Simple Summary

Gauntlet proposes no changes to Compound V3 ETH Comet parameters this week.

Abstract

These parameter updates are a continuation of Gauntlet’s regular parameter recommendations as part of Dynamic Risk Parameters.

Motivation

This set of parameter updates seeks to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets. Gauntlet has published a blog post on our parameter recommendation methodology to provide more context to the community.

Top 30 borrowers’ aggregate positions & borrow usages

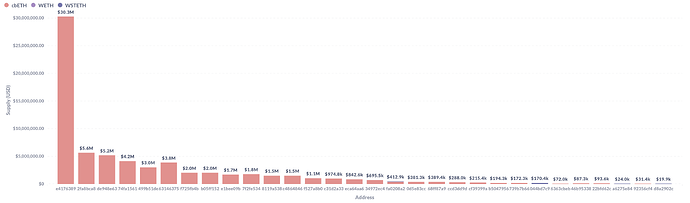

Top 30 borrowers’ entire supply

Top 30 borrowers’ entire borrows

Top 10 cbETH suppliers’ cbETH supply & percentage of total cbETH supply:

Top 10 cbETH suppliers’ cbETH supply & borrow usage:

Top 10 cbETH suppliers’ entire supply:

Top 10 cbETH suppliers’ entire borrows:

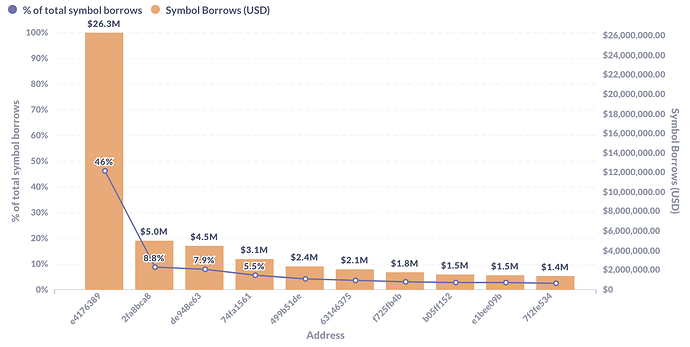

Top 10 ETH borrowers’ ETH borrows & percentage of total ETH borrows:

The proposal to increase cbETH supply cap from 30k to 40k was executed on 2023-03-14. The cbETH supply cap of 40k is now 98% utilized.

cbETH supply from 3/9/23 to 3/22/23

The user with address 0xccfa0530b9d52f970d1a2daea670ce58e4176389 has 17,268 cbETH supplied and accounts for 44% of the total cbETH supply and 46% of the total ETH borrows. This user has increased their cbETH token supply by 6,300 since the proposal was executed.

DEX liquidity has decreased since the last proposal, with 5k cbETH/ETH incurring 9.3% slippage.

Due to increased concentration risk from the largest cbETH supplier and decreased DEX liquidity, we do not recommend increasing the supply cap at this time, prior to the Shanghai upgrade.

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.