Summary

Gauntlet has observed that the V3 WETH Comets exhibit low utilization rates as noted in our weekly forums. Based on these observations, we recommend implementing the following incentive adjustments:

| Comets | Daily COMP Supply Rewards (Tokens) | Recommended Daily COMP Supply Rewards (Tokens) | Daily COMP Borrow Rewards (Tokens) | Recommended Daily COMP Borrow Rewards (Tokens) |

|---|---|---|---|---|

| Compound v3 WETH (Ethereum) | 70 | 70 | 0 | 20 |

| Compound v3 WETH (BASE) | 15 | 10 | 0 | 2 |

Analysis

Gauntlet closely monitors interest rates to guarantee that Compound V3 remains competitive within the market. In April, Gauntlet initiated and implemented proposals 236 and 239, which adjusted the interest rate parameters for both WETH Comets to enhance their competitiveness. The implementation of these proposals was aimed at driving increased utilization.

WETH Borrow and Supply - Comp v3 WETH Mainnet

Over the past few weeks, we’ve observed fluctuations in the supply of WETH tokens, characterized by an increase in market supply with relatively unchanged borrowing conditions.

Utilization has been trending lower than 70% since the beginning of March 30th, and this low utilization within the WETH Comet has directly resulted in recent negative growth in reserves, as shown in the weekly forum post.

WETH Utilization - Comp v3 WETH Mainnet

WETH Utilization - Comp v3 WETH BASE

The WETH BASE Comet has seen a slight increase in borrowing activity coupled with a decrease in supply. Despite these changes, borrowing demand within this Comet continues to be low. This limited demand can be traced back to the Comet’s market structure, which currently supports only one collateral asset. The community is currently in the process of adding wstETH to the Comet. Gauntlet will keep a close watch on these developments to help boost borrowing demand for WETH.

WETH Utilization - Comp v3 WETH BASE

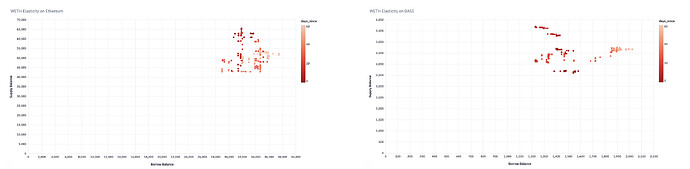

Elasticity of WETH Users

In both charts, it’s evident that each market displays a degree of borrower inelasticity, with the WETH Comet showing the most pronounced effect

Reward Recommendations

Ethereum

Gauntlet proposes increasing the daily COMP rewards for borrowing in the Ethereum V3 WETH Comet from 0 to 20. This recommendation aims to boost borrowing activity within the WETH Comet. We will closely monitor market reactions to this change to assess if additional adjustments are required.

Given the current utilization rates of the WETH Comet on Mainnet, this increase in distribution APR would stabilize the Net Borrow APR at the kink, assuming all other variables remain unchanged. The accompanying chart illustrates the variability of the Borrow Distribution APR with different borrowing volumes.

Borrow Distribution APR

Based on the present borrowing levels, we estimate a borrow distribution APR of approximately 0.42%.

BASE

Over the past few weeks, BASE utilization has fluctuated between 30% and 40%. In response, Gauntlet recommends reducing the Supply distribution to 10 COMP and increasing the Borrow distribution to 2 COMP. This recommendation aims to boost borrowing activity while promoting Comet to find higher market utilization.

The chart below demonstrates how the Borrow Distribution APR varies with different borrowing amounts. Based on current borrowing levels, we estimate a borrow distribution APR of 0.98%.

Borrow Distribution APR

The chart below illustrates the variability of the Supply Distribution APR in relation to different borrowing amounts. Based on the current supply levels, we project a borrow distribution APR of 1.84%.

Supply Distribution APR

Given the current Borrow APR rate of the WETH Comet on BASE, this increase in borrow distribution APR would settle the Net Borrow APR at the kink .91%.

Next Step

- Target on-chain vote 4/29/24.