We wanted to capture some ways to migrate users from V2 to V3 so that we could start to solicit preferences, as some folks in the community have already begun to indicate, on how aggressively the community would like to pursue a migration option. We are painting high-level plans based on level of aggressiveness, and will follow up on a deeper plan and analysis once the community expresses its intent. Of course, we welcome input from the community and are open to hearing ideas outside of our proposed paths.

Top goal for the migration plan is to transfer TVL from v2 to v3’s “core" user group, instead of deprecating v2’s specific use cases that v3 does not cover. We present two approaches with different levels of aggressiveness, defined by the amount of levers that can be pulled to facilitate the migration.

To get a sense of the options we took a look at the positions of the top USDC suppliers and borrowers:

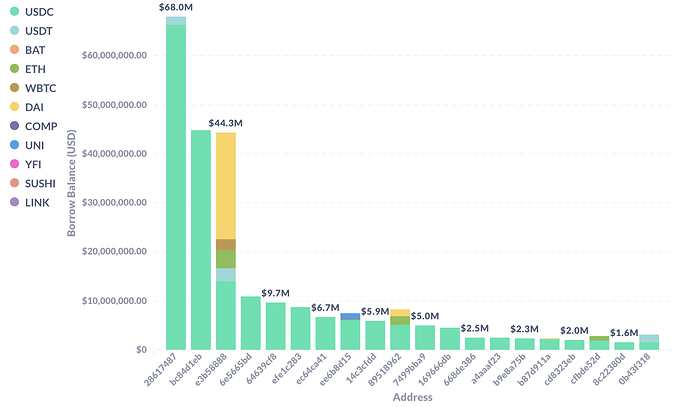

Top 20 USDC borrowers

Supply positions of the top 20 USDC borrowers on 01/17/2023

Borrow positions of the top 20 USDC borrowers on 01/17/2023

The majority of the top USDC borrowers are users who supply blue-chip tokens and borrow USDC (with major exceptions being the 2nd and 3rd largest USDC suppliers, who are recursive). These are the users the community may wish to prioritize migrating over to Compound v3.

Supply positions of the top 20 USDC suppliers on 01/17/2023

Borrow positions of the top 20 USDC suppliers on 01/17/2023

The majority of top USDC suppliers are either recursive borrowers or borrowers who are strictly trying to gain USDC supply APY. Note a few of the recursive borrowers borrow USDT against their USDC supply. The users who supply USDC to earn supply APY are the main liquidity providers for the users who supply blue-chip tokens and borrow USDC. If these users leave the protocol, the borrow APY for USDC will increase, thus incentivizing the blue-chip suppliers to migrate away from v2 to seek lower APY elsewhere.

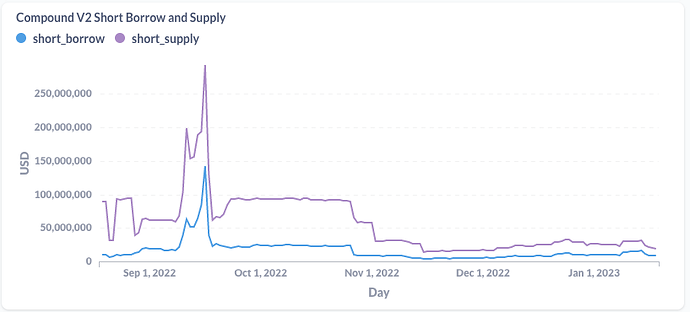

In addition, we looked at the protocol and broadly categorized it into volatile asset supply, stable borrow (in the chart below long_borrow/supply), and stable asset supply, volatile borrow (in the chart further below short_borrow/supply).

You can see from the above two charts that the vast majority of non-recursive Compound users are using Compound V2 with a volatile asset as collateral and a stable asset as borrow (note however that the first chart does include all stable assets, not just USDC).

With this user behavior in mind, we formulated the following two approaches.

Conservative approach

Top concern for the conservative approach is safer migration with minimal UX impact. Four levers to achieve this goal include 1. transferring COMP incentives from v2 to v3; 2. increasing RF on v2 USDC; 3. increase storefront price factor on v3; 4. increase v3 supply cap. Hereby we present some rationale on pros and cons of the four levers for the community to weigh on.

- Migrate v2 COMP distribution to v3

- Move USDC supply and borrow COMP distribution to USDC borrow distribution and the ETH COMP supply distribution to USDC borrow distribution from v2 to v3. We would love to hear the communities thoughts on providing a supply distribution for USDC on V3 to help incentivize further liquidity.

- Pro: Migrating COMP incentives would directly encourage the main user base for v3 to migrate from v2. Since they can use the same functionality across the two protocols, but v3 offers more rewards in COMP (and as a result more borrow power), v3 would offer a more attractive user experience.

