Simple Summary

To increase utilization and growth on the Ethereum Compound v3 ETH comet, Gauntlet proposes the following risk parameter changes:

- Increase storefront price factor from 50% to 100%.

- Decrease liquidation penalty from 5% to 2.5%.

- Decrease the borrow interest rate curve lower slope from 0.051 to 0.037.

- Increase COMP supply distribution from 38 to 70.

Analysis

Utilization and Growth

The chart below illustrates that the Ethereum Compound v3 ETH comet has experienced limited growth in utilization, borrows, and supplies over the past three months. Utilization has remained within the range of approximately 40-65%, while borrows and supplies have shown little change.

To stimulate growth, Gauntlet proposes updating the IR borrow curve, liquidation bonus, and rewards for the protocol. These adjustments aim to increase capital efficiency and TVL growth, by incentivizing higher utilization and more supply.

IR Curve

Gauntlet recommends updating the borrow IR curve according to the following chart. This update suggests reducing the borrow interest rate slope from 0.5 to 0.37. This adjustment is expected to result in lower interest rates for borrowers and consequently lead to higher utilization.

Specifically, the borrow interest rate will increase to 3.9% (reflecting the 30-day average of staking yield on Lido) when utilization reaches 80%. Given that the 2-month staking yield has been meaningfully lower than the 6-month staking yield (as shown in the chart below), this change ensures that recursive strategies remain profitable at full capital efficiency.

Storefront Price Factor and Liquidation Penalty

The WETH market has a 5% liquidation penalty, with half going to the protocol reserves due to the 50% storefront price factor, putting a significant of borrowers’ collaterals at risk and reducing competitiveness. To address this, Gauntlet proposes increasing the storefront price factor to 100% and decreasing the liquidation penalty to 2.5%. This adjustment ensures liquidators still receive the same compensation while reducing capital risks for borrowers.

COMP Rewards

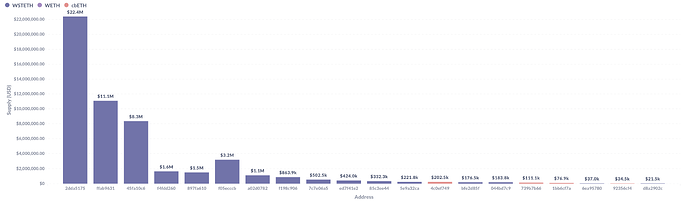

To incentivize TVL growth on the Ethereum Compound v3 ETH comet, Gauntlet proposes raising COMP supply distribution from 38 to 70. This reward distribution increases the Compound Earn APR to 1.66% and attract more suppliers to the market. In turn, lower utilization leads to lower borrow APRs which incentivizes borrowing in the comet. We recommend keeping the borrow distribution APR at 0%, as the interest curve update already incentivizes borrowers to participate.

Reserve Growth

Given the current price increase in COMP, the WETH comet loses $2,280 USD daily in COMP rewards which effectively offsets the protocol’s profit in ETH. The chart below shows the ratio of hourly profits in ETH to COMP losses due to the rewards program.

Increasing COMP rewards from 38 to 70 would increase the protocol’s daily COMP losses to $5,016 USD which adds up to $1,831,168 USD annually. However, if the proposals to decrease rewards on Polygon and Arbitrum pass, this extra cost will be counterbalanced. Additionally, as shown in the figure below, the reserve factor also gets reduced as the borrow curve changes.

Conclusion

To stimulate growth and increase utilization on the Ethereum Compound v3 WETH Comet, Gauntlet recommends several risk and IO parameter adjustments in order to incentivize TVL growth and higher utilization. The proposed changes include increasing the storefront price factor to 100% to minimize liquidation costs and enhance the protocol’s competitiveness. By lowering the borrow interest rate curve, recursive staking strategies become more profitable, encouraging increased borrowing activity. Additionally, Gauntlet suggests increasing the supply COMP distribution to incentivize supply growth and, subsequently, TVL growth.

Next Steps

- We welcome community feedback and will proceed forward with on-chain proposal.