[Gauntlet] Weekly Market Updates: Ethereum WETH (7/21/23 - 7/28/23)

Gauntlet would like to provide the community with an update on metrics from the Ethereum WETH comet over the past week and will include any relevant recommendations.

Simple Summary

- Due to the low utilization, Gauntlet recommends allocating rewards to the borrowers. Additionally, to increase the appeal of the protocol, we can decrease the Liquidation Bonus while decreasing the Storefront Price Factor. We will provide a formal proposal next week.

- WETH borrows are down 1.2%.

- WETH supply is up 0.2%.

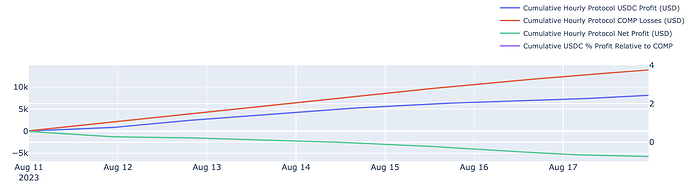

- The comet accumulated $4.13k WETH reserves over the past week, with an average reserve growth of 13.4%.

- The comet distributed $21.35k COMP rewards over the past week, for a Net Protocol Profit of -$17.22k.

Analysis

Below are metrics of the market and parameters over the past week.

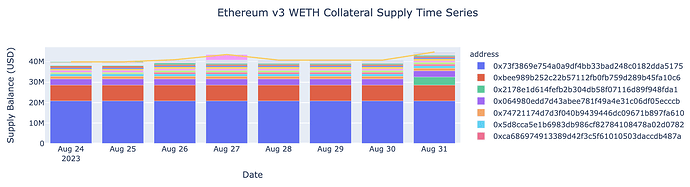

Market Growth

Total Collateral (USD) is down 5.1%, from $59.04M to $56.00M.

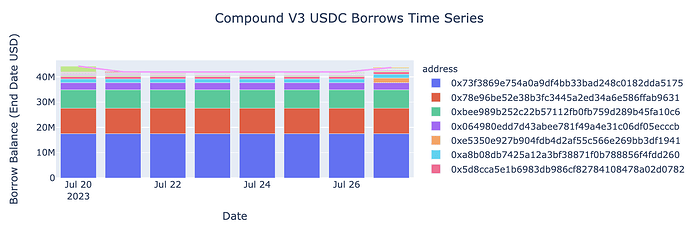

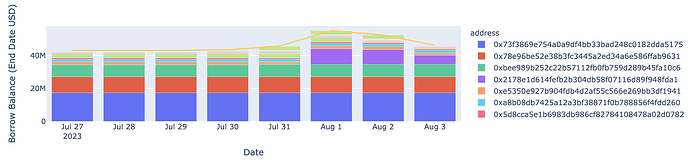

WETH borrows are down 1.2%, from $44.20M to $43.67M.

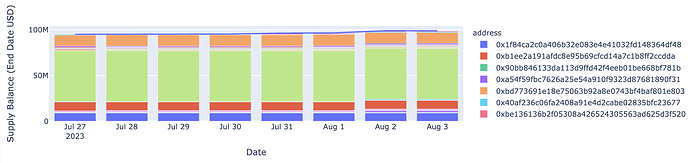

WETH supply is up 0.2%, from $95.97M to $96.17M.

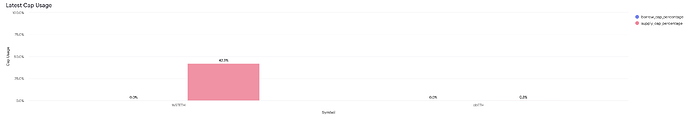

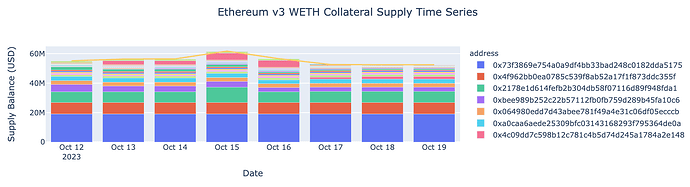

Supply Caps

As seen above, wstETH (39.6%) and cbETH (2.1%) both have supply cap utilizations < 75%. We do not currently recommend changing the supply caps.

Above is a time series of supply cap utilization for each asset over the past week.

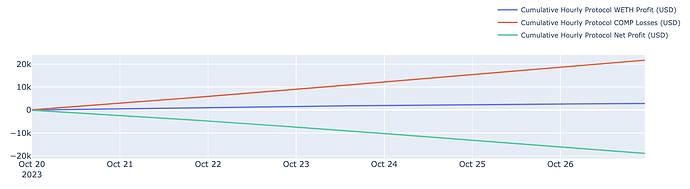

Utilization and Reserves

The minimum WETH utilization was 43.5%, and the maximum was 46.9%.

The minimum WETH reserve growth was 12.5%, and the maximum was 17.0%. The average WETH reserve growth was 13.4%.

The comet steadily accumulated $4.13k WETH reserves, while distributing $21.35k COMP rewards, for a weekly Net Protocol Profit of -$17.22k.

Recommendations

Due to the low utilization, Gauntlet recommends allocating rewards to the borrowers. Additionally, to increase the appeal of the protocol, we can decrease the Liquidation Bonus while decreasing the Storefront Price Factor. We will provide a formal proposal next week.