- Con: May hurt user experience in v2 and could lead to TVL loss to other platforms since we are decreasing the rewards offered in v2.

- Increase reserve factors on v2 USDC

- Increase reserve factor would decrease supply interest on v2 and drive USDC suppliers to v3.

- Pro: Directly impact supplier interest rate on v2 and drive supplier towards to v3 to supply USDC. Has a second-order effect in that when USDC suppliers pull liquidity and move to V3 Utilization will go up and thus Borrow rate for USDC in comp V2 which should cause borrowers to pay back their loans

- Con: May hurt user experience for v2 because of the decreased interest rate payout, but this impact should be minimal if we are applying the change gradually with guidance for v3 user group’s migration. This may also have the effect of washing out recursive borrowers by making the spread too wide such that comp incentives no longer make this profitable. This may also have the side effect of hurting the shorting asset use case - but this is mitigated by 2 things, 1) it is not a major portion of supply and borrow (as above), 2) we can reverse this after capital has migrated over

- Increase storefront price factor

- Increase storefront price factor enables liquidators to purchase at more favorable prices from Comet during liquidation events.

- Pro: Assuming a relative successful asset migration to v3, we would see some good increase in TVL and VaR (Value at Risk) would increase accordingly. To mitigate risk during the migration and encourage healthy liquidation - reserve recuperation cycle, increasing storefront price factor is on the safer side for not hurting the user experience.

- Con: Increasing storefront price factor would allocate less proceedings from successful liquidations to reserve, thus slowing the growth of the “cushion” in case of disastrous events. However, this can be mitigated by migrating v2 reserves.

- Increase v3 supply cap

- Accommodate more usage of Compound V3 preemptively in order to smooth the migration efforts.

- Pro: Increase supply cap is a necessity if use cases rise in v3.

- Con: Increase supply cap may increase protocol risk in terms of price manipulation and extreme events.

Aggressive approach

To achieve the same goal as the conservative approach, with a slightly shifted focus on quick and decisive migration. To achieve this, apply a more aggressive progression plan and apply one more lever. Notwithstanding, we present the two approaches as two prototypes with slightly different focuses for the community to consider, and a final agreement can be anything in between, and we may let go some of the levers if deemed appropriate.

For the implementation, we plan to use the same levers as above but with more aggressive progression plans. We have a sample timeline in the next section. In addition, we plan to use one more lever:

- Adjust interest rate curves for v3 to lower borrow APY

-

We plan to shift the borrow APY on v3 slightly lower. Lowering borrow APY has a first-order impact for the borrower user experience. This would directly encourage borrower migration as long as rates are attractive.

-

Pro: This would directly encourage the overlapping user case to migrate to v3 since borrowing USDC on v3 has a lower cost now.

-

Con: Revenues on the protocol would slightly decrease due to lower borrow APY. We can mitigate this by a careful and gradual implementation to make sure the downward shift in IR curve is well-paced with increase in the protocol TVL. In the meantime we may also attract users from outside of the protocol who are only exploiting the temporary borrow APY decrease and they may churn or behave riskier.

Here we illustrate changes to the interest rate curves if we apply a -0.4% reduction on annual base borrow rate. Before applying the change, reserve growth is on average 0.04% before the kink and -0.4% annually after the kink.

After applying a -0.4% change, reserve growth is on average -0.1% annually before the kink and on average -0.7% annually after the kink.

Migration plan example comparison

Below we provide an example timeline to contrast the two approaches. Note that the numbers here are just for illustration and the final implementation would depend on our quantitative analysis (conservative would fall on the lower end of estimation while aggressive would fall on the higher end of estimation).

Note that while we are presenting a progression here, the community has the clear ability to stop at any time and change course based on the states of V2 and V3 Compound at the time.

|

|

Week 1 - 2 |

Week 3 - 4 |

Week 5 - 6 |

Week 7 - 8 |

| Conservative |

|

|

|

|

|

|

Comp distribution migration (v2 → v3) |

20% |

20% |

15% |

10% |

|

RF increase for USDC on V2 |

+5% |

+5% |

+5% |

+5% |

|

IR curve changes for USDC |

N/A |

N/A |

N/A |

N/A |

|

Supply caps |

2x supply cap for WBTC and ETH (for COMP, UNI, LINK we will analyze more deeply at liquidity conditions) |

1.3x supply cap when hit 0.8x pending liquidity conditions deem it relatively safe to do so |

1.3x supply cap when hit 0.8x pending liquidity conditions deem it relatively safe to do so |

