowers’ supplies

Notable v2 non-recursive borrowers’ borrows

The migration has been successful in terms of both attracting new users to the protocol and keeping USDC utilization within the profitable 50%-85% band.

However, none one of the top non-recursive v2 borrowers shown above have migrated to v3, and most of them including the largest supplier have updated their token positions since the most recent migration proposal was executed, including the largest supplier with $180M supplied and $74M borrowed. This indicates the v2 users are consciously not deciding to migrate.

It’s possible that allocating rewards entirely to the borrows given the existing IR curves may be inhibiting v2→v3 migration based on the way we’ve seen users behave. This same borrow rewards allocation given current IR curves may also be inhibiting the growth of the Polygon comet.

The v3 USDC comet currently has $239M USDC supplied and $197M USDC borrowed, for 83% USDC utilization (within the desired 50%-85% utilization band that results in positive reserve growth). However, this only provides $238M-$197M = $42M USDC available to be borrowed at the current moment, which dissuades the large v2 USDC borrower who has $74M USDC & USDT borrowed from migrating over. Even if they partially migrate their position, they’d increase the v3 USDC utilization greatly and have to at least temporarily pay high borrow APR. Granted, this would result in more appealing than net borrow APR than v2 as outlined in our previous posts, especially given how quickly equilibrium is reestablished, but this may not be readily apparent to the user. This user last updated their v2 position on 4/13/23, so they seem to be intentionally keeping their position in v2. The other top non-recursive borrowers also are incentivized to migrate to v3, but similarly may not understand the incentives due to the short-term increased borrow APY they’d pay as a result of how their position could impact v3 utilization.

If we look at the Polygon v3 USDC market, there’s $6.84M USDC supplied and $5.66M USDC borrowed, resulting in 83% utilization (within the desired 50%-85% utilization band that results in positive reserve growth). The USDC borrow APR is 4.98% and borrow distribution is 9.12%, resulting in a large +4.14% net borrow APR. However, users continue not to flock to the comet. This similarly indicates the reason users aren’t deciding to join the Compound Polygon comet is due to lack of short-term USDC able to be borrowed, and the high short-term borrow APY they’d have to pay if they do borrow and increase the utilization prior to equilibrium reestablishing. Given the low TVL in the Polygon comet, even if borrowers did max out the utilization, it would take a lot of iterations of “USDC borrows → USDC supplied to reestablish equilibrium” to be able to substantially grow the protocol.

Therefore we recommend shifting rewards in favor of supplies and/or updating the IR curves to increase USDC supply and decrease utilization. This will allow large USDC borrowers to initialize larger positions, which will allow for more rapid growth while these protocols are in their early stages. We will assess the tradeoffs of each approach and release a concrete proposal next week.