Hello Compound Community ![]()

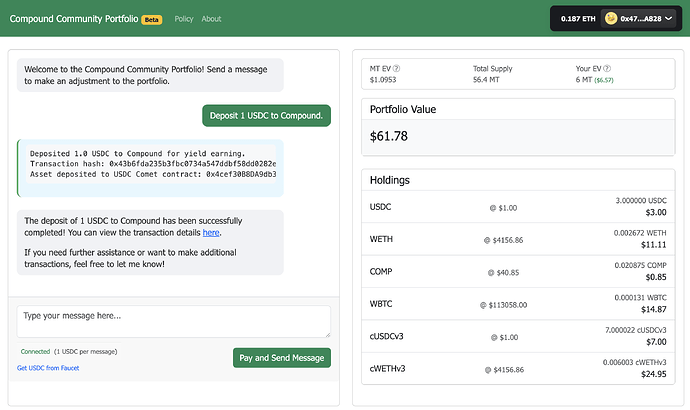

I’m excited to share a new experiment I’ve been building: Compound Community Portfolio (CompComm). This is a community‑managed portfolio that doesn’t use token voting. Instead, it pilots a Pay‑to‑Govern (P2G) model where anyone can pay to send messages (proposals) or pay to edit the on‑chain policy that guides an AI agent to perform the execution (or not execution depending on the policy). Those payments go straight into the portfolio, and contributors receive a Management Token (MT) that redeems pro‑rata for WETH from the portfolio at its terminal state.

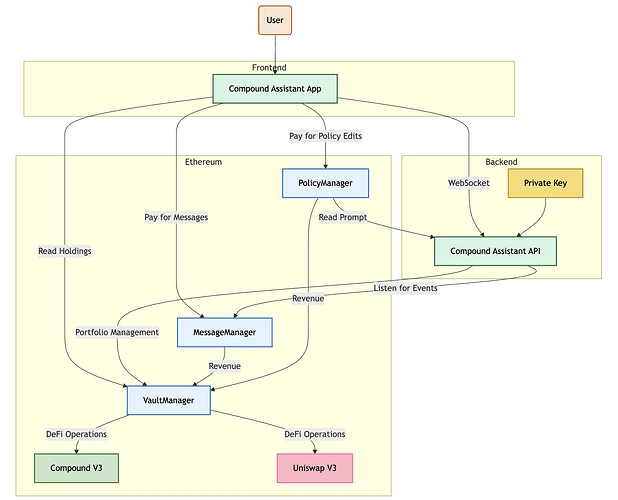

This work is a natural extension of my earlier CGP project, Compound Actions for Coinbase AgentKit, where I introduced messaging with an AI agent working from a policy (system prompt) to make portfolio decisions. CompComm takes that same foundation and applies it to decentralized portfolio management and governance.

What is CompComm?

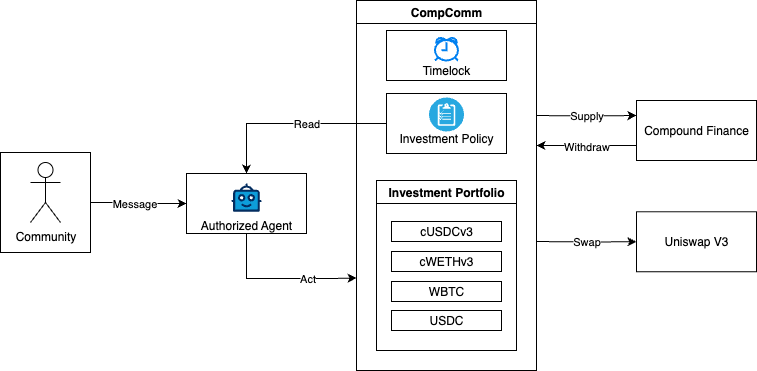

CompComm is a minimal, non‑upgradeable on‑chain portfolio with three main parts:

- Priced Inputs: pay‑per‑message (user prompts) and pay‑per‑policy‑edit (system prompt). Payments are in USDC and increase AUM for the portfolio.

- Claim‑Bearing Issuance: each paid input mints MT deterministically; holders later redeem pro‑rata in WETH after the consolidation phase. There is no premine.

- Bounded Execution: an authorized agent can only execute within allowlists (Compound v3 / Uniswap v3) and a fixed timelock that drives the lifecycle: Contribution → Consolidation → Redemption in WETH.

Why Pay‑to‑Govern (P2G)?

DAO governance often struggles with two extremes:

- Noise or spam when participation is free or cheap.

