Summary

Despite v3 USDC (Ethereum) net borrow APY being far more appealing than the v2 stablecoin net borrow APYs, we are still not observing the top non-recursive borrowers migrating over to v3. In the second phase of the migration, Gauntlet offers two proposals:

- If the community believes that more v3 USDC (Ethereum) rewards will incentivize users to migrate, we recommend migrating 200 daily COMP rewards from v2 to v3.

- If the community believes there are other reasons why users aren’t migrating (e.g. users are more comfortable with v2 at the moment, or dependent protocol integrations are blocking migration), then we do not recommend transferring any more rewards, and the community should revisit other options.

Recap of first migration proposal

The first migration proposal was executed on 3/6/23 (forum post here), with the following changes:

- Decrease v2 daily USDC supply COMP rewards from 241.20 to 211.20 (-30)

- Decrease v2 daily USDC borrow COMP rewards from 241.20 to 211.20 (-30)

- Decrease v2 daily DAI supply COMP rewards from 241.20 to 211.20 (-30)

- Decrease v2 daily DAI borrow COMP rewards from 241.20 to 211.20 (-30)

- Increase v3 daily USDC borrow COMP rewards from 161.41 to 281.41 (+120)

- Increase v3 ETH supply cap from 150k to 350k

- Increase v3 WBTC supply cap from 6k to 12k

- Increase storefront price factor from 50% to 60%

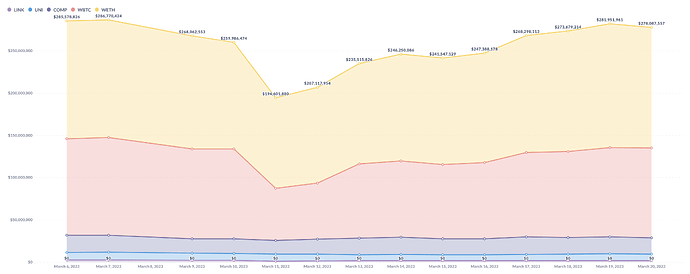

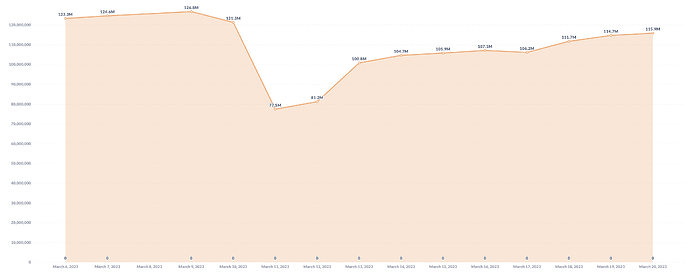

The goal of the update was to incentivize some of the top v2 non-recursive stablecoin borrowers (~$80M total borrows) to migrate to v3. In the 5 days after the proposal execution, we did not see any of these non-recursive borrowers migrate to v3, despite more favorable USDC net borrow APY. Then on 3/11/23 USDC lost parity with the dollar, and many users decided to withdraw their USDC supply and borrows from both v2 and v3, so much so that the v3 USDC borrow distribution APY was greater than the borrow APY. Since then, as seen in the charts below, the supplies and borrows for both protocols have almost fully recovered to their prior levels.

Compound v2 supply time series (3/6/23 - 3/20/23)

Compound v2 borrows time series (3/6/23 - 3/20/23)

Compound v3 USDC (Ethereum) supply time series (3/6/23 - 3/20/23)

Compound v3 USDC (Ethereum) borrows time series (3/6/23 - 3/20/23)

However, despite the regained trust in USDC, we are still not observing the top non-recursive borrowers migrating over to v3, even though v3 offers far greater net borrow APY, as shown below.

| v2 DAI | v2 USDT | v2 USDC | v3 USDC | |

|---|---|---|---|---|

| Borrow APY | 3.35% | 4.85% | 4.30% | 3.73% |

| Borrow Distribution | 1.77% | 0.47% | 1.18% | 3.93% |

| Net Borrow APY | -1.58% | -4.38% | -3.12% | +0.20% |

Second Migration Proposal (Option 1)

We propose increasing the v3 USDC borrow distributions to further incentivize users to migrate to v3. Specifically, we propose:

- Decrease v2 daily USDC supply COMP rewards from 211.20 to 161.20 (-50)

- Decrease v2 daily USDC borrow COMP rewards from 211.20 to 161.20 (-50)

- Decrease v2 daily DAI supply COMP rewards from 211.20 to 161.20 (-50)

- Decrease v2 daily DAI borrow COMP rewards from 211.20 to 161.20 (-50)

- Increase v3 daily USDC borrow COMP rewards from 281.41 to 481.41 (+200)

The resulting net borrow APYs are shown below:

| v2 DAI | v2 USDC | v3 USDC | |

|---|---|---|---|

| Borrow APY | 3.35% | 4.30% | 3.73% |

| New Borrow Distribution | 1.35% | 0.90% | 6.52% |

| New Net Borrow APY | -2.00% | -3.40% | +2.73% |

Analysis

Note: Assumes COMP price is $45.