1.3x supply cap when hit 0.8x pending liquidity conditions deem it relatively safe to do so |

|

Storefront Price Factor |

+2.5% |

+2.5% |

-2.5% |

-2.5% |

| Aggressive |

|

|

|

|

|

|

Comp distribution migration (v2 → v3) |

30% |

30% |

15% |

10% |

|

RF increase for USDC on V2 |

+10% |

+10% |

+10% |

+10% |

|

IR curve changes for USDC |

-0.4% |

increase by 0.1% |

increase by 0.1% |

increase by 0.1% |

|

Supply caps |

3x supply cap for WBTC and ETH (for COMP UNI, LINK we will look more deeply at liquidity conditions) |

1.5x supply cap when hit 0.7x pending liquidity conditions deem it relatively safe to do so |

1.5x supply cap when hit 0.7x pending liquidity conditions deem it relatively safe to do so |

1.5x supply cap when hit 0.7x pending liquidity conditions deem it relatively safe to do so |

|

Storefront Price Factor |

+5% |

+5% |

-5% |

-5% |

Other possible actions

We also considered a few other possible actions but decided against recommending them. Here we list them out and welcome the community’s feedback:

- Increase v3 collateral factors (CFs)

- Increase v3 CFs would make it easier for borrowers to set up their positions

- However, may encourage riskier behaviors and we might face force liquidations if the community wishes to adjust down CFs and liquidation thresholds after the migration completes

- Decrease v2 CFs

- As stablecoin borrowers migrate to v3, v2 will be comprised of the users who supply and borrow more volatile assets that may cause large amount of insolvencies. As a result, we should decrease v2 CFs from a risk perspective

- Granted there is a chance the safe users could flee to a different protocol given increase

- We may consider this as an option at the end of the migration, conditioned on most stablecoin borrowers having already migrated to v3.

- Migrate v2 reserves to v3

- As v2 users migrate to v3, move the cushion money as well.

- Pro: Migrating reserves to v3 would provide better protection in case of disastrous events, and increase v3 user group’s confidence in using the protocol.

- Con: This doesn’t directly incentivize users from v2 to migrate to v3, it would only give confidence that there are sufficient reserves

- Con: It may not be a good idea to incentivize self-liquidations given that they are currently good for the protocol

Potential risks

One risk could be temporary liquidity crunches.

The immediate effect of decreasing RF for USDC is a decrease in supply APY to USDC suppliers, thus disincentivizing users from supplying USDC. There are generally 3 types of USDC suppliers:

- USDC suppliers only seeking supply APY and COMP distribution

These users supply USDC and don’t borrow any assets. They are only interested in USDC supply APY and COMP returns. Increasing USDC RF would highly disincentivize them from staying in Compound v2.

- USDC recursive borrowers (COMP farmers)

These users gain USDC supply APY, pay USDC borrow APY, and receive COMP rewards. Increasing USDC RF would disincentivize them from staying in Compound v2 due to an increasing interest rate spread, but if the COMP rewards are large enough, we may expect fewer of them to flee compared to the previous users.

- USDC suppliers seeking to short tokens

These users are mainly interested in shorting tokens and probably do not care as much about the marginal USDC supply APY they lose as RFs increase. These users account for the least amount of USDC supply, and we expect these users to be the least elastic to RF increases.

As Type 1 users flee the protocol in response to increased USDC RF, the USDC supply will decrease, thus resulting in USDC utilization increasing and USDC supply and borrow APYs increasing as a result. This will either 1) re-incentivize the Type 1 users to remain in the protocol, re-establishing equilibrium at a lower supply and higher utilization or 2) incentivize users who supply blue-chip tokens and borrow USDC to flee the protocol, until similar supply and borrow APYs have been re-established.

The current USDC utilization rate is 45.88%. Recursive borrowers usually have a higher utilization rate than this. So as Type 2 users flee the protocol, USDC utilization would decrease, thus decreasing supply and borrow APY. This will incentivize Type 1 users to flee the protocol as well until equilibrium is re-established at an even lower supply and higher utilization.

As this pattern repeats, and especially as USDC RF is gradually increased, USDC suppliers and borrowers will continue to be incentivized to leave the protocol. There may not be any long-term liquidity crunches, since high utilization will encourage USDC borrowers to repay their borrowers, thereby allowing suppliers to reclaim their collateral. We expect this to be the case irrespective of how quickly or gradually the RFs are increased.

Another risk is that we may also lose some TVL throughout this process, especially with respect to Reserve factor changes. Particularly we could see an effect on recursive borrowers and to a lesser extent short positions on the protocol. This is similarly mitigated by having a gradual shift in parameter changes and monitoring the effect over time. Equally, users that leave Compound V2 may not go to Compound V3 (for whatever reason).

Next steps

We welcome community feedback on the above, and as we get more signal as to how the community would like to proceed, we are happy to concretize the schedule plan.