Date Prepared: 2 August 2025

Summary

Since the DAO allocated reserves and vendor payment assets to the Aera vault on 28 October 2024, Aera has generated ~$1.42M in realized yield on a principal of roughly $37.4M. Gauntlet, as the vault’s strategy manager, sets parameters for vault allocations and charges the DAO zero fees for doing so.

-

$1.42M realized income to the Compound DAO to date on $37.4M deployed.

-

$1.72M projected annual yield at current market rates

-

Fully Integrated Tech Stack: Deposits stay in DAO-controlled vaults, while a parameter-driven strategy layer lets Compound adjust asset mix and risk limits without new contracts or integration work.

Aera Vault Overview

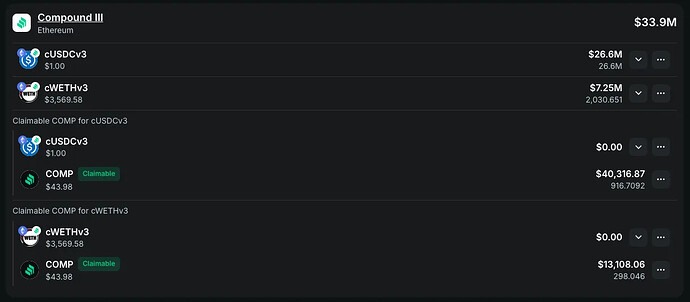

The reserves vault retains $33.9M ($26.6M in the USDC v3 Comet and $7.2M in the WETH Comet). July’s spike in USDC borrow utilization briefly lifted supply rates above 6 percent before stabilizing near 5 percent. At current levels, the reserves position is on pace to deliver over $1.72M in annualized yield to the DAO.

Parallel to the reserves vault, the Vendor Payment vault maintains $3.5M to cover operating expenses. With a 5.46 percent supply rate, it is tracking toward $191K in annual revenue and has already produced $317K in realized yield.

-

Reserves allocation remains USDC-heavy (~78 percent) to maximize rate capture while staying within risk limits.

-

The Vendor Payment vault holds solely cUSDC as it requires a higher liquidity profile to meet month-to-month cash needs.

Risk Controls and Operational Framework

The Aera vaults are fully non-custodial: assets stay in a DAO-owned contract, and no actor (Gauntlet included) can move funds outside preset parameters. Every transaction is vetted on-chain before execution.

Controls:

-

Bounded guardian scope: Gauntlet may execute only whitelisted calls (e.g.,

supply,withdraw) in approved markets; it cannot grant itself new permissions or redirect assets elsewhere. -

Ability to pause: The DAO can pause the vault at any time; while paused, no new operations execute until governors vote to resume.

-

Oracle-checked slippage limits: Rebalance calls embed price bounds; if on-chain oracles show deviations beyond those bounds, the transaction reverts automatically.

With these guardrails, only explicitly authorized operations run, governance retains final control, and Gauntlet can still optimize positions within transparent, data-driven limits.

Figures

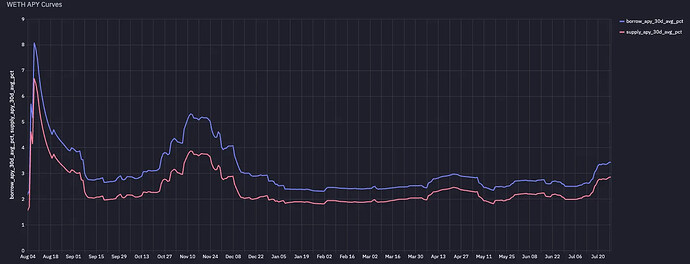

Compound V3 Mainnet WETH Supply and Borrow APYs:

Compound V3 Mainnet USDC Supply and Borrow APYs:

Recommended Actions

The vaults have accrued a meaningful balance of COMP (~$53.4K) since the initial deposit.

Recommendation: Claim the COMP incentives now that they exceed $50K.

Looking Ahead

We value the DAO’s continued trust. Gauntlet and Aera remain focused on delivering secure risk-adjusted yield, keeping Compound’s idle reserves productive and fully aligned with governance objectives.