Simple Summary

A proposal to adjust one (1) risk parameter (supply cap) across one (1) Compound V3 wETH Comet asset.

Specification

| Parameter | Current Value | Recommended Value |

|---|---|---|

| cbETH Supply Cap | 20,000 | 30,000 |

Abstract

These parameter updates are a continuation of Gauntlet’s regular parameter recommendations as part of Dynamic Risk Parameters.

Motivation

This set of parameter updates seeks to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets. Gauntlet has published a blog post on our parameter recommendation methodology to provide more context to the community.

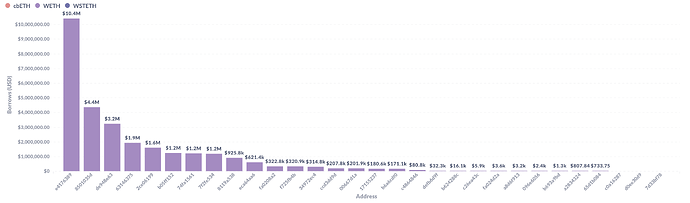

Top 30 borrowers’ entire supply

Top 30 borrowers’ entire borrows

The cbETH supply cap of 20,000 is 99.8% utilized, and we propose increasing the supply cap to 30k.

Daily open, high, low, close ratio between cbETH and WETH from 2022-08-24

cbETH-WETH price has been trending upwards, reflecting the market’s confidence in a successful Shanghai upgrade rollout. As a result, there are decreasing depegging risks.

Additionally, liquidity for cbETH/ETH is sufficient as of 2023-02-08, with 4k cbETH able to be swapped for ETH at 1.6% slippage across DEXs, as shown below. This allows liquidators to quote blocks of 4,000 cbETH from the protocol and sell with a profit after discount.

Next Steps

- Targeting on-chain proposal next week.

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.