Gauntlet Weekly Market Update: Ethereum WETH (7/28/23 - 8/3/23)

Gauntlet would like to provide the community with an update on metrics from the Ethereum WETH comet over the past week.

Simple Summary

- Gauntlet recently recommended the following changes in this forum post:

- Increase storefront price factor from 50% to 100%.

- Decrease liquidation penalty from 5% to 2.5%.

- Decrease the borrow interest rate curve lower slope from 0.51 to 0.37.

- Increase COMP supply distribution from 38 to 70.

- WETH borrows are up 7.3%, from $43.13M to $46.28M.

- WETH supply is up 4.0%, from $94.98M to $98.77M.

- WETH utilization has increased from 43.6% to 46.9%.

- The comet accumulated $6.83k WETH reserves over the past week, with an average reserve growth of 18.2%.

- The comet distributed $20.87k COMP rewards over the past week, for a Net Protocol Profit of -$14.04k.

Analysis

Below are metrics of the market and parameters over the past week.

Market Growth

Collateral Time Series

Total Collateral (USD) is up 10.5%, from $55.06M to $60.82M.

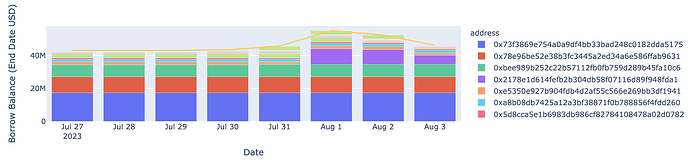

WETH Borrows Time Series

WETH borrows are up 7.3%, from $43.13M to $46.28M.

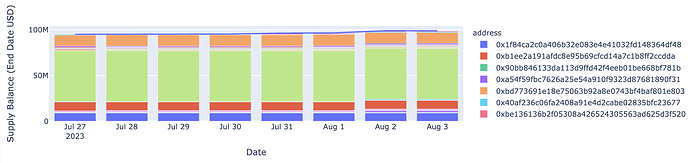

WETH Supply Time Series

WETH supply is up 4.0%, from $94.98M to $98.77M.

WETH utilization has increased from 43.6% to 46.9%.

Supply Caps

As seen above, wstETH (44.7%) and cbETH (0.8%) both have supply cap utilizations < 75%.

Above is a time series of supply cap utilization for each asset over the past week.

Utilization and Reserves

The minimum WETH utilization was 43.6%, and the maximum was 57.1%.

The minimum WETH reserve growth was 12.4%, and the maximum was 28%. The average WETH reserve growth was 18.2%.

The comet steadily accumulated $6.83k WETH reserves, while distributing $20.87k COMP rewards, for a weekly Net Protocol Profit of -$14.04k.