Current v2 COMP distributions

| Daily Supply | Daily Supply (USD) | Daily Borrow | Daily Borrow (USD) | |

|---|---|---|---|---|

| DAI | 211.20 | $9,504 | 211.20 | $9,504 |

| USDC | 211.20 | $9,504 | 241.20 | $9,504 |

| USDT | - | - | 34.74 | $1,563 |

Compound distributes roughly $40k COMP/day (~$14.6M COMP/year) to stablecoin users in Compound v2.

Current v3 COMP distributions

| Daily Supply | Daily Supply (USD) | Daily Borrow | Daily Borrow (USD) | |

|---|---|---|---|---|

| USDC | 0 | $0 | 281.41 | $12,663 |

Compound distributes roughly $12.6k COMP/day (~$4.6M COMP/year) to stablecoin users in Compound v3.

Current v3 daily reserve growth

Data is from 3/21/23.

Current borrows: $121M

Current utilization: 66%

Below is a table of various daily reserve growth and earn APRs given the current borrows in Compound v3 at various utilization rates. Note that v3 daily reserve growth is only positive between 50% and 85%.

| Utilization | Daily reserve growth | Earn APR |

|---|---|---|

| 0% | -$4,873 | 0.03% |

| 50% | $33 | 1.62% |

| 68% (current) | $1,882 | 2.14% |

| 86% | -$46 | 5.0% |

| 90% | -$1,768 | 6.60% |

| 95% | -$3,324 | 8.60% |

| 100% | -$4,310 | 10.60% |

Given the current v3 state, the daily reserve growth is $1,882/day.

On the low end of the utilization curve, the max loss in reserves would be $4,873/day at 0% utilization.

On the high end of the utilization curve, the max loss in reserves would be $4,310/day at 100% utilization.

The reserves scale linearly with increased borrows.

Below we show the notable non-recursive stablecoin borrowers in v2, all of whom were listed in the previous forum post and still remain in the v2 protocol, in addition to a new USDT borrower who joined v2 the day after the USDC lost parity with the dollar. In addition to their current positions, we show how much daily net borrow interest these users pay in v2, vs how much they’d pay in v3 assuming they migrate their positions, given this proposal is accepted and utilization equilibrium is re-established. As shown below, the top v2 users are paying ~$1k+/day in net borrow interest, and would actually earn money if they were to migrate to v3.

Notable v2 non-recursive USDC borrowers

| Address | Supply tokens | Supply | Borrows | v2 net borrow paid interest/day by this user | v3 net borrow interest paid/day by this user if proposal executed & user migrated (without reward dilution) | v3 net borrow interest paid/day by this user if proposal executed & user migrated (with reward dilution) |

|---|---|---|---|---|---|---|

| 28617487 | WBTC, ETH, BAT | $174.9M | $72.0M | -$6,700 | +$5,400 | +$594 |

| 6e5665bd | ETH | $29.8M | $13.4M | -$1,250 | +$1,000 | +$764 |

| 64639cf8 | ETH, WBTC | $24.8M | $12.0M | -$1,120 | +$900 | +$705 |

| 7499bba9 | ETH | $27.1M | $10.0M | -$930 | +$750 | +$612 |

| ec64ca41 | ETH | $50.4M | $11.2M | -$1,040 | +$840 | +$669 |

| 14c3cfdd | ETH, WBTC | $18.0M | $9.0M | -$840 | +$670 | +$562 |

Notable v2 non-recursive DAI borrowers

| Address | Supply tokens | Supply | Borrows | v2 net borrow paid interest/day by this user | v3 net borrow interest paid/day by this user if proposal executed & user migrated (without reward dilution) | v3 net borrow interest paid/day by this user if proposal executed & user migrated (with reward dilution) |

|---|---|---|---|---|---|---|

| fbe5ddc3 | ETH | $43.1M | $25.4M | -$1,389 | +$1,900 | +$1,114 |

| aa43ba42 | WBTC | $13.8M | $4.9M | -$368 | +$367 | +$333 |

Notable v2 non-recursive USDT borrowers

| Address | Supply tokens | Supply | Borrows | v2 net borrow paid interest/day by this user | v3 net borrow interest paid/day by this user if proposal executed & user migrated (without reward dilution) | v3 net borrow interest paid/day by this user if proposal executed & user migrated (with reward dilution) |

|---|---|---|---|---|---|---|

| 8d50b40d (new user) | ETH | $54.2M | $18.3M | -$1,888 | +$1,369 | +$940 |

| e9605af5 | ETH, WBTC | $23.7M | $7.9M | -$815 | +$591 | +$505 |

Second Migration Proposal (Option 2)

- No changes to current COMP distributions

There may be factors other than rewards that are preventing users from migrating to V3. For example, some protocols that have integrated with V2 may not be able to migrate to V3 without building new features / versions of their own product. Or users may be more comfortable using V2 over V3 at the moment for non-quantitative reasons that are difficult to predict. If this is the case, then migration from incentives may not be very impactful right now.

If the community believes that more incentives will improve migration, then we recommend Proposal 1. Otherwise we can look at other options.

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.