Simple Summary

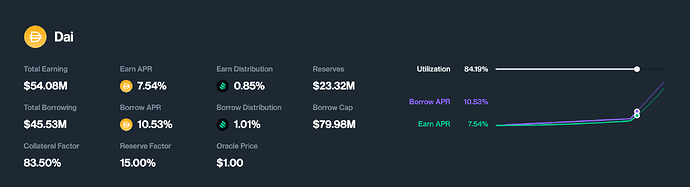

If the community decides to implement a DAI Comet on Mainnet, we suggest the following initial parameter recommendations for the comet:

Risk Parameters

| Asset | Collateral Factor | Liquidation Factor | Liquidation Penalty | Supply Cap |

|---|---|---|---|---|

| WBTC | 80% | 85% | 5% | 7,200 WBTC |

| WETH | 83% | 90% | 5% | 175,000 WETH |

| USDe | 70% | 75% | 15% | 66,000,000 |

| sUSDe | 70% | 75% | 15% | 35,000,000 |

Rationale

As mentioned in the V2 Deprecation post, the DAI supply balance has experienced a drop, plummeting from $545 million to $66 million by April 2024, which represents an 87% reduction in the amount of DAI supplied in the Compound v2 markets. This significant decline occurred despite the presence of incentives like a 0.77% Earn Distribution and a 0.92% Borrow Distribution. There were no specific deprecation measures targeting the DAI market, yet the balances still saw a major decrease. In light of the considerable outflow of DAI TVL, Gauntlet suggests launching a DAI Comet with the above collateral and risk parameters to maintain or regain market share.

DAI utility

Maker’s endgame strategy includes the introduction of NewStable, a stablecoin designed to capture future yields and backed by real-world assets (RWAs). In contrast, DAI will remain backed solely by native crypto assets while maintaining its peg to the USD. Users will have the flexibility to upgrade DAI to NewStable and easily convert NewStable back to DAI instantly. Acting as the liquidity and integration backbone for NewStable, DAI will facilitate seamless 1:1 conversions between the two, enhancing user experience across NewStable applications and interfaces. Given DAI’s versatility and enduring utility, launching the DAI Comet on Mainnet could significantly boost utilization and reclaim market share to Compound.

Revenue from DAI Comet

The introduction of DAI Comet would expand opportunities for reserve generation. Despite significant outflows in Compound v2, DAI continues to generate the second highest annual reserves as of June 20th, 2024, totaling $250k annually, excluding peak supply balances observed in 2022 and early 2023. This is despite the fact that DAI has one of the lowest Reserve Factors among v2 assets.

Collateral Assets

Gauntlet suggests including WBTC and WETH as collateral assets in the DAI Comet. The pie chart illustrates that WBTC and WETH have dominated as collateral against DAI borrows, with a minimal percentage backed by assets like UNI and LINK. This trend has persisted over the past 12 months, evident from snapshots in June 2023 and current positions. Additionally, Gauntlet proposes adding USDe and sUSDe as collateral due to their high demand in DeFi lending.

2023-06-01

Current

USDe and sUSDe

Ethena has experienced exponential growth in Total Value Locked (TVL), surpassing $3.5 billion in the protocol. The current daily volume exceeds $40 million. Ethena’s USDe serves as a synthetic dollar, tokenizing delta-neutral derivative positions involving ETH and BTC. Meanwhile, sUSDe is a staked version that captures yields from staked Ethereum, along with funding rates and spreads from delta-hedged positions. Given the prevalence of rate-arbitrage strategies between sUSDe and DAI, Gauntlet recommends including USDe and sUSDe as collateral assets in the DAI Comet. This move would create an additional avenue and potentially drive utilization, supported by appropriate risk parameters.

Supply Caps and Liquidation Penalty

Supply caps and Liquidation Penalty for WBTC and WETH are recommended to mirror the current supplies (Not the Supply Cap) and LP in the USDC comet. Gauntlet will monitor utilization and update caps when necessary.