- Plutocracy when governance relies on token voting, concentrating power in a few whales.

P2G flips the model:

- Paying to govern filters out low‑signal proposals.

- Every governance action grows the portfolio itself by adding investable USDC.

- MT issuance is strictly tied to these payments, ensuring influence is always backed by real value and issued ONLY to individuals providing that value.

In short: you don’t buy governance power up front, instead you pay to govern and earn a claim on the terminal portfolio in return. Your claim is proportional to your investment in governing.

How it Works in this Experiment

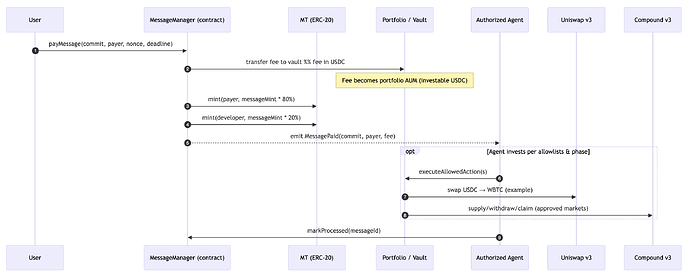

1. Message Flow (User Prompts)

- Pay a fixed 10 USDC fee per message (user prompt)

- Vault receives the fee, increasing the AUM of the portfolio

- 1 MT is minted to the payer and 0.2 MT to the dev treasury,

MessagePaidevent emitted - Authorized agent will act (supply/withdraw on Comet; swap via Uniswap v3) based on the current policy (system prompt)

2. Policy Evolution (System Prompt)

- Pay 1 USDC per 10 characters changed to edit the on‑chain investment policy.

- Each 10 characters changed mints MT (1 MT to payer / 0.2 MT to dev treasury), policy version increments

- Policy is updated, Agent will act based on the new policy (system prompt) in the next message

3. Lifecycle & Guardrails

The authorized agent will be an AI agent running on a virtual server instance using Coinbase’s AgentKit. A front end interface will be available for the community to connect their wallets and send messages. The agent will be reading the policy from on-chain each new message as it’s system prompt before acting. AUM in the portfolio will be timelocked for 18 months, then consolidated to WETH, and finally redeemable by MT holders. The agent will not be able to perform transfers, only allowlisted actions.

- Contribution (pre‑unlock): allowlisted actions only. Allow actions are:

- Compound Supply and Withdraw to allowlisted Comet contracts

- Uniswap Swap between allowlisted tokens

- Consolidation (post‑unlock): anyone can unwind positions to WETH.

- Only allows Compound withdraws and swaps to WETH.

- Redemption: burn MT for pro‑rata WETH.

- Only allowed after the timelock period and when the portfolio is consolidated to WETH.

Self Funding the Experiment

Each mint event mints an additional 20% MT to the dev treasury multisig. My intent is to use this 20% as lightweight funding for the experiment (ops, infra, audits). Notably, this dev share would only be redeemable for value when the terminal state of the portfolio is reached or a market for MT tokens is established.

How this Extends Previous Work

This experiment directly builds on my CGP‑funded work, Compound Actions for Coinbase AgentKit, and forks the Compound Assistant Github Template. There, I built Supply, Borrow, Repay, and Withdraw actions for a LangGraph-based agent, signed messaging flows for secure interactions, and a simple frontend interface to chat with it and view its contract interactions. CompComm applies that same system to the governance of community portfolios.

What Success for this Experiment Looks Like

- A steady flow of paid messages and policy edits that both fund the portfolio and surface higher‑signal governance inputs.

- On‑chain observability of backlog, actions, and policy versions, enabling dashboards and audits.

- At unlock, a clean consolidation to WETH and pro‑rata redemption for MT holders after 18 months.

- A thriving CompComm community on Telegram. Join us here: Telegram: Join Group Chat

Feedback Welcome

- Does P2G feel like a healthier alternative to coin voting for community managed portfolios?

- Any strong views on the 20% developer share?

- Again, this share would only be redeemable for value when the terminal state of the portfolio is reached after 18 months or a market for MT tokens is established.

- Which assets/markets should be on the initial allowlists for Compound v3 and Uniswap v3?

- This will be on Base so I think all the assets on Compound would be allowed, but I’m not sure about the Uniswap v3 assets.

- Is there any interest in an initial presale of Management Tokens to help me fund this experiment?

Looking forward to the discussion! I’ve set up a Telegram group if you’re interested in chatting more about it there: Telegram: Join Group Chat

– Mike