USDe and sUSDe Caps and Liquidation Penalty (LP)

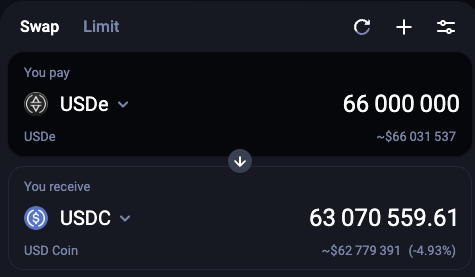

USDe Liquidity

| Dex Category | TVL(mil) | URL |

|---|---|---|

| curve (USDe/FRAX) | 84.38 | Link |

| curve (USDe/USDC) | 32.35 | Link |

| curve (USDe/DAI) | 30.79 | Link |

| uniswap_v3 (USDe/USDT) | 17.53 | Link |

Total TVL: 165.06mil

Given the above liquidity sources, we recommend setting the supply cap that would cause 5% slippage i.e A third of the liquidation penalty although our methodology allows for higher supply caps. This means that the total slippage should the entire supply get liquidated needs to be < LP. Gauntlet recommends a supply cap of 66M USDe, this swap would cause a slippage of ~5% vs a liquidation penalty of 15%. We recommend higher Liquidation Penalty for Ethena assets to sufficiently incentivize liquidators in the case of a liquidity crunch caused by depegs.

sUSDe Liquidity

| Dex Category | TVL(mil) | URL |

|---|---|---|

| curve (sUSDe/sDAI) | 35.18 | Link |

| uniswap_v3 (sUSDe/wstETH) | 10.50 | Link |

| balancer_ethereum (sUSDe/USDC) | 3.36 | Link |

| balancer_ethereum (sUSDe/wstETH) | 1.49 | Link |

Total TVL: 50.53mil

Ethena Insurance Fund

Considering sUSDe’s 7-day withdrawal window for unstaking into USDe and its lower liquidity compared to USDe, a potential depeg scenario could deplete external liquidity, especially with significant amounts of sUSDe accumulating in the withdrawal queue. To address this risk, Gauntlet recommends implementing a supply cap equivalent to 80% of Ethena’s reserve fund size while maintaining the same Liquidation Penalty as USDe. Ethena’s reserve fund comprises USDT, DAI, and LP positions, with the supply cap adjusting for the value of LP positions (approximately $11.5M or 20% of reserve fund). This adjustment is crucial to account for potential accumulation of USDe over USDT in LP positions during a depeg scenario. This recommendation translates to a supply cap of 35 million sUSDe.

Collateral Factors

We have evaluated the volatility for collateral assets against USDC and DAI and have concluded that both WBTC and WETH can mirror the LFs and CFs set on the USDC Comet.

WETH/USDC vs WETH/DAI

For WETH, the Maximum drawdowns as well as the Daily Logarithmic Volatility and the 30D Logarithmic Volatility only differ by a few bps.

WBTC/USDC vs WBTC/DAI

Similarly, for WBTC, the Maximum drawdowns,the Daily Logarithmic Volatility and the 30D Logarithmic Volatility only differ by a few bps, with DAI pair resulting in lower volatility and drawdown values.

USDe

USDe witnessed heightened volatility at its launch, however, this volatility has converged to more stability since. The Daily Log Volatility has been about 15% with a maximum log drawdown of -4.2%. Borrowing the LF formula for pegged assets as used for LRTs, the LF would then be:

LF = 1 - (LP + Annualized Daily Volatility) (1)

Gauntlets suggest an LF of 75% and a CF of 70% for USDe.

sUSDe

Similarly, for sUSDe, the daily logarithmic volatility stands at approximately 12.5%. Using the same equation (1), we derive an LF of 77.5%. However, considering sUSDe’s 7-day withdrawal period and lower liquidity compared to USDe, we recommend aligning the LF and CF parameters with those of USDe, specifically setting them at 75% LF and 70% CF.

Risks associated with Ethena

Gauntlet would like to flag the intrinsic and systemic risks for Ethena that still need to be accounted for, some of which are:

USDe/sUSDe Depeg

- Exposure to LST Risks: Ethena leverages Liquid Staking Tokens (LSTs) to capture yields, inherently assuming all associated risks, including validator slashing and smart contract exploits. Any depeg events in the underlying LSTs will directly affect both USDe and sUSDe. Historical instances of such depegging events should be examined to understand the potential impact on Ethena’s ecosystem.

- Perpetual Position Liquidations: The risk of liquidations in Ethena’s perpetual positions can impact the peg of USDe/sUSDe to the dollar, leading to potential market disruptions.

- 7-Day Cooldown Period: The mandatory 7-day cooldown period for redeeming sUSDe can strain on-chain liquidity for USDe during large withdrawals, potentially causing market-driven price depegs.

- Yield Shocks: Yield shocks due to slashing risks, mass withdrawals, or insolvencies can further pressure sUSDe, leading to depegging and associated liquidity issues.

Systemic Risks

- Open Interest (OI) Concentration: Ethena’s Open Interest currently constitutes 7.3% of the total OI for BTC and 12% for ETH. As Ethena scales or during market events, this OI concentration could become a significant fraction of the overall OI, potentially leading to:

- Partial liquidations or exits of Ethena’s positions.

- Market-wide volatility due to the impact of Ethena’s large perpetual positions.

- ARCH Nature of Funding Rates: The Autoregressive Conditional Heteroskedasticity (ARCH) nature of funding rates implies that negative funding rates could persist. With the insurance fund currently at only 1.26% of the USDe supply, there is a risk that it might be inadequate to cover costs should LST yields fail to offset growing funding rate expenses.

- Trading Operational Risks: Ethena inherits a suite of trading operational risks inherent in managing hedged positions, including:

- Basis Risk: Divergence between the hedge instrument and the underlying asset.

- Execution Errors: Mistakes in trade execution can lead to significant financial losses.

- Settlement Risks: Counterparty failures in settling trades can disrupt operations.

- Counterparty Risks: The risk of default by counterparties in derivative trades.

- Slippage: Price movement between the trade initiation and execution.

- Centralized Exchange (CEX) and Custodian Risks: Risks associated with operating on centralized exchanges and using custodians include:

- Hacks and Security Breaches: Centralized platforms are prime targets for cyber-attacks.

- Exchange Insolvency: Financial instability of exchanges can lead to loss of assets.

- System Downtime: Technical issues can halt trading activities.

- Regulatory Compliance: Navigating legal and regulatory requirements is complex and essential for operational integrity.

- Concentration Risks: Centralized control of assets introduces single points of failure.

- Transparency: Limited visibility into exchange and custodian operations can obscure risk management efforts.

Gauntlet will monitor the above risks and adjust parameters appropriately. Due to the above factors, Gauntlet doesn’t recommend employing an Exchange Rate based Oracle. Due to the same risks mentioned above, Gauntlet doesn’t recommend using an Exchange Rate based Oracle.

Storefront price factor: 60%

Targetted Reserves: 20M

IR Curve Parameters

Gauntlet recommends the following IR parameters for DAI Comets:

| Parameter | Current Value |

|---|---|

| Annual Supply Interest Rate Base | 0 |

| Annual Supply Interest Rate Slope Low | 0.069 |

| Supply Kink | 0.85 |

| Annual Supply Interest Rate Slope High | 3.2 |

| Annual Borrow Interest Rate Base | 0.015 |

| Annual Borrow Interest Rate Slope Low | 0.081 |

| Borrow Kink | 0.85 |

| Annual Borrow Interest Rate Slope High | 4.2 |

Utilization vs APRs

Net Daily Protocol Profit

The chart above demonstrates that the generation of DAI Comet reserves will be positive when utilization exceeds 70%.

Incentive Parameters

Our COMP rewards recommendations are designed to offer appealing distribution APRs when the comets are first launched and when supply caps are highly utilized.

Gauntlet is recommending supply rewards to incentivize a more significant inflow of supply tokens into the protocol. This is important in the early stages of protocol growth before borrowers can join. Daily COMP rewards are subject to change as TVL rises and the markets evolve. Furthermore, we recommend deprecating incentives on this v2 market prior to launching this comet.

| Daily COMP Supply Rewards | Daily COMP Borrow Rewards |

|---|---|

| 25 | 15 |

With the above utilization and the present Interest Rate curve:

- Supply APR: 5.86%

- Borrow APR: 8.38%

Given the current COMP price of $50:

- Supply Distribution APR: 0.3%

- Borrow Distribution APR: 0.23%

This results in the following Net APRs:

Utilization vs Net APRs

- Net Supply APR: 6.16%

- Net Borrow APR: 8.15%

Next Steps

- Welcome Community Feedback